UNITED STATES BANKRUPTCY COURT

SOUTHERN DISTRICT OF NEW YORK

---------------------------------------------------------

x

In re

:

Chapter 11

:

SAS AB, et al.,

:

Case No. 22-10925 (MEW)

:

Debtors.

1

:

(Jointly Administered)

:

---------------------------------------------------------

x

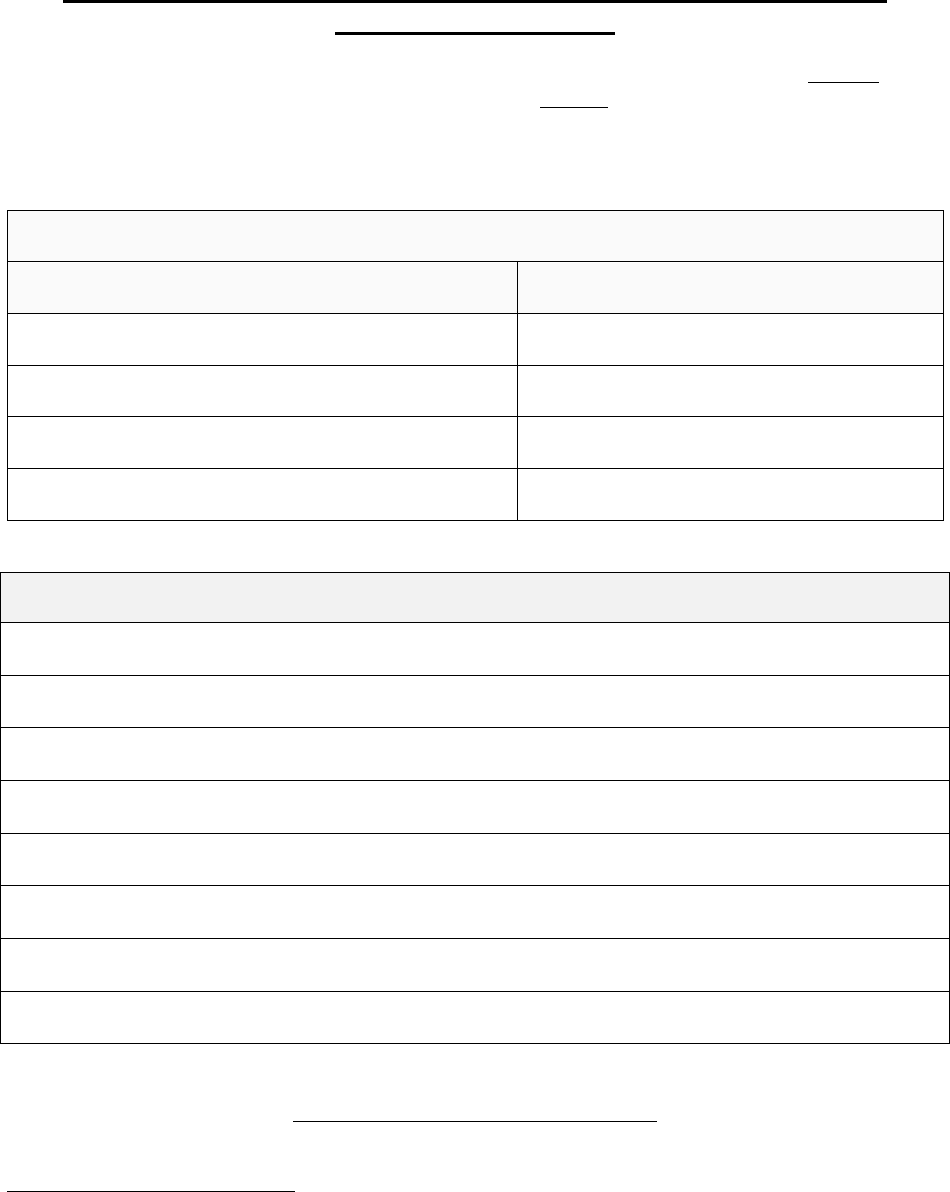

REGISTRATION FORM FOR

DISTRIBUTION OF NEW SHARES, CVNS, AND AVAILABLE

CASH UNDER CHAPTER 11 PLAN AND SWEDISH REORGANIZATION PLAN

To: Holders of General Unsecured Claims against (i) SAS AB in Class 3 (Aircraft Lease Claims

and Trade Claims), (ii) the Consolidated Debtors in Class 3 (Aircraft Lease Claims, Trade

Claims, and Union Claims), and Class 5 (Other General Unsecured Claims), and (iii) the

Gorm Blue Entities in Class 3 (Aircraft Lease Claims) and Class 5 (Other General

Unsecured Claims), as well as holders of general unsecured claims in the Swedish

reorganization of SAS AB under the Swedish Company Reorganization Act (Sw. lag

(2022:964) om företagsrekonstruktion)

Name of Holder:

Claim Amount & Class:

Username:

Password:

PLEASE NOTE THAT THE INFORMATION COLLECTED THROUGH THIS FORM,

INCLUDING THE EXHIBITS ATTACHED HERETO (COLLECTIVELY,

THE “REGISTRATION FORM”), IS NEEDED (I) TO SATISFY THE CONDITIONS

PRECEDENT SET FORTH IN THE CHAPTER 11 PLAN AND SWEDISH

REORGANIZATION PLAN (EACH AS DEFINED BELOW) FOR RECEIPT OF ANY

1

The Debtors in these chapter 11 cases are SAS AB, SAS Danmark A/S, SAS Norge AS, SAS Sverige AB,

Scandinavian Airlines System Denmark-Norway-Sweden, Scandinavian Airlines of North America Inc. (2393),

Gorm Asset Management Ltd., Gorm Dark Blue Ltd., Gorm Deep Blue Ltd., Gorm Sky Blue Ltd., Gorm Warm Red

Ltd., Gorm Light Blue Ltd., Gorm Ocean Blue Ltd., and Gorm Engine Management Ltd. The Debtors’ mailing

address is AVD kod: STOUU-T, SE-195 87 Stockholm, Sweden.

2

NEW SHARES

2

AND CVNS

3

YOU MAY BE ENTITLED TO AND (II) FOR THE

REORGANIZED DEBTORS TO EFFECT THE ISSUANCE, REGISTRATION, AND

DISTRIBUTIONS OF THE NEW SHARES, CVNS, AND AVAILABLE CASH,

4

IN

EACH CASE, AS APPLICABLE, AND TO THE EXTENT SET FORTH IN THE

CHAPTER 11 PLAN AND SWEDISH REORGANIZATION PLAN (EACH AS DEFINED

BELOW).

I. Background

On July 5, 2022, SAS AB and its debtor subsidiaries, as debtors and debtors in possession in the

above-captioned chapter 11 cases (collectively, the “Debtors”), commenced voluntary cases

under chapter 11 of title 11 of the United States Code in the United States Bankruptcy Court for

the Southern District of New York (the “Bankruptcy Court”).

On February 7, 2024, the Debtors filed the Second Amended Joint Chapter 11 Plan of

Reorganization of SAS AB and Its Subsidiary Debtors [ECF No. 1936] (as may be amended,

modified, or supplemented from time to time in accordance with the terms thereof, the “Chapter

11 Plan”). On March 22, 2024, the Bankruptcy Court entered the Findings of Fact, Conclusions

of Law, and Order Confirming Second Amended Joint Chapter 11 Plan of Reorganization of SAS

AB and Its Subsidiary Debtors [Docket No. 2347] (the “Confirmation Order”), which

confirmed the Chapter 11 Plan.

5

On March 27, 2024, SAS AB commenced a Swedish company reorganization proceeding (Sw.

företagsrekonstruktion) under the Swedish Act on Company Reorganization (Sw. lag (2022:964)

om företagsrekonstruktion) in the Stockholm District Court, Case No. Ä 5580-24 (the “Swedish

Reorganization”).

Pursuant to the Chapter 11 Plan and, insofar as it relates to Allowed General Unsecured Claims

against SAS AB, the reorganization plan to be approved as part of the Swedish Reorganization

(the “Swedish Reorganization Plan”), each holder of an Allowed General Unsecured Claim

against (i) SAS AB in Class 3 (Aircraft Lease Claims and Trade Claims) and Class 4 (Norwegian

2

“New Shares” means the equity interests is SAS AB as reorganized on the date upon which all conditions to the

effectiveness of the Chapter 11 Plan have been satisfied or waived in accordance with the terms of the Chapter 11

Plan and the Chapter 11 Plan becomes effective.

3

“CVNs” means Contingent Value Notes to be issued by SAS GUC Entity, a private limited liability company

(société à responsabilité limitée) incorporated and existing under the laws of the Grand Duchy of Luxembourg,

established in accordance with the Chapter 11 Plan and the GUC Documents (as defined in the Chapter 11 Plan) in

the principal amount equal to a portion of the GUC Cash (as defined in the Chapter 11 Plan) as set forth in Section

5.4(b) of the Chapter 11 Plan.

4

“Available Cash” means an aggregate amount of Cash (as defined in the Chapter 11 Plan) equal to the GUC Cash

less the portion of GUC Cash funded to the GUC Entities (as defined in the Chapter 11 Plan) in the legal tender of

the Kingdom of Sweden in accordance with the Chapter 11 Plan and the GUC Agreement (as defined in the Chapter

11 Plan) less the portion of the GUC Cash, if any, required to fund the Convenience Class Funding Amount (as

defined in the Chapter 11 Plan).

5

Capitalized terms used but not otherwise defined herein shall have the meanings ascribed to such terms in the

Chapter 11 Plan or the Confirmation Order, as applicable.

3

Term Loan Claims), (ii) the Consolidated Debtors in Class 3 (Aircraft Lease Claims, Trade

Claims, and Union Claims), Class 4 (Danish Term Loan Claims, Swedish Term Loan Claims,

and Norwegian Term Loan Claims), and Class 5 (Other General Unsecured Claims), and (iii) the

Gorm Blue Entities in Class 3 (Aircraft Lease Claims) and Class 5 (Other General Unsecured

Claims), as well as each holder of a general unsecured claim in the Swedish Reorganization

(collectively, the “Allowed Claims”), is entitled to receive New Shares, CVNs, and/or Available

Cash in accordance with the terms set forth in the Chapter 11 Plan, Confirmation Order, and

Swedish Reorganization Plan, as of the Effective Date of the Chapter 11 Plan.

The New Shares will be unlisted subordinated shares (Sw. förlagsaktier) (ISIN code

SE0019354788) and be book-entry registered in a securities register operated by Euroclear

Sweden AB in accordance with the Swedish Central Securities Depository and Financial

Instruments Accounts Act.

6

The CVNs will be contingent value notes due in 2033, denominated in Euros, subject to limited

recourse provisions and a springing maturity described in the terms and conditions of the CVNs,

the form of which is included in the Information Regarding GUC Interests and Related GUC

Documents, attached as Exhibit A to the Notice of Filing of Plan Supplement in Connection with

Second Amended Joint Chapter 11 Plan of Reorganization of SAS AB and Its Subsidiary Debtors

[ECF No. 2254] (as may be amended, modified, or supplemented from time to time, the “Plan

Supplement”). It is expected that the CVNs will be accepted for clearance through the facilities

of Euroclear Bank SA/NV and Clearstream Banking S.A under common code 284863232 and

ISIN code XS2848632324.

