UNITED STATES DEPARTMENT OF AGRICULTURE

Farm Service Agency

Washington, DC 20250

Direct Loan Servicing – Debt

Collection and Resolution

7-FLP

Amendment 11

Approved by: Deputy Administrator, Farm Loan Programs

Amendment Transmittal

A Reasons for Amendment

Subparagraphs 81 F through H have been added because page 3-33 was inadvertently removed in

Amendment 9.

Subparagraph 202 B has been amended to add the requirement that CNC promissory notes be

retained as the borrower remains liable for the debt.

Subparagraphs 404 A and 408 A have been amended to note that debt discharged in

reorganization bankruptcy or otherwise legally without merit may be canceled by SED using

authority delegated from the Administrator on FSA-2731.

Subparagraph 405 F has been added to provide information on requesting a LexisNexis search.

Exhibit 39 has been amended to:

• update examples A, B, and C to the most recent form

• add example D for partial cancellation of debt discharged in reorganization bankruptcy.

Page Control Chart

TC

Text

Exhibit

3, 4

3-33 (add)

7-1, 7-2

7-3 (add)

12-13, 12-14

12-19 through 12-22

12-25, 12-26

39, pages 1-6

page 7

page 8 (add)

page 9 (add)

8-4-22 Page 1

.

Table of Contents (Continued)

Page No.

Part 10 (Reserved)

281-350 (Reserved)

Part 11 Monitoring, Servicing, and Settling Judgment Debts

351 Monitoring Judgment Debts ................................................................................ 11-1

352 Servicing FSA Debts That Are Under DOJ’s Jurisdiction .................................. 11-2

353 Servicing Judgment Debts Returned by DOJ ...................................................... 11-3

354 Debt Settlement of Judgment Debts .................................................................... 11-4

355-400 (Reserved)

Part 12 Debt Settlement

401 Overview and Authority ...................................................................................... 12-1

402 Determining If The Debt Can Be Settled ............................................................. 12-6

403 Types of Debt Settlement..................................................................................... 12-8

404 Cancellation Without Borrower/Debtor Signature (FSA-2731) .......................... 12-13

405 Debt Settlement Requested by Borrower/Debtor (FSA-2732) ............................ 12-18

406 Review Timeframes and Responsibilities ............................................................ 12-21

407 Borrower Repayment Ability ............................................................................... 12-23

408 Approval and Rejection ....................................................................................... 12-25

409 Payments and Servicing - Approved FSA-2732 .................................................. 12-30

8-4-22 7-FLP Amend. 11 TC Page 3

Table of Contents (Continued)

Exhibits

1 Reports, Forms, Abbreviations, and Redelegations of Authority

2 Definitions of Terms Used in This Handbook

3 (Reserved)

4 State Supplements

5, 6 (Reserved)

7 Example of Due Process Letter to Refer Debt to Treasury for TOP, Cross-Servicing, and

AWG

8 Reviewing Alternative Repayment Agreements (ARA’s)

9-11 (Reserved)

12 Review and Determination for Pro Rata Offset

13 Reconsideration Review, Mediation and NAD Appeal

14-16 (Reserved)

17 Timeframe for Quarterly Referrals to TOP

18 TOP Offset Programmatic Delete Codes

19 TOP Offset Manual Online Screen Delete Codes

20 TOP Offset Online Screens

21-28 (Reserved)

29 AWG Reference Guide for LSPMD

30-33 (Reserved)

34 Approving Debt Settlements Under FCCS

35 Optional Guide to Document Asset Search

36-38 (Reserved)

39 Completed Examples of FSA-2731, Cancellation of Debt Without Application, and

FSA-2731A, Cancellation of Debt Without Application (Continuation)

10-26-20 7-FLP Amend. 9 TC Page 4

Par. 81

81 Offset Procedures, Reports, Automation (Continued)

*--F Reports

For relevant reports, refer to the following:

• 63-FI, paragraph 178 for FWADM Active Other Agency Offset Profiles Report

64-FI, paragraph 82 for a list of FWADM reports in NRRS

• 1-FLP, Part 3 for DLS, GLS, FOCUS, and Data Mart

• 3-PL (Rev. 2), Part 8 for delinquent debt determinations in web subsidiary:

• subparagraph 305 N for a list of all delinquent debtors

• paragraph 303 for a specific borrower.

Note: For guidance on accessing FWADM, see 1-FI, Part 8.

G FSAFS, NRRS and NPS

FSAFS is used to establish, modify, and cancel “Other Agency Debt” indicators to offset FP

program payments to collect delinquent FLP debt. See 63-FI, Part 5.

NRRS is used for remittances and receipts, and to refund offset collections received for FLP

debt when needed. See 64-FI, Part 5.

