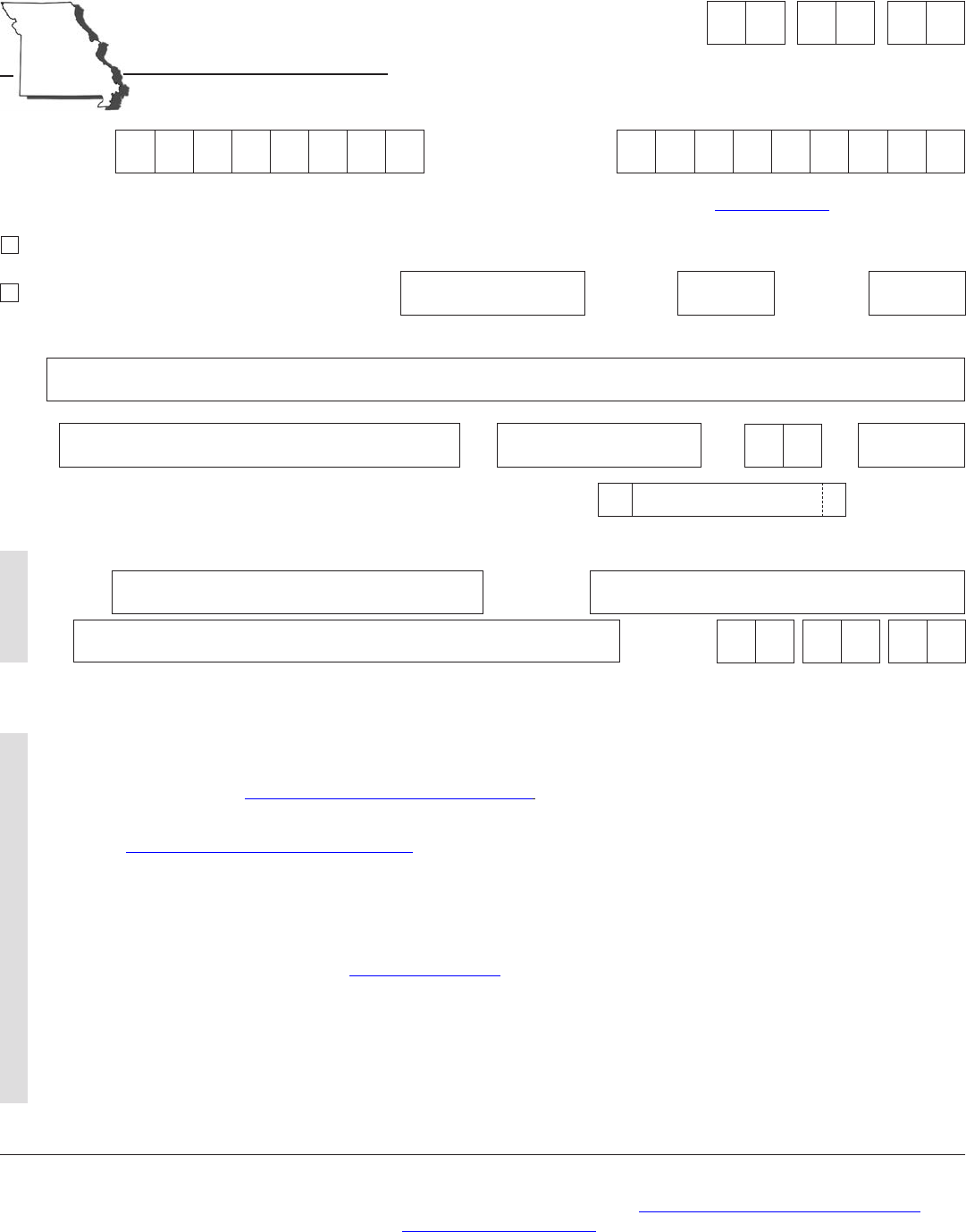

Name

Signature

I have direct control, supervision, or responsibility for filing this report. Under penalties of perjury, I declare it is a true, accurate, and complete report.