THIS REGISTRATION FORM MUST BE COMPLETED AND SUBMITTED TO THE

DEBTORS’ CLAIMS AND NOTICING AGENT, KROLL RESTRUCTURING

ADMINISTRATION LLC (“KROLL”), ACCORDING TO THE INSTRUCTIONS SET

FORTH BELOW IN ORDER FOR YOU TO RECEIVE ANY DISTRIBUTION OF NEW

SHARES, CVNS, AND/OR AVAILABLE CASH THAT YOU MAY BE ENTITLED TO

IN ACCORDANCE WITH THE CHAPTER 11 PLAN, CONFIRMATION ORDER, AND

SWEDISH REORGANIZATION PLAN.

If you sell your Allowed Claim(s) prior to the Distribution Record Date, the transferee must

submit the information requested in this Registration Form in order to receive any distributions

of New Shares, CVNs, and/or Available Cash that such transferee may be entitled to on account

of such Allowed Claim(s). You should alert a potential transferee of such requirement.

II. New Shares

6

All New Shares issued to holders of Allowed Claims and the Investors pursuant to the Chapter 11 Plan will be

“subordinated shares” (Sw. förlagsaktier), as included in SAS AB’s existing Articles. The name and rights of the

subordinated shares are expected to be amended by adoption of the Post-Closing Articles (as defined in the

Investment Agreement) at an extraordinary general meeting to be held as soon as practically possible following the

registration of the New Shares and the cancellation of all Existing Equity Interests (common shares) with the

Swedish Companies Registration Office (Sw. Bolagsverket) (see Schedule 4 to the Recipient Shareholders’

Agreement).

4

In accordance with paragraph 12 of the Confirmation Order and Section 5.16 of the Chapter 11

Plan, holders of Allowed Claims entitled to distributions from the SAS AB New Shares

Distribution Pool, the Consolidated Debtors New Shares Distribution Pool, and the Gorm Blue

New Shares Distribution Pool (in each case to the extent applicable and as set forth in the

Chapter 11 Plan) must, as conditions precedent to the receipt of such New Shares, submit the

following documents to the Debtors prior to the Effective Date:

1. A duly executed agreement evidencing that the relevant Allowed Claim has been

contributed to SAS AB, a form of which is attached hereto as Exhibit 1

(the “Contribution Agreement”)*

2. A duly executed subscription list, a form of which is attached hereto as Exhibit 2

(the “Subscription List”)*

3. A duly executed signature page to the Recipient Shareholders’ Agreement, a copy

of which is attached hereto as Exhibit 3*

4. Account information for the securities account or custody account to which the New

Shares will be distributed, as set forth in Exhibit 4 attached hereto

1. Contribution Agreement

For registration purposes under Swedish law, you will have to evidence “payment” for the New

Shares by way of a debt-to-equity conversion. This will be effected either through set-off

(Sw. kvittning) or payment-in-kind (Sw. apport) of a portion of your Allowed Claim (depending

on the Debtor entity against which your Allowed Claim is held).

• Set-off: For Allowed Claims against SAS AB, the New Shares will be issued through set-

off against your Allowed Claim (in an amount corresponding to your Pro Rata share of

Items 1-3 marked with * above may be signed through a power of attorney in order to minimize

the administrative burden and need for further action on your part.

You may opt to authorize representatives from Nordic Trustee & Agency AB (publ) (the “Authorized

Representatives”) to finalize and sign the Contribution Agreement, Subscription List, and Recipient

Shareholders’ Agreement on your behalf by submitting a separate power of attorney, in the form

attached hereto as Exhibit 5 (the “Power of Attorney Form”).

If you are a duly authorized signatory of several holders of Allowed Claims, you may submit the same

Power of Attorney Form for all such holders by listing all relevant holders that you represent in

Schedule 1 to the Power of Attorney Form. Please note, however, that a separate Registration Form

must be submitted for each holder of Allowed Claim(s) and you must submit a copy of the duly

executed Power of Attorney Form for each holder of Allowed Claim(s) the authorized signatory is

signing on behalf of.

Please also note that in order to receive the New Shares, even if you submit the Power of Attorney

Form, you will still be required to

provide the account information in Exhibit 4, as well as the

Certification & Corporate Authority form as described on page 11 of this Registration Form.

5

the SAS AB New Shares Distribution Pool), in exchange for the New Shares that you are

entitled to receive on account of such Allowed Claim.

• Payment-in-kind: For Allowed Claims against the Consolidated Debtors, Gorm Dark

Blue Limited, Gorm Deep Blue Limited, Gorm Sky Blue Limited, Gorm Light Blue

Limited, and Gorm Ocean Blue Limited, the New Shares will be issued against payment-

in-kind. This means that you will contribute a portion of your Allowed Claim (in an

amount corresponding to your Pro Rata share of the Consolidated Debtors New Shares

Distribution Pool and the Gorm Blue New Shares Distribution Pool, as applicable) to

SAS AB, in exchange for the New Shares that you are entitled to receive on account of

such Allowed Claim.

To evidence the payment and receive New Shares, you will need to provide a duly executed

Contribution Agreement. For the avoidance of doubt, you will not have to pay any cash amount

for the New Shares, and the Contribution Agreement serves the sole purpose of reflecting the

treatment provided under the Chapter 11 Plan and Swedish Reorganization Plan.

Please note that the Contribution Agreement in Exhibit 1 is a form, and that the final

Contribution Agreement will need to be individualized to reflect your Allowed Claims. As

explained above, you may opt to grant a power of attorney to the Authorized Representatives to

finalize and execute the Contribution Agreement on your behalf (see instructions in the gray box

on page 4).

If you have not granted the power of attorney prior to the Initial Registration Date (as defined

below), an execution version of the Contribution Agreement (including a completed Schedule 1

thereto) will be sent to the Person(s) identified in the Certification & Corporate Authority form

for any Allowed Claims you hold. The Contribution Agreement must be executed prior to the

Effective Date.

2. Subscription List

As a condition precedent to the receipt of New Shares, you will need to provide a duly executed

Subscription List.

Please note that the Subscription List in Exhibit 2 is a form, and that the final Subscription List

will need to be individualized in connection with Effective Date to reflect the number of New

Shares that you are entitled to receive pursuant to the Chapter 11 Plan and the Swedish

Reorganization Plan (as applicable). As explained above, you may opt to grant a power of

attorney to the Authorized Representatives to finalize and execute the Subscription List on your

behalf (see instructions in the gray box on page 4).

If you have not granted such power of attorney to the Authorized Representatives, you will be

required to execute and submit the following documents to Kroll in accordance with the

instructions set forth on pages 7 and 9 below:

1. A duly executed signature page to the Subscription List (provided on page 2 of

Exhibit 2), which must be submitted as a wet-ink hard hardcopy; and

6

2. A duly completed and executed authorization in the form set forth in Exhibit 2A hereto,

whereby you appoint one or more representatives to approve the final Subscription List

and confirm release of the signature page on your behalf via e-mail in connection with the

Effective Date.

Please note that the Subscription List cannot be finalized until the number of New Shares to

which you are entitled has been determined, which is contingent on the Closing FX Rate in

connection with the Effective Date. If you have not granted a power of attorney to the

Authorized Representatives, Kroll will send the completed Subscription List to the e-mail

address(es) set forth in Exhibit 2A no later than two calendar days prior to the Effective Date and

the Person(s) identified therein will have to confirm the release of the signature page

immediately upon receipt of the completed Subscription list and no later than one calendar day

prior to the Effective Date (which may require your action during the weekend).

3. Recipient Shareholders’ Agreement

As a condition precedent to the receipt of New Shares, you will need to enter into the Recipient

Shareholders’ Agreement by providing a duly executed signature page thereto.

As explained above, you may opt to grant a power of attorney to the Authorized Representatives

to finalize and execute the Recipient Shareholders’ Agreement on your behalf (see instructions in

the gray box on page 4).

If you do not grant such power of attorney, you will be required to deliver a duly executed

signature page to the Recipient Shareholders’ Agreement (provided on page 22 of Exhibit 3) to

Kroll in accordance with the instructions set forth on page 7 below.

4. Securities Account or Custody Account for New Shares

As a condition precedent to the receipt of New Shares, you will need to provide information

regarding the account to which the New Shares you are entitled to should be distributed. To do

so, please fill out and submit the form set forth in Exhibit 4 hereto.

Please note that such account will need to have the ability to hold Swedish shares that are

affiliated with Euroclear Sweden AB, the Swedish Central Securities Depositary. Unless you

already have a securities account affiliated with Euroclear Sweden AB, we advise you to

contact your bank in due time to ensure that it can receive the New Shares on your behalf.

You must also instruct your bank that you expect to receive shares in SAS AB (publ) with ISIN

SE0019354788.

Please also note that if the New Shares are held through a custody account, you are subject to

certain information requirements pursuant to Section 6.4 of the Recipient Shareholders’

Agreement.

5. Certification & Corporate Authority

Please submit the Certification & Corporate Authority form (set forth on page 11 hereto)

together with a registration certificate or corresponding authorizing documentation evidencing

7

that each signatory/signatories executing and submitting the information and documents included

with this Registration Form are duly authorized representatives of the relevant holder of Allowed

Claim(s).

6. Deadline & Submission

Please follow the instructions below to return the documents set forth in this Registration Form

via Kroll’s electronic submission portal (the “E-Portal”) on or prior to 5:00 p.m. (prevailing

Eastern Time) on July 29, 2024 (the “Initial Registration Date”).

If you have not granted a power of attorney to the Authorized Representatives, in addition

to submitting a scanned copy of your duly executed signature page to the Subscription List

through the E-Portal, you must also send the original signature page to Kroll as a wet-ink

hardcopy at the address below.

If you have not granted a power of attorney to the Authorized Representatives prior to the

Initial Registration Date, please note that separate deadlines and instructions apply for the

execution of the Contribution Agreement and the Subscription List.

• After the Initial Registration Date, an execution version of the Contribution Agreement

(including a completed Schedule 1 thereto) will be sent to the Person(s) identified in the

Certification & Corporate Authority form for any Allowed Claims you hold and must be

executed prior to the Effective Date.

• Provided that you have submitted a duly executed signature page to the Subscription List

(in wet-ink hard copy) and a duly completed and executed authorization in the form set

forth in Exhibit 2A hereto, the final Subscription List will be sent to the e-mail

address(es) set forth therein no later than two calendar days prior to the Effective Date,

and the authorized Person(s) will have to confirm the release of the signature page

immediately upon receipt of the completed Subscription List and no later than one

calendar day prior to the Effective Date (which may require your action during the

weekend).

If you fail to complete the foregoing steps, you will not receive any New Shares under the

Chapter 11 Plan and Swedish Reorganization Plan, as applicable, and all right, title, and

interest in such New Shares will be forfeited as of the Effective Date. If you provide a duly

executed Contribution Agreement and a duly executed Subscription List by the Effective Date

but fail to satisfy any of the other conditions precedent listed above, the New Shares to which

you would otherwise be entitled to pursuant to the Chapter 11 Plan and the Swedish

Reorganization Plan, as applicable, will instead be immediately transferred, and such New

Shares will be distributed to, GLAS Trustees Limited in its capacity as holding period trustee

(“GLAS”). GLAS will, in its own name, hold in trust, for your benefit, the New Shares in

accordance with the applicable holding period trust agreement to be entered into by SAS AB (the

“New Shares Holding Period Trust Deed”)

7

(with such New Shares so distributed to GLAS to

7

The New Shares Holding Period Trust Deed will be filed with the Bankruptcy Court, and accessible on the

Debtors’ case website maintained by Kroll, as an exhibit to a further amended Plan Supplement.

8

be held as trust property in bare trust for and on your behalf, with any proceeds from the sale(s)

of New Shares by GLAS (net of reasonable costs and expenses actually incurred in connection

with such sale(s)) to be distributed pro rata to the beneficiaries of the trust).