NPS is used to process FP program payments and internal administrative offsets to collect

delinquent FLP debt. See 1-FI, subparagraphs 98 B and G.

H Canceling Offset

The authorized agency official will notify the State Office to remove a borrower from

internal administrative offset, TOP (Part 4), and cross-servicing (Part 8), as applicable, when

a delinquent debt is either of the following:

• has been resolved according to subparagraph 63 B

• is no longer eligible for other reasons such as bankruptcy, or a determination that offset is

not feasible according to subparagraph 63 A.

Note: To unlink 1 or more co-borrowers, see subparagraph 104 A.--*

82-100 (Reserved)

8-4-22 7-FLP Amend. 11 Page 3-33

.

Par. 201

Part 7 Servicing Unsecured Account Balances and CNC Classification

201 Servicing Requirements for Unsecured Account Balances

A Issuing FSA-2716 and FSA-2717

After all security has been liquidated, and all proceeds have been applied to the account, the

authorized agency official will send FSA-2716 and FSA-2732 to all liable borrowers.

In cases of voluntary liquidation and/or third party foreclosures, FSA loans might not have

been delinquent at the time of sale. As appropriate, the authorized agency official will ensure

that all applicable loan servicing and offset notices are sent according to Parts 2, 3, and 4.

For conveyance and according to 5-FLP, subparagraphs 497 A and 517 A, the authorized

agency official can accept a borrower’s conveyance offer and deny a borrower’s debt

settlement request that was submitted with the conveyance offer. In these cases, after all

appeal rights have been concluded and the conveyance has been processed, the authorized

agency official will send FSA-2717 to all liable borrowers for any remaining account

balance.

If FSA loans were not delinquent at the time of conveyance, the authorized agency official

will ensure that all applicable offset notices are sent according to Parts 2, 3, and 4.

*--Note: If the account has not been accelerated or is not fully matured, see 5-FLP Part 15 to

determine if 5-FLP Exhibit 48 must be sent.--*

B Continued Servicing

The authorized agency official will determine whether the debt can be classified as CNC if

borrowers do not:

pay the debt in full or submit a completed FSA-2732 within 30 calendar days of the date

on FSA-2716

• pay the debt in full within 30 calendar days of the date on FSA-2717.

Internal administrative offset, TOP, and Federal salary offset will continue until the

delinquency is cured.

C No Remaining Liable Borrowers

If there is a remaining account balance and there are no liable borrowers for the debt because

of bankruptcy discharge, death, etc., the authorized agency official will prepare FSA-2731

recommending cancellation according to Part 12.

12-28-17 7-FLP Amend. 7 Page 7-1

Par. 202

202 CNC Classification

A Required Notification Before CNC

Before classifying debt as CNC, borrowers must have received the following:

• all applicable loan servicing notices

• FSA-2701, FSA-2702, FSA-2703, FSA-2704, or previous authorized form, as applicable

• 60-day due process letter (Exhibit 7) sent as part of the TOP screening procedure in Part 4

• FSA-2716 or FSA-2717 or previous authorized form, as applicable

acceleration notice unless all accounts have been fully matured.

Note: See 5-FLP, Part 15 for acceleration process.

• If State law considers voluntary conveyance offers and the completion of

FSA-2732 as the borrower’s acknowledgment that the debt is fully due and

payable, an Acceleration Notice is not required. SED should work with OGC on

State supplement if needed.

• Any applicable timeframes about the information in this part must have expired

and all security liquidated, conveyed, released, or otherwise resolved.

B Determining CNC Eligibility and Classification Processing

The authorized agency official will:

• use FSA-2720 to determine CNC eligibility

• submit CNC eligible debt on FSA-2720 to the State Office through DD

• ensure that eligible debts are classified CNC using transaction code 3K, class of write off

code 5

*--ensure that original promissory notes are retained in a fireproof cabinet or fireproof safe

Note: A CNC classification is not a debt settlement. The promissory notes are needed to

prove continued liability for the debt.--*

• ensure that CNC debt is referred to cross-servicing for collection according to Part 8.

Note: See restrictions for CNC associated with discrimination complaints in 1-FLP,

subparagraph 41 K.

8-4-22 7-FLP Amend. 11 Page 7-2

Par. 202

202 CNC Classification (Continued)

C Servicing Debts Not Eligible for CNC

The authorized agency official will:

• determine whether the debt can be debt settled according to Part 12

• monitor debt that is not eligible for CNC or debt settlement until it:

• becomes eligible for CNC

• is paid in full

• is debt settled, or otherwise resolved.

203-220 (Reserved)

8-4-22 7-FLP Amend. 11 Page 7-3

.

