Employee Residency Requirements Information

Residence Requirements

Most employees of the City of New York are subject to residency requirements pursuant to the Administrative Code (§12-

119 through §12-121), as amended by Local Law 48 of 2009, and/or Mayoral Executive Order No. 131 of 2010, dated

February 24, 2010. The requirements for residence may vary based upon an employee’s position, title, status or agency,

but most City employees are required to establish and maintain residence in one of the five boroughs (Brooklyn, Bronx,

Manhattan, Queens and Staten Island) for two years of City employment.

As a result of Local Law 48, most employees may now reside in one of the six designated New York State counties (Nassau,

Westchester, Suffolk, Rockland, Orange or Putnam) after two years of continuous City employment. Other positions, such

as positions in the Executive Office of the Mayor and senior-level positions in Mayoral agencies, require that the employee

maintain city residence for the duration of his/her employment. Generally, employees have up to 90 days to establish City

residence if they are residing outside of the City at the time of appointment. For appointment to certain peace officer

titles, the NYS Public Officers Law requires City residence at the time of appointment.

As compliance with the residency requirements is a condition of employment, failure to establish and maintain compliance

with the residency requirements requires termination.

Those employees serving in the title of Chaplain or whose regular work site is located outside of the five boroughs are

excepted from the residency requirements, as are employees selected for titles certified as hard-to-recruit. For more

details regarding residence requirements and how they relate to the position for which you are being considered, please

review PSB 100-8R and speak with your HR representative.

Section 1127 of the New York City Charter

The provisions of Section 1127 of the New York City Charter require that City employees residing outside of New York

City at any time during their employment pay to the City an amount equal to that which would be paid if such non-resident

were a City resident as defined by Section 11-1705(b) (or any similar provision) of the Administrative Code of the City of

New York (Note: the City Charter incorrectly refers to 11-1706).

As a condition precedent to employment, each applicant must read and agree to the provisions of Section 1127 of the City

Charter by signature on the Affirmation that if he/she becomes a City Nonresident Individual:

(a) he/she will pay to the City an amount equivalent to the taxes that would be computed and determined for

City Residents;

(b) the City may deduct and withhold from such person's wages or compensation, such amount through payroll

deductions

(c) he/she will complete a NYC-1127 Form, which must be submitted before May 15 and must be accompanied

by a copy of his/her State income tax return (IT-201 or IT-203) along with copies of any relevant federal

schedules (i.e. D, E, C, etc.).

(d) he/she will update his/her address in NYCAPS using ESS and must notify the head of the employing agency if

his/her status as a nonresident individual or a resident individual changes.

Reporting Residence Information

New hires must report residence information at the time of appointment in the completion of their Comprehensive

Personnel Document (CPD-B). Any future changes of residence should be reported by the employee via Employee Self

Service (ESS). Changes made in ESS are not necessarily reflected in other systems. The employee, therefore, is responsible

for ensuring appropriate notifications of any subsequent address changes to the Department of Citywide Administrative

Services (DCAS) Bureau of Examinations, DCAS Certification Unit, his/her Collective Bargaining Unit, etc. as applicable.