During the 12 month period following the Effective Date, beneficiaries of the New Shares

Holding Period Trust may make a request to GLAS to transfer their New Shares that were issued

and transferred to GLAS; provided that, among other things, the beneficiary: (i) delivers a

validly completed and signed transfer request, in substantially the form attached to the New

Shares Holding Period Trust Deed, (ii) delivers a validly executed signature page counterpart to

the Recipient Shareholders’ Agreement, (iii) certifies that the beneficiary is an Eligible Holder

(as defined in the Recipient Shareholders’ Agreement), (iv) provides a validly completed account

holder letter, in substantially the same form as attached to the New Shares Holding Period Trust

Deed, and any documentation necessary to complete customary “know your client” laws and

regulations, anti-money laundering procedures and regulations, and any other obligations

provided by applicable law, and (v) represents and warrants that the beneficiary is not a

sanctioned person, and such transfer is not in breach of any law or regulation.

Subject to any restrictions on transfer arising under applicable Law and the New Shares Holding

Period Trust Deed, GLAS will, at the end of the 12 months following the Effective Date, but

before the third anniversary of the date of the New Shares Holding Period Trust Deed (the

“Termination Date”), as promptly as practicable, use reasonable best efforts within a reasonable

period of time, to sell or otherwise dispose of the remaining New Shares, on the open market for

such consideration as GLAS is reasonably able to obtain on such open market, and accept the

highest or otherwise best offer as determined by GLAS in its sole discretion. GLAS shall hold

any proceeds from such sale or disposition on bare trust for each beneficiary pro rata until the

Termination Date. After such sale or disposition has been completed but before the Termination

Date, a beneficiary may request that GLAS transfer the beneficiary’s pro rata share of the net

proceeds of such sale to the beneficiary in accordance with the terms and conditions of the New

Shares Holding Period Trust Deed, including the satisfaction of the required conditions set forth

therein.

Following a sale of the New Shares by GLAS or its selling agent, any beneficiary who fails to

timely and properly claim its share of the proceeds from the sale of such New Shares (the

“Unclaimed Proceeds”), or in the absence of a sale, its allocation of the New Shares (the

“Unclaimed Shares”), will, in each case, (i) in respect of Unclaimed Proceeds, have such

Unclaimed Proceeds forfeited and reallocated pro rata to other beneficiaries who have satisfied

the required conditions set forth in the New Shares Holding Period Trust Deed, or (ii) in respect

of Unclaimed Shares, have such Unclaimed Shares forfeited and reallocated by way of gift to

Reorganized SAS AB in accordance with the New Shares Holding Period Trust Deed.

III. CVNs

In order to receive the CVNs to which you are entitled, you must review and complete the

registration form attached hereto as Exhibit 6 (the “CVN Registration Form”), including the

investor questionnaire included as Part 4 therein.

9

Please return the completed CVN Registration Form to Kroll through Kroll’s E-Portal system in

accordance with the instructions below by no later than the Effective Date.

Submission through Kroll’s E-Portal system is the only valid method of submission. Submission

via physical or electronic mail will not be accepted.

If you do not timely deliver the CVN Registration Form, then you will be deemed a Disqualified

Person.

8

CVNs that would otherwise be distributable under the Chapter 11 Plan and Swedish

Reorganization Plan, as applicable, to you or any other holders of Allowed Claims that are

Disqualified Persons or Ineligible Holders,

9

in each case, will be issued to GLAS to be held as

trust property in bare trust for the benefit of such Disqualified Persons or Ineligible Holders.

Subject to any restrictions on transfer arising under applicable Law, the GUC Holding Period

Trust Deed (as defined in the Plan Supplement), and the GUC Agreement, GLAS will, at the end

of the Holding Period (as defined in the Plan Supplement), sell any remaining CVNs held by it as

promptly as practicable and, subject to satisfaction of the required conditions set forth in the

GUC Holding Period Trust Deed, release the proceeds from the sale of such CVNs to the

respective Disqualified Persons or Ineligible Holders, as applicable. Any Disqualified Person or

Ineligible Holder who fails to timely and properly claim its share of the proceeds from the sale of

such CVNs will, in each case, have such proceeds forfeited and reallocated by way of gift to

Reorganized SAS AB in accordance with the GUC Holding Period Trust Deed. A copy of the

form of GUC Holding Period Trust Deed is attached as Appendix C to Exhibit A of the Notice of

Filing of Plan Supplement in Connection with Second Amended Joint Chapter 11 Plan of

Reorganization of SAS AB and Its Subsidiary Debtors [ECF No. 2254].

IV. Available Cash

To the extent you (i) hold an Allowed Claim against SAS AB in Class 3 (Aircraft Lease Claims

and Trade Claims) or the Consolidated Debtors in Class 5 (Other General Unsecured Claims)

and (ii) are entitled to any distribution of Available Cash under the Chapter 11 Plan or Swedish

Reorganization Plan on account of such Allowed Claim, as applicable, you must complete the

Bank Account Details Form attached hereto as Exhibit 7 by no later than the Initial Registration

Date.

To the extent you are entitled to any distributions of Available Cash under the Chapter 11 Plan or

Swedish Reorganization Plan, as applicable, such Available Cash will be distributed in U.S.

dollars.

* * * * *

8

“Disqualified Person(s)” means any holder of an Allowed Claim who fails to deliver the CVN Registration Form

and any supporting documentation reasonably requested by the Debtors prior to the Effective Date.

9

“Ineligible Holder” means any holder of an Allowed Claim who (i) is a “U.S. person” (as defined in Section

902(k)(1) of Regulation S of the Securities Act), and not a “qualified purchaser” (as defined in in Section 2(a)(51) of

the Investment Company Act) or (ii) holds the right to receive CVNs in an amount that is less than the minimum

denomination value of the CVNs.

10

IF YOU FAIL TO TIMELY RETURN A PROPERLY COMPLETED REGISTRATION

FORM IN ACCORDANCE WITH THE INSTRUCTIONS SET FORTH HEREIN, YOUR

DISTRIBUTION IS SUBJECT TO FORFEITURE, AND YOU MAY BE DEEMED TO

WAIVE ANY RIGHT TO ANY DISTRIBUTION OF NEW SHARES AND CVNS, AS

APPLICABLE, IN ACCORDANCE WITH THE TERMS OF THE CHAPTER 11 PLAN

AND SWEDISH REORGANIZATION PLAN.

This Registration Form includes a checklist of the documents that must be submitted in order to

receive any New Shares and CVNs you may be entitled to (see pages 12 – 13).

Return completed documents for your New Shares to Kroll via the E-Portal system.

To do so, please navigate to the Debtors’ case website at https://cases.ra.kroll.com/SAS/ and click

on the link titled “Submit Registration Form for New Shares” found in the Quick Links section of

the case website.

Return completed documents for your CVNs to Kroll via the E-Portal system.

To do so, please navigate to the Debtors’ case website at https://cases.ra.kroll.com/SAS/ and click

on the link titled “Submit Registration Form for CVNs” found in the Quick Links section of the

case website.

Submission through the E-Portal system is the only valid method of submission. Physical

and electronic mail will not be accepted, except as required by this Registration Form with

respect to the Subscription List (only relevant for New Shares).

If you have not granted a power of attorney to the Authorized Representatives, in addition

to submitting a scanned copy of your duly executed signature page to the Subscription List

through the E-Portal, you must also send the original signature page to Kroll as a wet-ink

hardcopy at the address below.

SAS Registration Form Processing

c/o Kroll Restructuring Administration LLC

850 Third Avenue, Suite 412

Brooklyn, New York 11232

If you have any questions regarding the distribution registration procedures or need additional

copies of this Registration Form or other related materials, please contact Kroll by (i) emailing

(Toll Free) or +1 347.338.6450 (International).

PLEASE NOTE: Kroll is the claims and noticing agent for the Debtors’ Chapter 11 Cases. As

such, Kroll cannot provide you with legal or financial advice. If you have any questions about

the legal or tax implications of providing this information, you should contact your attorney or

tax advisor.

* * * * *

11

Certification & Corporate Authority

By signing below, each undersigned hereby certifies that it, individually or jointly with any other

Person who has signed below (as applicable), has the requisite authority to execute and submit

the information and documents included in this Registration Form on behalf of the holder(s) of

Allowed Claim(s) set forth below. To evidence such authority, you must also submit a

registration certificate or corresponding authorizing documentation evidencing that the

signatory/signatories are duly authorized representatives of the holder(s) of Allowed Claim(s) set

forth below. Please submit such documentation together with this Registration Form by the

Initial Registration Date.

If you are a duly authorized signatory of several holders of Allowed Claim(s), you may submit

the same Certification & Corporate Authority form for all such entities, provided that all relevant

holders of Allowed Claim(s) are duly identified in the table below. Please note that a separate

Registration Form must be submitted for each holder of Allowed Claim(s) and you must

submit a copy of this duly executed Certification & Corporate Authority form along with

the other documents required by this Registration Form for each holder of Allowed

Claim(s) you sign on behalf of.

Name of Holder(s) of Allowed Claim(s) (full legal name)