Authorized

Signature

Printed Name

Title

Date Signed

(MM/DD/YY)

1. Total Missouri Income Tax Withheld.................................................. 1 00

Address City State ZIP

W-3 Corrected

Do not send payment with this form. If you have withholding tax due, use Form MO-941.

Form MO W-3 (Revised 11-2018)

Number of

W-2(s)

Number of

1099-R(s)

Tax

Year

Visit

http://dor.mo.gov/business/withhold/

for more information.

Mail to: Taxation Division Phone: (573) 751-8750

P.O. Box 3330 Fax: (573) 522-6816

*14211010001*

14211010001

Check this box if you participate in the Combined

Federal/State Filing (CF/SF) Program

Instructions

1. Total Missouri Income Tax Withheld - Enter total Missouri withholding reported on payee statements issued under this withholding account number (e.g. Box 17 of

federal Form W-2 or Line 12 of federal Form 1099-R).

• Foremployerswithlessthan250employees,youareencouragedtoreportelectronicallythroughourwebsite.Specicationsforpaperlessreportingare

provided through our website, https://dor.mo.gov/business/withhold/EFW2.php. Information reported electronically through our website should be labeled

withthenameandaccountnumberoftheemployer.Alternatively,youmaysendallFormW-2(s)and1099-R(s)viapaper,compactdisc,orashdrive.

• Foremployerswith250ormoreemployees,youmustreportelectronicallythroughourwebsite.Specicationsforpaperlessreportingareprovidedthroughour

website, https://dor.mo.gov/business/withhold/EFW2.php. Information should be labeled with the name and account number of the employer. The

requirementtoleelectronicallyisautomaticallywaivediftheIRShasgrantedawaiverofthefederalrequirementtoleelectronicallyandtheemployerhas

ledacopyofthewaiverwiththeDepartment.

NOTE:TheDepartmentwillnotprovidenoticationwhentheinformationisprocessed;norwilltheDepartmentreturncompactdiscsorashdrivestotheemployer.

IfyoudiscoveranerrorhasoccurredonapreviouslyledEmployer’sReturnofIncomeTaxWithheld(FormMO-941)oranerrorinLine17ontheoriginalW-2(s),you

must correct it by remitting an amended Form MO-941. This form must be used to increase or decrease any previously reported tax amounts. Attach a copy of the Form

W-2C(s) to Form MO W-3 and check the box indicated before submitting. Enter the total new correct amount for all Form W-2(s) in box 1. Corrections by employers

with 250 or more employees must be sent by email to [email protected]

unlesstheemployerhasbeengrantedawaiverofthefederalrequirementtole

electronicallyandhasledthiswaiverwiththeDepartment.Correctionsbyemployerswithlessthan250employeesmaybesentbyemailtotheaboveemailaddress,

sent in writing to the address below, or sent by fax to the fax number below.

NOTE: Do not send copies of W-2C(s) if no change in withholding tax liability.

TheTransmittalofTaxStatements(FormMOW-3),copiesofallFormsW-2(s)and1099-R(s)(Copy1),thecompactdisc,orashdriveisdueonorbeforeFebruary28,

afterallofyourwithholdingtaxreturnshavebeenled.Theduedateforemployerswith250ormoreemployeestolecopiesofallFormW-2(s)isJanuary31.Ifthedue

datefallsonaSaturday,Sunday,orlegalholiday,theselingswillbeconsideredtimelyifpostmarkedorledelectronicallythroughtheDepartment’swebsiteonthenext

business day.

Form

MO W-3

Missouri Department of Revenue

Transmittal of Tax Statements

Department Use Only

(MM/DD/YY)

Missouri Tax I.D.

Number

Federal Employer

I.D. Number

Reset Form

Print Form