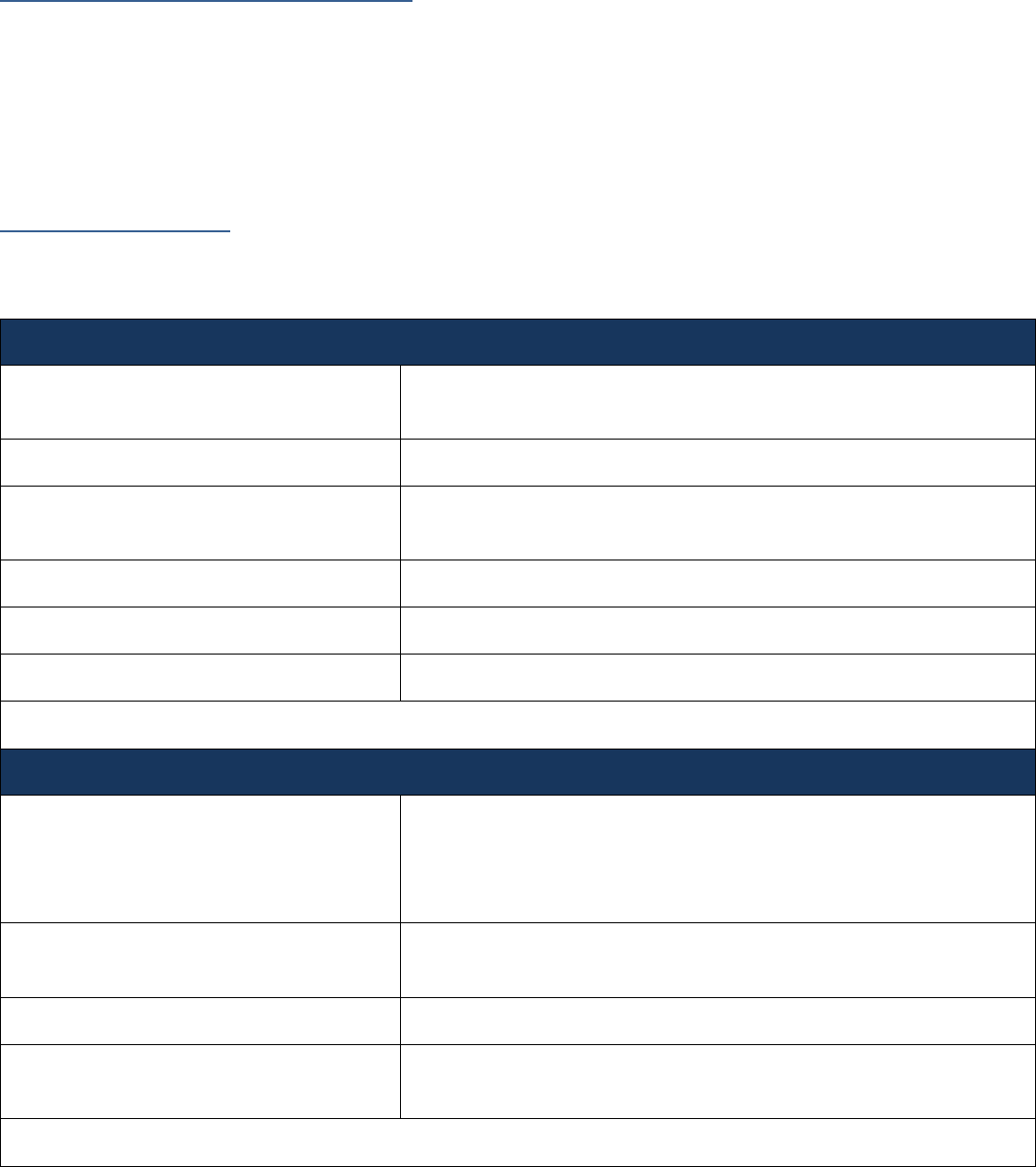

Proof of Residence

Proof of residence will be required at the time of appointment and for any subsequent residence changes to DCAS

Investigation Unit and/or the employing agency. Acceptable verification documents include:

PRIMARY DOCUMENTS (Show 2)

Original Utility Bill*

Original mailed copy of a monthly gas, landline telephone, oil, electric, cable

or other utility bill.

Original Charge Account Statement*

Original mailed copy of a monthly major credit card or store card bill.

Original Bank Account/Life Insurance

Statement*

Original mailed copy of a monthly bank account statement or life insurance

statement.

Mortgage Statement*

Original mailed copy of a monthly mortgage statement.

Rent receipt on letterhead

Original rent receipt printed on landlord’s professional letterhead.

Homeowner’s/renter’s insurance policy*

Original mailed copy of a homeowner’s or renter’s insurance policy.

*NOTE: Printouts of electronic versions of such statements are considered to be secondary documents. All monthly statements

(mailed or printed) should be dated within 30-60 days of submission to requesting agency representative and/or investigator.

SECONDARY DOCUMENTS (Show 3, or 1 PRIMARY and 2 SECONDARY)

Electronic version of any statement above with

asterisk (*)

Printed version of a monthly online statement, downloaded via Internet

website of service provider and/or bank or creditor. May provide two different

electronic statements and one other secondary document or a primary

document.

W-2 statement, 1099 statement or payment of

City tax**

Original or printed version of an electronic copy of W-2 or 1099 statement or a

NY State tax return showing payment of City tax.

Voter registration**

Proof of voter registration with full name and address.

Motor vehicle insurance receipts or ID card

Receipts of payment for motor vehicle insurance and/or an original insurance

identification card as provided by carrier.

** NOTE: These documents are time-sensitive and therefore, subject to review and acceptance at agency/investigator’s

discretion.