_____________________________ _____________________________

Signature Signature

_____________________________ _____________________________

Name of Signatory Name of Signatory

_____________________________ _____________________________

Title of Signatory Title of Signatory

_____________________________ _____________________________

Telephone No. of Signatory Telephone No. of Signatory

_____________________________ _____________________________

E-Mail Address of Signatory E-Mail Address of Signatory

Date Completed: _____________________________

12

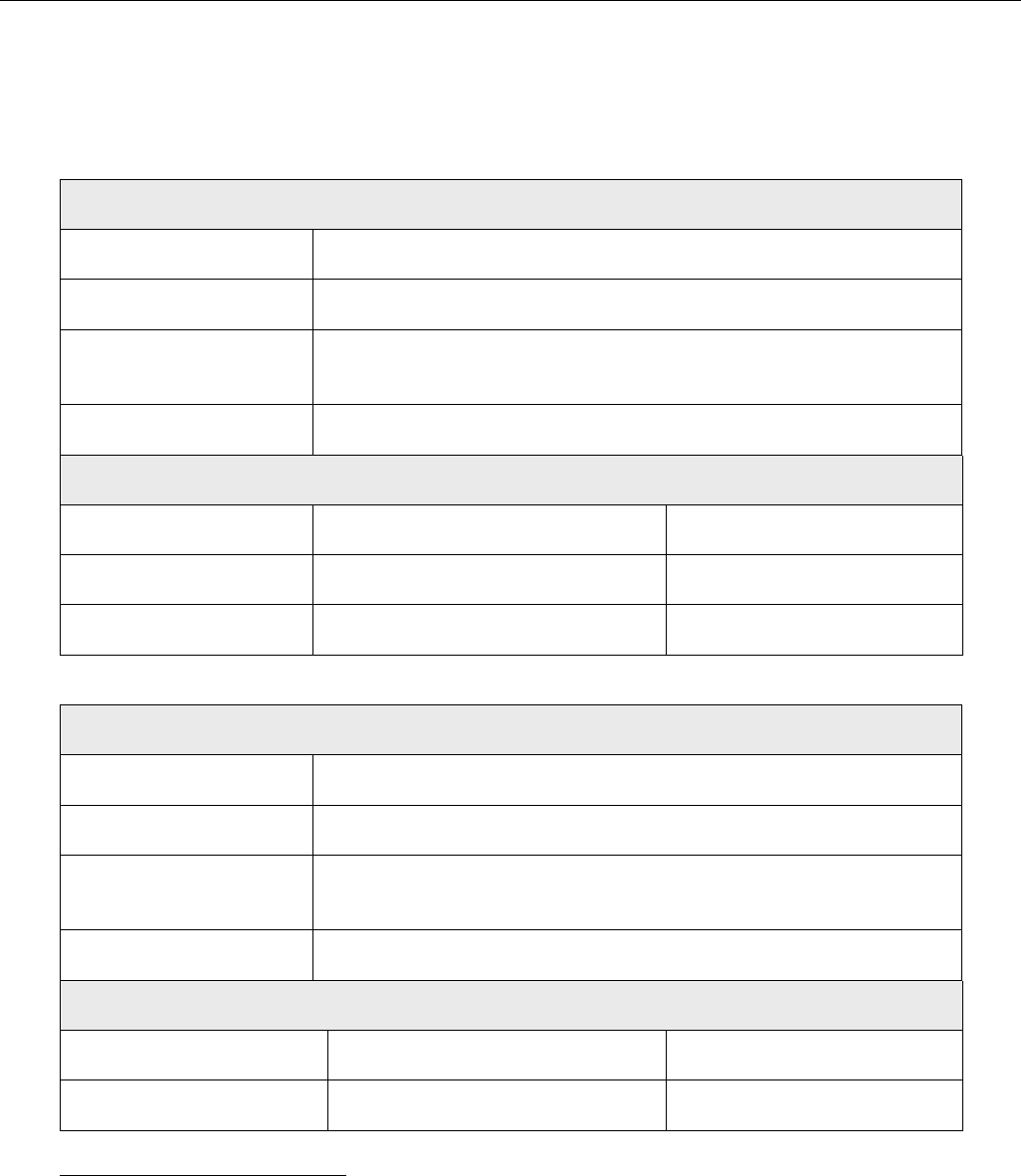

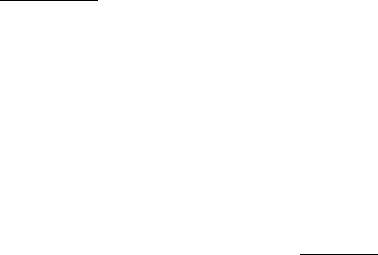

Document Checklist

Holders of Allowed Claims granting a power of attorney to the Authorized Representatives (and

not opting out of such power of attorney with respect to any documents) should complete and

return in accordance with the instructions in this Registration Form the following documents for

each holder of an Allowed Claim:

Duly completed and executed Power of Attorney (Exhibit 5)

Duly completed and executed account information form (Exhibit 4)

Duly completed and executed CVN Registration Form (Exhibit 6)

Duly completed and executed Bank Account Details Form (Exhibit 7)

Duly executed Certification & Corporate Authority form (including relevant

supporting documentation), evidencing that each Person having signed the above

documents are duly authorized representatives of the relevant holder of Allowed

Claim(s)

Holders of Allowed Claims not granting a power of attorney to the Authorized Representatives

should complete and return in accordance with the instructions in this Registration Form the

following documents for each holder of an Allowed Claim:

A. Prior to the Initial Registration Date

Duly executed signature page to the Subscription List (page 3, Exhibit 2) (the

original signature page must also be submitted as a wet-ink hardcopy)

Duly completed and executed authorization to release signatures on the

Subscription List (Exhibit 2A)

Duly executed signature page to the Recipient Shareholders’ Agreement

(Exhibit 3)

Duly completed and executed account information form (Exhibit 4)

Duly completed and executed Bank Account Details Form (Exhibit 7)

Duly completed and executed Certification & Corporate Authority form

(including relevant supporting documentation), evidencing that each Person

having signed the above documents are duly authorized representatives of the

relevant holder of Allowed Claim(s)

13

B. Following the Initial Registration Date and prior to the Effective Date (or otherwise as set

forth below)

Duly executed Contribution Agreement (Exhibit 1) – once the amounts of all

Allowed Claims are known, a final agreement will be circulated to the holders of

Allowed Claims by email for execution prior to the Effective Date

Confirmation of release of signatures to the Subscription List – the final list will

be finalized and circulated to holders of Allowed Claims by email (to the

addresses listed in Exhibit 2A) by Kroll two calendar days prior to the Effective

Date, after which one of the Person(s) listed in Exhibit 2A will be required to

confirm release of the holder of Allowed Claim’s signatures by e-mail

immediately upon receipt of the final Subscription List and no later than one

calendar day prior to the Effective Date (which may require action during the

weekend by such Persons)

Duly completed and executed CVN Registration Form (Exhibit 6)

Exhibit 1

Form of Contribution Agreement

FORM OF CONTRIBUTION AGREEMENT

This contribution agreement (the “Agreement”) is dated on the date on which it is executed by all parties

and made between:

(1) SAS AB (publ), Swedish Reg. No. 556606-8499 (the “Issuer”);

(2) each of Debtor(s) listed in Schedule 1

hereto (the “Relevant Debtor” or “Relevant

Debtors”); and

(3) each of the Person(s) listed in Schedule 1 hereto (the “Creditor” or “Creditors”),

each a “Party” and collectively the “Parties”.

Capitalized terms used but not otherwise defined herein shall have the meanings ascribed to such terms

in the Chapter 11 Plan (as defined below).

BACKGROUND

A. On July 5, 2022, the Issuer and certain of its subsidiaries (including the Relevant Debtors)

commenced voluntary cases under chapter 11 of title 11 of the United States Code, which

are being jointly administered under the caption In re SAS AB, et al., Case No. 22-10925 (the

“Chapter 11 Cases”), in the United States Bankruptcy Court for the Southern District of

New York (the “Bankruptcy Court”).

B. On March 27, 2024, the Issuer commenced a Swedish company reorganization proceeding

(Sw. företagsrekonstruktion) under the Swedish Act on Company Reorganization (Sw. lag

(2022:964) om företagsrekonstruktion) in the Stockholm District Court, Case No. Ä 5580-

24 (the “Swedish Reorganization”).

C. Pursuant to the Second Amended Joint Chapter 11 Plan of Reorganization of SAS AB and

Its Subsidiary Debtors [ECF No. 1936] (as may be amended, modified, or supplemented

from time to time, the “Chapter 11 Plan”)

1

and, insofar as it relates to claims held against

the Issuer, the reorganization plan to be approved as part of the Swedish Reorganization (the

“Swedish Plan”), each holder of an Allowed Aircraft Lease Claim, Allowed Trade Claim,

Allowed Union Claim and Allowed Other General Unsecured Claim against SAS AB, the

Consolidated Debtors, and the Gorm Blue Entities shall receive, in full and final satisfaction

1

The Chapter 11 Plan was confirmed by order of the Bankruptcy Court entered on March 22, 2024 [ECF No.

2347].

2(10)

of such Claim, the distributions to which such holder is entitled pursuant to the Chapter 11

Plan and the Swedish Plan.

2

D. The Creditor holds one or more Allowed Aircraft Lease Claims, Allowed Trade Claims,

Allowed Union Claims, or Allowed Other General Unsecured Claims against one or several

of the Relevant Debtors as set forth in Schedule 1

hereto (each an “Allowed Claim” and

collectively, the “Allowed Claims) and is, on account of such Claims, entitled to subscribe

for a number of new shares

3

(the “New Shares”) in the Issuer in an amount corresponding

to the Creditor’s Pro Rata share of New Shares Distribution Pool, as further detailed in the

proposed resolutions set forth in the Swedish Plan and items (a)–(b) below. Each New Share

shall be subscribed for at the lowest possible price under Swedish law being the quota value

(Sw. kvotvärde) corresponding to approx. SEK 1.19040499526657 (the “Share

Subscription Price”).

(a) On account of Allowed Claims held against the Consolidated Debtors, Gorm Dark

Blue Limited, Gorm Deep Blue Limited, Gorm Light Blue Limited, Gorm Ocean

Blue Limited or Gorm Sky Blue Limited (as applicable), the Creditor is entitled to

subscribe for a number of New Shares corresponding to the Creditor’s Pro Rata

share of the Consolidated Debtors New Shares Distribution Pool and the Gorm Blue

New Shares Distribution Pool (as applicable), converted to SEK using the Closing

FX Rate, divided by the Share Subscription Price (whereby the number of New

Shares shall be truncated to the nearest integer) (the “In-Kind Shares”). The

aggregate subscription price in SEK for the In-Kind Shares

4

(the “In-Kind

Subscription Amount”) shall be paid for by way of the Creditor contributing a

portion of its Allowed Claim(s) corresponding to the In-Kind Subscription Amount

to the Issuer as payment-in-kind (Sw. apport), whereby the Issuer shall be the new

holder of such portion of the Creditor’s Allowed Claim(s).

(b) On account of any Allowed Claims held against the Issuer (the “SAS AB Claims”),

the Creditor is entitled to subscribe for a number of New Shares corresponding to

the Creditor’s Pro Rata share of the SAS AB New Shares Distribution Pool,

converted to SEK using the Closing FX Rate, divided by the Share Subscription

Price (whereby the number of New Shares shall be truncated to the nearest integer)

2

The distributions consist of such holder’s Pro Rata share of the SAS AB New Shares Distribution Pool, the SAS

AB GUC Interests, the Residual SAS AB Available Cash, the Consolidated Debtors New Shares Distribution Pool,

the Consolidated Debtors GUC Interests, the Gorm Dark Blue New Shares Distribution Pool, the Gorm Dark Blue

GUC Interests, the Gorm Deep Blue New Shares Distribution Pool, the Gorm Deep Blue GUC Interests, the Gorm

Light Blue New Shares Distribution Pool, the Gorm Light Blue GUC Interests, the Gorm Ocean Blue New Shares

Distribution Pool, the Gorm Ocean Blue GUC Interests, the Gorm Sky Blue New Shares Distribution Pool and the

Gorm Sky Blue GUC Interests, in each case to the extent applicable and as set forth in the Chapter 11 Plan and the

Swedish Plan (collectively, the “Recovery Entitlements”).

3

All New Shares issued to creditors and the Investors pursuant to the Chapter 11 Plan will be “subordinated

shares” (Sw. förlagsaktier), as included in the Issuer’s existing Articles. The name and rights of the subordinated

shares are expected to be amended by adoption of the Post-Closing Articles (as defined in the Investment

Agreement) (see Schedule 4 to the Recipient Shareholders’ Agreement) at an extraordinary general meeting to be

held as soon as practically possible following the registration of the New Shares and the cancellation of all Existing

Equity Interests with the Swedish Companies Registration Office (Sw. Bolagsverket).

4

Calculated as the number of In-Kind Shares multiplied by the Share Subscription Price.

3(10)

(the “Set-Off Shares”). The aggregate subscription price in SEK for the Set-Off

Shares

5

(the “Set-Off Subscription Amount”) shall be paid to the Issuer by way of

set-off (Sw. kvittning) against the SAS AB Claims remaining after write-down in

accordance with the Swedish Plan.

1. CONTRIBUTION, RELEASE AND DISCHARGE OF CLAIM

1.1 Subject to Clause 5 below, the Creditor hereby conclusively, absolutely, unconditionally,

and irrevocably contributes to the Issuer, as payment for the In-Kind Shares, a portion of

each Allowed Claim that it holds against the Consolidated Debtors, Gorm Dark Blue

Limited, Gorm Deep Blue Limited, Gorm Light Blue Limited, Gorm Ocean Blue Limited or

Gorm Sky Blue Limited (as applicable) corresponding to such Claim’s Pro Rata share of the

In-Kind Subscription Amount (i.e. the aggregate portion of the Allowed Claims so

contributed by the Creditor to the Issuer shall correspond to the In-Kind Subscription

Amount).

1.2 Subject to Clause 5 below, the Creditor hereby acknowledges and agrees that a portion of

the SAS AB Claims (if any) corresponding to the Set-Off Subscription Amount shall be used

as set-off payment for the Set-Off Shares in accordance with the Swedish Plan.

1.3 Subject to (i) Clause 5 below and (ii) the distribution of the Recovery Entitlements pursuant

to the Chapter 11 Plan (whether distributed to the Creditor or to a holding period trust in

accordance with Clause 2.2(c) below, the Chapter 11 Plan and the Swedish Reorganization

Plan), the Creditor hereby conclusively, absolutely, unconditionally, irrevocably and forever

releases and discharges the Relevant Debtor(s) from any remaining portion of the Allowed

Claims (including any accrued but unpaid interest); provided, however, that condition (ii)

above in this Clause 1.3 shall be deemed satisfied despite any failure by the Issuer to

distribute the Creditor’s Pro Rata share of the New Shares Distribution Pool, if such failure

is solely a result of the Creditor’s failure to provide a duly executed subscription list (the

“Subscription List”) as set forth in Clause 2.2(c) below).

1.4 For the avoidance of doubt, nothing under this Agreement shall release the Relevant Debtor,

in its capacity as debtor under the portion of the Allowed Claims that has been contributed

to the Issuer pursuant to Clause 1.1 above, from any payment obligations to the Issuer, as

new creditor, insofar as it relates to such portion of the Allowed Claims.

2. ACKNOWLEDGMENTS

2.1 The Creditor hereby acknowledges and confirms that:

(a) it is an Eligible Shareholder, as defined in the Recipient Shareholders’ Agreement

6

(provided, however, that item (v) in the definition of “Eligible Shareholder” shall be

5

Calculated as the number of Set-Off Shares multiplied by the Share Subscription Price.

6

A copy of the Recipient Shareholders’ Agreement is set forth as Exhibit 3 to the Registration Form for

Distribution Of New Shares and CVNs under Chapter 11 Plan and Swedish Reorganization Plan, hereinafter

referred to as the “Registration Form”).

4(10)

deemed satisfied, as set forth in Section 21(e) of the Recipient Shareholders’

Agreement);

(b) it has not assigned, transferred or delegated all or any of its rights and obligations

relating to any Allowed Claim; and

(c) it will notify the Issuer immediately upon any assignment, transfer or delegation of

all or any of its rights and obligations relating to any Allowed Claim.

2.2 The Creditor hereby further acknowledges and agrees that:

(a) no interim shares (Sw. interimsaktier) will be issued pending registration of the New

Shares with the Swedish Companies Registration Office (Sw. Bolagsverket);

(b) neither the Issuer nor anyone acting on its behalf has taken, or will take, any action

that would require the Issuer to publish a prospectus pursuant to the Regulation (EU)

2017/1129 of the European Parliament and of the Council of June 14, 2017 or any

prospectus equivalent in any other jurisdiction in connection with the issuance of the

New Shares or CVNs, and hereby confirms that it has received all information that

it believes is necessary or appropriate in connection with the subscription for the

New Shares or the CVNs and the Issuer through the documentation provided in

connection with the Chapter 11 Cases and the Swedish Reorganization;

(c) if the Creditor has not, on the calendar day prior to the Effective Date, provided the

Issuer with a duly executed Subscription List in accordance with the instructions set

forth in the Registration Form, then all right, title, and interest in the New Shares

will be forfeited as of the Effective Date pursuant to the Chapter 11 Plan (noting that

this condition precedent may be satisfied either (i) by granting power of attorney to

representatives from Nordic Trustee & Agency AB (publ) to execute and deliver the

Subscription List on the Creditor’s behalf, or (ii) by the Creditor confirming to the

Issuer the release of a duly executed Subscription List, a signature page to which

may have been previously submitted); and

(d) if the Creditor has provided a duly executed Subscription List as set forth in item (c)

above but has not, prior to the Effective Date, provided the Issuer with (i) a signature

page to the Recipient Shareholders’ Agreement and (ii) an account number of the

securities account (Sw. VP-konto) or custody account (Sw. förvaltarkonto) to which

the New Shares shall be distributed, in each case in accordance with the instructions

set forth in the Registration Form, then the title to the New Shares for which the

Creditor has subscribed shall instead be immediately transferred, and such New

Shares shall instead be distributed, to GLAS Trustees Limited in its capacity as a

holding period trustee (“GLAS”) engaged by the Issuer, whereby GLAS shall, in its

own name, hold in trust, for the benefit of the Creditor, the New Shares in

accordance with the applicable holding period trust agreement to be entered into by

5(10)

the Issuer (the “New Shares Holding Period Trust Deed”)

7

(with such New Shares

so distributed to GLAS to be held as trust property in bare trust for and on behalf of

the Creditor, with (i) any Proceeds (as defined in the New Shares Holding Period

Trust Deed) from the sale(s) of New Shares by GLAS (net of reasonable costs and

expenses actually incurred in connection with such sale(s)) to be distributed pro rata

to the Creditor and the other beneficiaries of the trust, and (ii) the Remaining Trust

Property (as defined in the New Shares Holding Period Trust Deed) to be distributed

to Reorganized SAS AB for cancellation on the terms and conditions set forth in

further detail in the New Shares Holding Period Trust Deed.

2.3 The Issuer and the Relevant Debtors hereby acknowledge and confirm that the execution of

this Agreement shall satisfy the condition precedent set forth in Section 5.16(ii)(B) of the

Chapter 11 Plan.

3. NOTICE OF CONTRIBUTION AND RELEASE

This Agreement shall constitute a notice (denunciation) (Sw. denuntiation) of the

contribution of a portion of the Allowed Claims to the Issuer pursuant to Clause 1.1 above,

as well as a notice of release of the remaining portion of the Allowed Claims (including any

security, lien or guarantee claims) to the Issuer and the Relevant Debtors.

4. ENTIRE AGREEMENT, AMENDMENTS AND WAIVERS

4.1 The Parties acknowledge that the performance of the obligations of each Party under this

Agreement, the Chapter 11 Plan and the Swedish Plan constitutes the entire agreement

between the Parties with respect to the subject matter hereof. This Agreement can be

amended, supplemented or changed, and any provision hereof can be waived, only by written

instrument making specific reference to this Agreement executed by all of the Parties.

4.2 The Parties further acknowledge that this Agreement is solely entered into for the purpose

of effecting the distribution of the New Shares that the Creditor is entitled to pursuant to the

Chapter 11 Plan and the Swedish Plan, and that it is not intended to impose any additional

rights or obligations on the Parties in excess of what is contemplated by the Chapter 11 Plan

and the Swedish Plan.

5. EFFECTIVENESS

This Agreement, including the contribution, set-off, discharges and releases contemplated in

Clause 1 above, shall be conditional on the decision by the Stockholm District Court to

7

The New Shares Holding Period Trust Deed will be filed with the Bankruptcy Court, and accessible on the

Debtors’ case website maintained by the Debtors’ Claims and Noticing Agent, Kroll Restructuring Administration

LLC, as an exhibit to a further amended Notice of Filing of Plan Supplement in Connection with Second Amended

Joint Chapter 11 Plan of Reorganization of SAS AB and Its Subsidiary Debtors [ECF No. 2254] (as may be

amended, modified, or supplemented from time to time).

6(10)

approve and confirm the Swedish Plan becoming final and binding (Sw. lagakraftvunnen)

and shall become effective on the Effective Date of the Chapter 11 Plan.

6. GOVERNING LAW AND DISPUTES

6.1 This Agreement and all non-contractual obligations in connection with this Agreement shall

be governed by the laws of Sweden.

6.2 Any dispute, controversy or claim arising out of or in connection with this Agreement, or

the breach, termination or invalidity thereof, shall be finally settled by arbitration in

accordance with the Arbitration Rules of the Arbitration Institute of the Stockholm Chamber

of Commerce. The arbitral tribunal shall be composed of three arbitrators. The seat of

arbitration shall be Stockholm. The language to be used in the arbitral proceedings shall be

English.

6.3 Each Party undertakes to ensure that all arbitral proceedings conducted in accordance with

this Agreement shall be kept strictly confidential. This undertaking shall cover, inter alia,

that arbitral proceedings have been initiated, all information disclosed during the course of

such proceedings, as well as any decision or award made or declared by the arbitral tribunal.

This Clause shall not restrict or prevent disclosure by a Party of any information if and to

the extent (i) the disclosure is required by law or applicable stock exchange regulations, or

(ii) such disclosure has been approved by the other Party in advance in writing.

***

Signature page follows

By signing this Agreement, each undersigned confirms that it is duly authorized, individually

or jointly with any other Person who has signed on behalf of the same Party (as applicable),

to enter into this Agreement on behalf of each Party on whose behalf it has signed.

7(10)

This Agreement has been signed electronically (in DocuSign) by the Parties.

[SAS AB (PUBL)

SCANDINAVIAN AIRLINES SYSTEM DENMARK-NORWAY-SWEDEN

GORM DARK BLUE LIMITED

GORM DEEP BLUE LIMITED

GORM SKY BLUE LIMITED

GORM LIGHT BLUE LIMITED

GORM OCEAN BLUE LIMITED]

Date: Date:

________________________ _______________________

[Clarification of signature:] [Clarification of signature:]

[Title] [Title]

[NAME OF CREDITOR ENTITY]

Date: Date:

________________________ _______________________

[Clarification of signature:] [Clarification of signature:]

[Title] [Title]

[NAME OF SECOND CREDITOR ENTITY]

8

8

Note to draft: If there are several holders of Allowed Claims with a common representative (e.g. a beneficial

owner), it is sufficient to execute one version of this Agreement for all such creditors, provided that all relevant

creditors and Allowed Claims are duly identified in Schedule 1 and that the signatory/signatories are duly

authorized to sign on behalf of all such creditors.

8(10)

Date: Date:

________________________ _______________________

[Clarification of signature:] [Clarification of signature:]

[Title] [Title]

9(10)

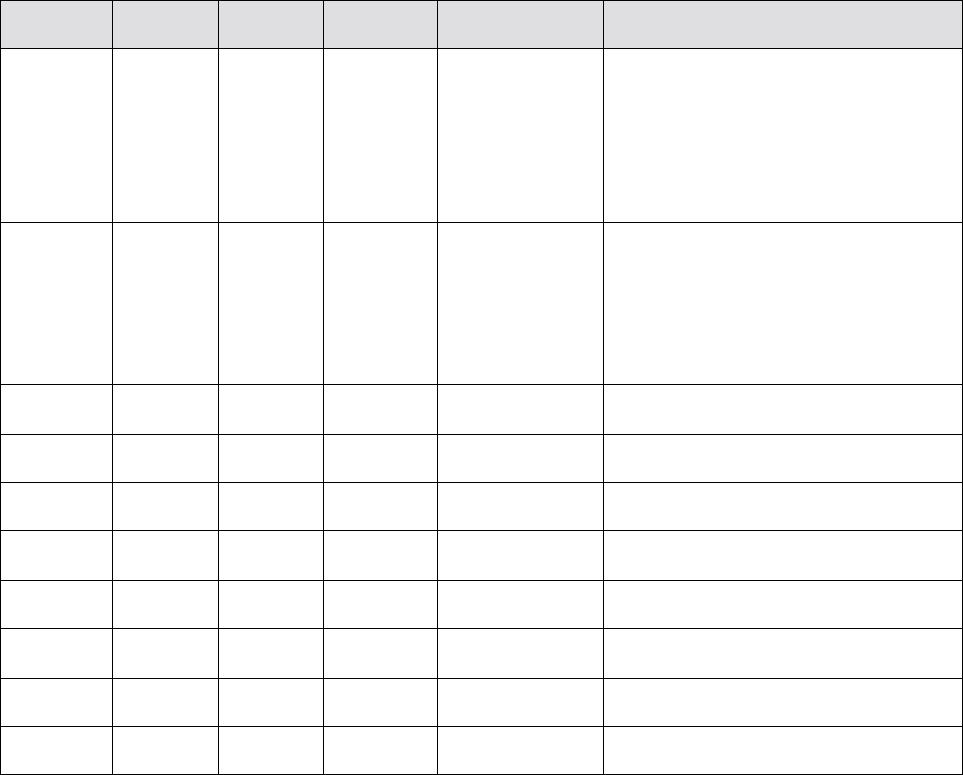

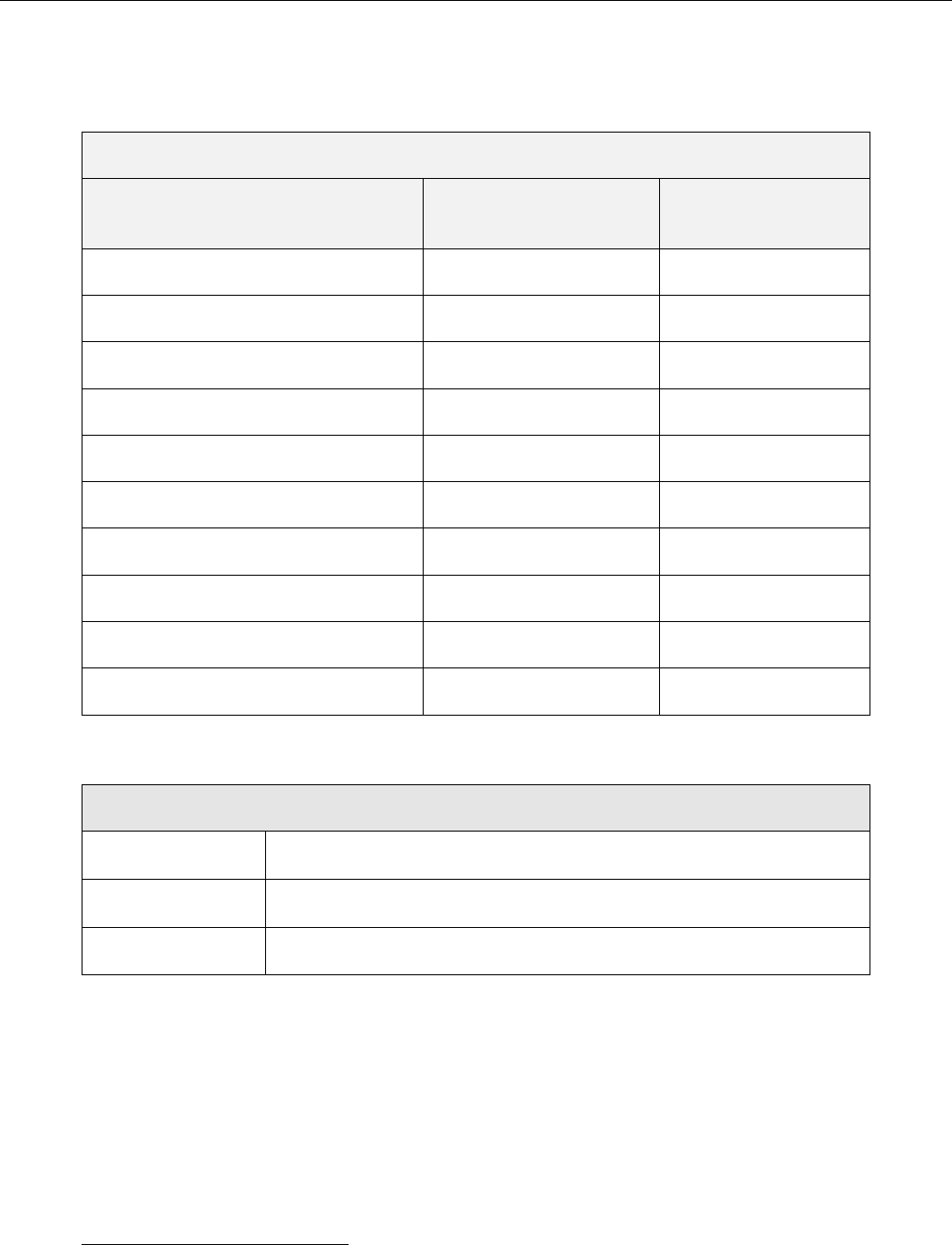

SCHEDULE 1

CREDITOR, DEBTOR(S) AND ALLOWED CLAIMS

9

CREDITOR

Legal name:

[●]

Corporate Reg. No:

[●]

Country of

incorporation:

[●]

Contact details:

[●]

ALLOWED CLAIMS

Debtor

Description of claim

Allowed Claim

[●]

[●]

[USD] [●]

[●]

[●]

[USD] [●]

CREDITOR

10

Legal name:

[●]

Corporate Reg. No:

[●]

Country of

incorporation:

[●]

Contact details:

[●]

ALLOWED CLAIMS

Debtor

Description of claim

Allowed Claim

[●]

[●]

[USD] [●]

9

Note to draft: Schedule to be individualized for each Creditor prior to execution.

10

Note to draft: If there are several holders of Allowed Claims with a common representative (e.g. a beneficial

owner), it is sufficient to execute one version of this Agreement for all such creditors, provided that all relevant

creditors and Allowed Claims are duly identified in this Schedule 1 and that the signatory/signatories are duly

authorized to sign on behalf of all such creditors. ).

Exhibit 2

Form of Subscription List

1

On [date] 2024, in Case No. Ä 5580-24, the District Court of Stockholm (Sw. Stockholms tingsrätt)

approved the reorganization plan for SAS AB (publ), reg. no. 556606-8499 (the “Company”), thereby

resolving on the issuance of new subordinated shares in the Company on the terms and conditions set

forth in Appendix 2 [and Appendix 3].

2

Documents pursuant to Chapter 13, Section 13, of the Swedish Companies Act (2005:551) are available

at the Company’s head office in Stockholm, Sweden.

[Date] 2024

[On the terms and conditions set forth in Appendix 2 and Appendix 3, [Christoffer Andersson/Victor

Schander/Adam Kastengren Sandberg/Anna Litewka/[other appointed person]] (all being employees of

Nordic Trustee & Agency AB (publ)) by power of attorney hereby subscribe for [number] subordinated

shares in the Company on behalf of the subscribers listed in Appendix 1.]

3

[On the terms and conditions set forth in Appendix 2 [and Appendix 3], the subscriber(s) listed in

Appendix 1 hereby subscribe(s) for [number] subordinated shares in the Company.]

4

1

Note to draft: The highlighted/bracketed information on this page will be filled out/included by the Company once

available.

2

Note to draft: Appendix 3 will be removed if the holder of an Allowed Claim does not hold any Allowed Claims

against SAS AB.

3

Note to draft: For holders of Allowed Claims having granted a power of attorney to the Authorized

Representatives.

4

Note to draft: For holders of Allowed Claims signing the Subscription List it their own name.

2

On behalf of the subscriber(s) listed in Appendix 1

_____________________________ _____________________________

Signature Signature

_____________________________ _____________________________

Name Name

_____________________________ _____________________________

Title Title

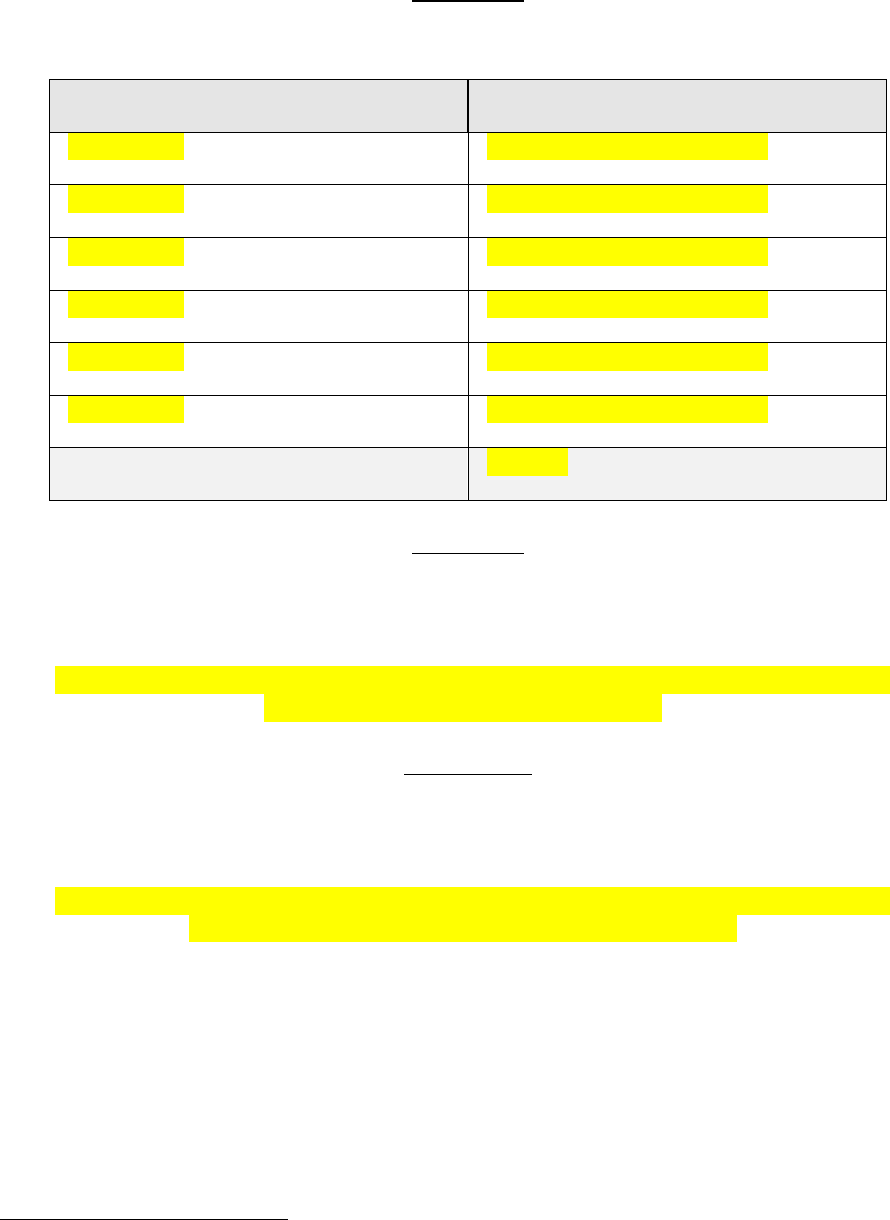

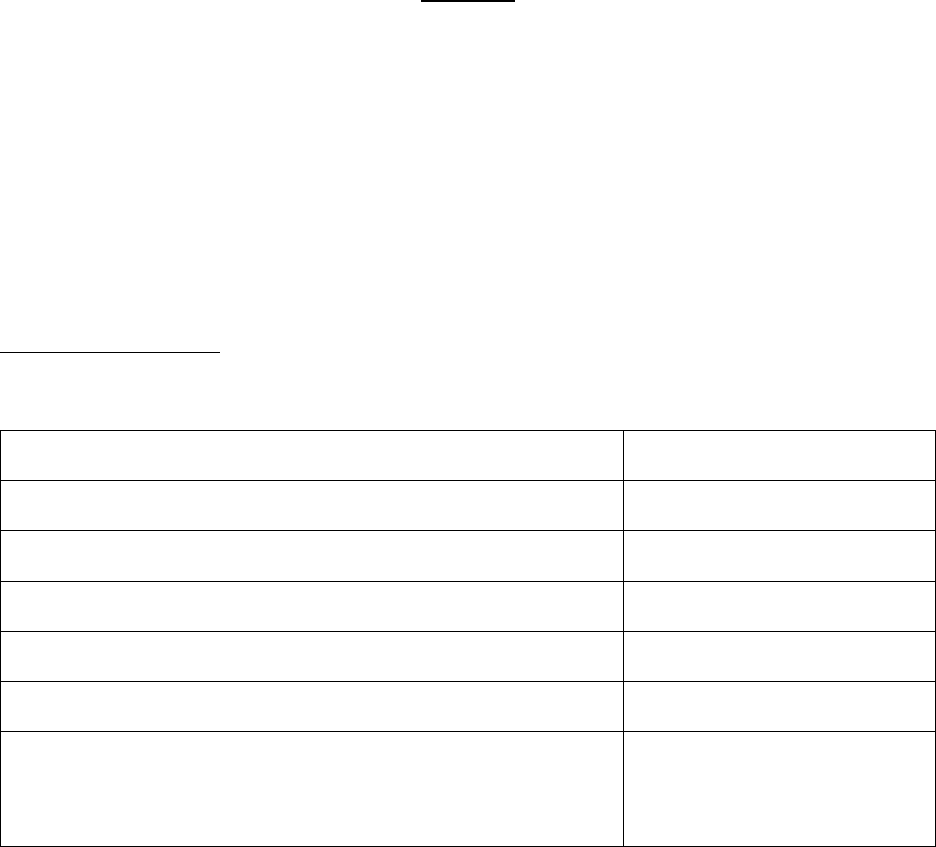

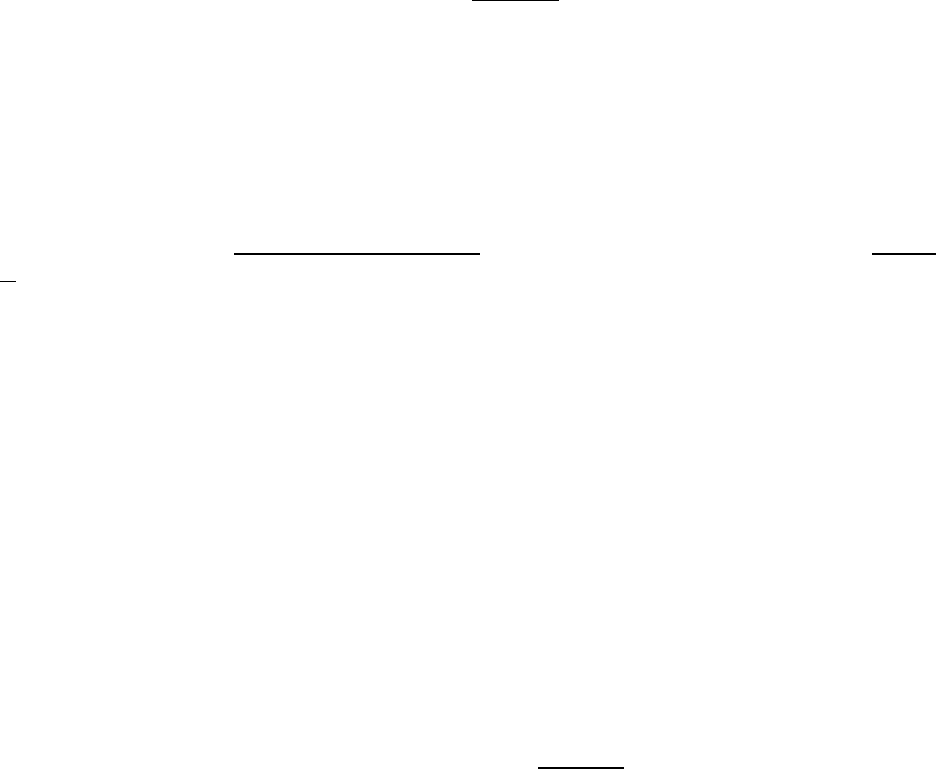

Appendix 1

Subscribers

1

Entity

Number of shares subscribed

[Entity name]

[Number of shares subscribed]

[Entity name]

[Number of shares subscribed]

[Entity name]

[Number of shares subscribed]

[Entity name]

[Number of shares subscribed]

[Entity name]

[Number of shares subscribed]

[Entity name]

[Number of shares subscribed]

Total number of shares subscribed

[Number]

Appendix 2

The Board of Directors of SAS AB (publ)’s proposal for a resolution on a new issue of

subordinated shares with payment in kind

[The proposal, as included in the Swedish Reorganization Plan, will be appended to the

execution version of the Subscription List]

[Appendix 3]

[The Board of Directors of SAS AB (publ)’s proposal for a resolution on a new issue of

subordinated shares with payment through set-off]

[The proposal, as included in the Swedish Reorganization Plan, will be appended to the

execution version of the Subscription List (as applicable)]

1

Note to draft: The highlighted information on this page will be filled out/included by the Company once available.

Exhibit 2A – Authorization Form for Release of Signatures on Subscription List

Instructions:

If you have not granted a power of attorney to the Authorized Representatives to finalize and

execute the Subscription List on your behalf (see instructions in the gray box on page 4 of the

Registration Form), please execute and submit the authorization form in this Exhibit 2A together

with a duly executed signature page to the Subscription List by the Initial Registration Date.

If you are duly authorized signatory of several holders of Allowed Claim(s), you may execute

one signature page for the Subscription List and submit the same authorization form in this

Exhibit 2A for all such entities, provided that all relevant holders of Allowed Claim(s) are duly

identified in Table 2 in Exhibit 2A. Please note that a separate Registration Form must be

submitted for each holder of Allowed Claim(s), and you must submit a copy of the duly

executed signature page and the duly completed and executed authorization form in this

Exhibit 2A, along with the other documents required by this Registration Form, for each

holder of Allowed Claim(s) you sign on behalf of.

Please note that the original of the executed signature page must also be submitted to Kroll as a

wet-ink hardcopy (if you are submitting the same signature page for several holders of Allowed

Claims, you only need to submit one wet-ink hardcopy).

AUTHORIZATION FORM FOR RELEASE OF SIGNATURES ON

SUBSCRIPTION LIST

The undersigned, acting on behalf of the holder(s) of Allowed Claim(s) set forth in Table 2 below

(the “Creditor”), hereby appoints the Person(s) set forth in Table 1 below to, individually or two jointly,

finalize and confirm the release of my/our signatures to the form Subscription List (enclosed with this

authorization form), in order to

effectuate the subscription of all New Shares that the Creditor is entitled

to receive pursuant to the Chapter 11 Plan and Swedish Reorganization Plan (as applicable).

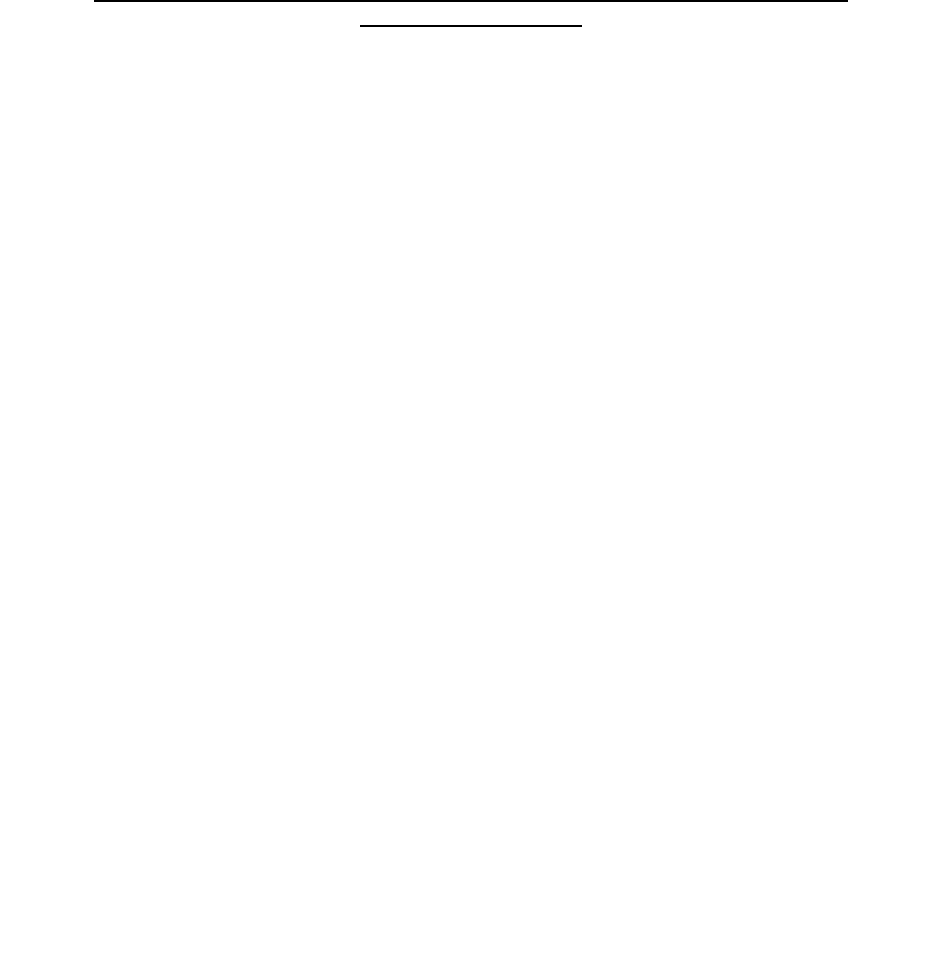

Table 1: Name of authorized persons

Full name E-mail address

Table 2: Creditor(s)

1

(full legal name)

1

Please list all entities that hold Allowed Claims and on whose behalf the Person(s) set forth in Table 1 shall be

authorized to act (i.e., not the beneficial owner).

2

The Creditor acknowledges and agrees (i) that Kroll will send the completed Subscription List to the e-

mail address(es) set forth above no later than two calendar days prior to the Effective Date and (ii) that if

the Creditor (through any of the Person(s) set forth above) fails to, following the receipt of the completed

Subscription List and no later than one calendar day prior to the Effective Date (which may require your

action during the weekend), reply with an e-mail confirmation to Kroll confirming the release of the

Creditor’s signatures to the Subscription List (or fails to submit a duly executed Contribution Agreement),

then all right, title, and interest in the New Shares will be forfeited as of the Effective Date pursuant to the

Chapter 11 Plan.

_____________________________

The undersigned hereby certifies that it is duly authorized, individually or jointly with any other Person

who has signed below, to execute and submit this form on behalf of the Creditor(s).

Date:

On behalf of the Creditor(s),

_____________________________ _____________________________

Signature Signature

_____________________________ _____________________________

Name Name

_____________________________ _____________________________

Title Title

Exhibit 3

Recipient Shareholders’ Agreement

Dated [] 2024

Recipient Shareholders’ Agreement

1

by and among

CL-S Holdings Lux S.à r.l.,

Air France-KLM S.A.,

Lind Invest ApS,

the Danish State

(as Investor Shareholders)

and

the Recipients

(as defined herein)

1

Note to draft: As a condition precedent to receiving New Shares on the Effective Date (as defined in the Chapter 11

Plan), the Recipients are required to execute a signature page to and enter into this Agreement. Any Recipients who do

not deliver an executed signature page counterpart as of the Effective Date will be deemed a “Disqualified Person”. The

Debtors (as defined in the Chapter 11 Plan) may deliver the New Shares that would otherwise be distributable to such

Disqualified Persons under the Chapter 11 Plan to a third-party service provider, in its capacity as holding period trustee

(the “Trustee”), to be held in trust for the benefit of such Disqualified Persons. In such event, the Company would enter

into, on terms customary for similar arrangements, a Holding Period Trust Deed with the Trustee (in form and substance

acceptable to the Debtors and the Investors). Among other things, such agreement would provide that: (a) any New

Shares delivered to the Trustee will be held by the Trustee for a holding period (to be agreed between the Debtors and

the Investors), at the end of which, any remaining New Shares held by the Trustee will be sold as promptly as

practicable, on arm’s length terms, [and on the highest or best possible terms]* pursuant to the terms of this Agreement;

(b) the proceeds from the sale of such New Shares (net of reasonable costs and expenses actually incurred in connection

with such sale(s)) will be distributed to the respective Disqualified Persons; and (c) (i) from and after the end of the

holding period each Disqualified Person will have no entitlement to the New Shares previously held on its behalf by the

Trustee, and (ii) at the end of the term of the Holding Period Trust Deed, any remaining, unclaimed cash proceeds from

the sale of any New Shares then held by the Trustee shall be transferred by way of gift to the Company. *Open point, to

be resolved with Trustee.

This Recipient Shareholders’ Agreement (this “Agreement”) is entered into on [●]

By and among:

(1) CL-S Holdings Lux S.à r.l., a private limited liability company incorporated under the laws

of Luxembourg (“Castlelake”);

(2) Air France-KLM S.A., a société anonyme organized under the laws of France, with

company registration number 552 043 002 (“AFKLM”);

(3) Lind Invest ApS, a private limited liability company incorporated under the laws of

Denmark, with Danish business registration number (CVR) No. 26559243 (“Lind”);

(4) The Kingdom of Denmark, represented by the Ministry of Finance, including any political

subdivision thereof, including any ministry, agency, authority and national bank (the “Danish

State”); and

(5) the Persons listed in Schedule 1 (each a “Recipient” and collectively the “Recipients”).

Castlelake, AFKLM, Lind and the Danish State are herein collectively referred to as the “Investor

Shareholders”. The Investor Shareholders and the Recipients are herein each referred to as a

“Party”, and collectively the “Parties”.

Background:

(A) This Agreement constitutes the “Recipient Shareholders’ Agreement” as referred to in the

Second Amended Joint Chapter 11 Plan of Reorganisation pursuant to the US Bankruptcy

Code, dated February 7, 2024, in respect of SAS AB, a public limited company incorporated

in Sweden, with registered number 556606-8499 (the “Company”), and its subsidiary debtors

(the “Chapter 11 Plan”), pursuant to which, among other things, the Company’s and its

subsidiary debtors’ existing debt and other obligations are restructured (the “Restructuring”).

(B) As part of the Restructuring, the Recipients (constituting holders of certain Allowed General

Unsecured Claims (as defined in the Chapter 11 Plan)) will receive new shares in the

Company (“New Shares”). As a condition precedent to receiving such New Shares, the

Recipients are required to enter into this Agreement.

(C) Concurrently with and subject to the Closing, this Agreement shall become automatically

effective with legal and binding effect.

(D) This Agreement governs the relationship between the Investor Shareholders, on the one hand,

and the Recipients, on the other, as shareholders in the Company following the Closing and

certain aspects relating to the management and the affairs of the Company.

1. Definitions

Capitalized terms used herein shall have the meanings ascribed to such terms in Schedule 2.

2. Company Objectives

2.1 Subject in each case to any Applicable Regulatory Approval, the Recipients hereby

acknowledge and agree that the Company shall conduct its business in accordance with the

objectives set forth in Schedule 3 (the “Objectives”) in all respects. In the event the Company

fails to comply with any Objective, each Recipient shall, in each case subject to any

Applicable Regulatory Approval, take all Necessary Actions as promptly as practicable to

cause the Company to comply with such Objective.

2

2.2 Notwithstanding anything set out in this Agreement to the contrary, without the prior written

consent of each of the Investor Shareholders, whether adopted or approved at a General

Meeting or otherwise, no Recipients shall exercise their voting rights and/or make or support

any resolutions that could reasonably be expected to result in a deviation from the Objectives

(in each case subject to any Applicable Regulatory Approval).

3. Undertaking to Support certain Proposals of the Board

3.1 Subject in each case to any Applicable Regulatory Approval, the Recipients undertake to

exercise their voting rights at General Meetings to support any proposal by the Board in

relation to the following matters, other than if such proposal would (1) be materially adverse

to the Recipients (as a group) vis-à-vis the Investor Shareholders (as a group), or (2) would be

in breach of Chapter 7, Section 47 of the Swedish Companies Act:

(a) any proposal to change the Articles;

(b) any proposal (1) to implement an incentive program for the Company (and/or the

Group), or to amend, update or extend such incentive program, and/or (2) transfer

securities in the Company (or any subsidiary of the Company) in the context of a

management buyout or similar transaction, including but not limited to, in each case,

any issue and/or transfer of securities that is subject to the rules in Chapter 16 of the

Swedish Companies Act;

(c) for as long as the Company is a “public company” (as defined in the Swedish

Companies Act), any proposal regarding a merger and/or a demerger between the

Company and a private company (as defined in the Swedish Companies Act); and

(d) any proposal to convert the Company from being a public company to a private

company (as such terms are defined in the Swedish Companies Act).

3.2 Notwithstanding anything to the contrary in this Agreement, the Recipients undertake to,

immediately in connection with the issuance of the New Shares, exercise their voting rights at

a General Meeting to adopt the Articles attached hereto as Schedule 4, and hereby explicitly

waive the notice requirements set out in the Swedish Companies Act and the Company’s

existing articles of association in relation to such General Meeting, and undertake to (if

requested by the Investor Shareholders) sign the minutes from such General Meeting to

memorialize the foregoing.

4. Undertaking not to Support or Initiate certain Actions

4.1 Subject in each case to any Applicable Regulatory Approval, the Recipients undertake not to

exercise their voting rights at General Meetings to support any resolution that would entail

any of the following:

(a) that any ordinary or deputy director of the Board or the CEO is denied discharge from

liability for the previous financial year at any annual General Meeting (other than if

the auditor of the Company has recommended against discharge);

(b) that the Company is required to redeem any Share or other security of the Company

held by any Recipient (other than if redemption has been proposed by the Board); and

(c) that the Company is required to pay a dividend (other than if the proposal to pay a

dividend has been proposed by the Board).

4.2 Subject in each case to any Applicable Regulatory Approval, the Recipients further undertake

not to support any proposal to convene an extraordinary General Meeting (other than if the

3

proposal has been recommended by the Board) or to appoint a so-called special examiner

(Sw. särskild granskare).

5. Issuances in Connection with Convertible Notes

Upon exercise by any holder of Convertible Notes of its conversion rights in accordance with

the Indenture, the Recipients shall take all Necessary Action to authorize at a General

Meeting or cause the Board to (as the case may be) (i) issue Shares to such holder of

Convertible Notes in the amount required pursuant to the Indenture, and (ii) approve any

ancillary resolutions required in respect of changes to the share capital or the Articles in

connection with the exercise of such conversion rights.

6. Restrictions on Transfer of Shares

6.1 No Recipient shall be entitled to effect any Transfer save for a Transfer in accordance with

the provisions of this Agreement.

6.2 The provisions of Clause 7 (Eligible Shareholder) apply to any proposed Transfer by a

Recipient, and Clause 8 (Adherence Undertaking) apply to any proposed Direct Transfer by a

Recipient (including, in each case, in connection with a Permitted Transfer). Further, subject

to Clause 9 (Permitted Transfers), the provisions of Clause 10 (Right of First Offer) and

Clause 11 (Drag-Along Right) shall always apply when a Recipient proposes to Transfer any

Shares.

6.3 For the avoidance of doubt, the restrictions on Transfer of Shares in Clauses 6 through 10 in

this Agreement shall not apply to any Transfer of Shares by an Investor Shareholder.

6.4 Notwithstanding anything to the contrary in this Agreement, if a Recipient is to hold Shares

through a nominee (Sw. förvaltare), the Recipient must first inform the Company about this

in writing, including quantity of Shares being held and the name and contact details

(including email and phone number) of the nominee (and all such details of all sub-nominees

that hold the Shares on behalf of the Recipient and/or the nominee). The relevant Recipient

shall immediately inform the Company in writing about any change in such details relating to

the Shares being held and/or of the nominee (and/or the sub-nominees that hold the Shares on

behalf of the Recipient and/or the nominee).

7. Eligible Shareholder

No Recipient shall be entitled to effect any Transfer (including, for the avoidance of doubt,

any Permitted Transfer) unless, in each case, such proposed transferee (and any other Person

who has Control of such proposed transferee) has been determined to be an Eligible

Shareholder, whereby:

(a) the Recipient shall inform (in writing) the Investor Shareholders of the identity of

such transferee (and any other Person who has Control of such proposed transferee)

and such Recipient’s basis for determining that such transferee (and any other Person

who has Control of such proposed transferee) is an Eligible Shareholder; and

(b) the Investor Shareholders (other than the Danish State unless specifically requested so

by the Danish State) having confirmed (in writing) to such Recipient (not later than

within 20 Business Days following receipt of the information from the Recipient) that

they concur with the Recipient’s determination that such transferee (and any other

Person who has Control of such proposed transferee) is an Eligible Shareholder,

whereby absent (1) such confirmation from the Investor Shareholders and (2) a

rejection from any Investor Shareholder disputing such determination by the

4

Recipient, the proposed transferee (and any other Person who has Control of such

proposed transferee) will be deemed as being an Eligible Shareholder.

8. Adherence Undertaking

No Recipient shall be entitled to effect any Direct Transfer (including, for the avoidance of

doubt, any Permitted Transfer) unless, in each case, such proposed transferee has executed an

adherence undertaking to this Agreement (and provided a copy thereof to each Investor

Shareholder), in the form attached hereto as Schedule 5, in which such transferee agrees to be

bound by the terms of this Agreement as if such transferee was an original party hereto (an

“Adherence Undertaking”), and, upon consummation of such Transfer and execution of

such Adherence Undertaking, such transferee shall be considered a Recipient for all purposes

of this Agreement.

9. Permitted Transfers

Notwithstanding the provisions of Clause 10 (Right of First Offer):

(a) a Recipient may Transfer all or a portion of its Shares to an Affiliate (provided that if

such Affiliate ceases to be an Affiliate of such Recipient, such Affiliate promptly

Transfers such Shares to such Recipient or an Affiliate of such Recipient) (a

“Permitted Transfer”);

(b) a Recipient may effect any Transfer following an IPO; and

(c) a Transfer shall not be deemed to occur where a transfer of shares between third

parties of any publicly traded equity securities of a Recipient (or of a Person who has

Control of a Recipient) takes place.

10. Right of First Offer

10.1 Prior to a Transfer by any Recipient (in any case, the “Selling Recipient”), to any Person of

all or a portion of its Shares (the “Offered Securities”), the Selling Recipient, shall first

deliver to each Investor Shareholder (each, a “Non-Selling Shareholder”) written notice (the

“ROFO Notice”) of its bona fide intention to sell the Offered Securities, which ROFO Notice

shall disclose the number of Offered Securities to be Transferred, the purchase price of each

share that the Selling Recipient would accept in respect of such Offered Securities, and all

other material terms and conditions of the proposed Transfer.

10.2 Each Non-Selling Shareholder may elect to purchase its pro rata portion of the Offered

Securities upon the same price per share and other material terms and conditions as those set

forth in the ROFO Notice by delivering a written notice (an “Acceptance Notice”) of such