Par. 404

404 Cancellation Without Borrower/Debtor Signature (FSA-2731)

A Overview

When cancellation of debt does not require borrower’s signature, agency officials will cancel

the debt using FSA-2731. Borrower signature is not required as follows:

• all debt returned from cross-servicing as uncollectible

• all debt returned from cross-servicing after paying compromise or adjustment offer

(subparagraph C)

*--obligor has been discharged of the debt under Chapter 7 bankruptcy and there is no

remaining FSA security, or reorganization bankruptcy (Chapter 11, 12, or 13) when a

final order of discharge has been issued by the court

Note: See subparagraph 408 A for partial debt settlement exception authority for

reorganization bankruptcy.--*

• obligor is deceased or defunct and there are no assets from which FSA can collect

• DOJ settlement negotiated instead of foreclosure or judgment, plea agreement, or the

remaining balance of the debt is not covered by the judgment and determined by OGC

to be legally without merit

*--Note: See subparagraph 408 A for partial debt settlement exception authority.

• OGC has determined that the debt is legally without merit--*

• DOJ, Civil Division settlement because of prior debt forgiveness with outstanding

principal of $100,000 or greater (Exhibit 34)

• cancellation of judgment debt unless borrower requests cancellation according to

paragraph 405

* * *

• obligor signature cannot be obtained or has disappeared.

Note: FSA-2731 may be used in conjunction with FSA-2732 for any borrower who is not

required to submit a signed application.

For CFR procedure/authority references, see subparagraph 403 D.

8-4-22 7-FLP Amend. 11 Page 12-13

Par. 404

*--404 Cancellation without Borrower/Debtor Signature (FSA-2731) (Continued)--*

B Documentation Needed

Except for debt returned from cross-servicing, (see subparagraph C) the following

documentation is needed to cancel debt without borrower/debtor signature.

• FSA-2731 and the following, if applicable, for:

• debts legally without merit, written OGC determination

• deceased debtors (FSA-2490)

• bankruptcy cases:

• Chapter 7 – attach a copy of the “Discharge of Debtor” order(s) by the court for

all obligors

• Chapters 11, 12, and 13 unsecured claims:

• organization plan (Chapter 11)

• reorganization plan (Chapters 12 and 13)

• confirmation order by the court confirming the plan

• order completing the plan (a similar order)

• written opinion by OGC that the confirming order has discharged the

obligor(s) of liability for that part of the debt.

Note: See Exhibit 39 for completed examples of FSA-2731 and FSA-2731A.

10-26-20 7-FLP Amend. 9 Page 12-14

Par. 405

405 Debt Settlement Requested by Borrower/Debtor (FSA-2732) (Continued)

A Information Needed (Continued)

• FSA-2014, or other written verification of non-farm income

Note: Verification of a non-debtor spouse income is also needed for consideration in

meeting family living expenses.

• Federal income tax returns for the last 3 years

• other information required to obtain a clear understanding of each borrower’s financial

condition.

*--Notes: FSA-2731 may be used in conjunction with FSA-2732 for any borrower/debtor not

required to submit a signed application.

For accounts where the last remaining liable debtor is deceased and the FSA-2490

indicates that FSA will be filing a claim, the applicable information needed for debt

settlement can be provided by the administrator or executor of the Estate, heir, or

other authorized person who can sign FSA-2732. FSA-2490 will be attached to

FSA-2735 or FSA-2732.

Exception: According to 7 CFR 761.404(b)(3) in cases where the full amount of the

unsecured debt cannot be collected in a reasonable time by legal or enforced

collection proceedings, FSA may consider a debt settlement offer submitted

by a borrower without requiring complete financial information. OGC written

concurrence must be obtained in these cases. However, National Office

concurrence is not needed. See subparagraph 403 D.--*

B Continued Collection

Borrowers may request debt settlement before the debt is referred to Treasury’s cross-

servicing program (Part 8) pursuant to 7 CFR part 3 and 31 CFR part 285.

*--DCIA and the CONACT provide specific timeframes during which a borrower can request

debt settlement. They are listed in subparagraph 408 A. When borrowers apply for debt

settlement during those timeframes, FSA generally suspends the next pending collection

action so the application can be considered.

When an application is submitted outside of those timeframes, it does not prevent, suspend,

or delay collection activities required by the CONACT or DCIA, including but not limited--*

to administrative offset, and salary offset. These collections will continue while FSA verifies

and reviews the financial information submitted with the debt settlement request.

10-26-20 7-FLP Amend. 9 Page 12-19

Par. 405

405 Debt Settlement Requested by Borrower/Debtor (FSA-2732) (Continued)

C Debt That Can Be Settled

See paragraph 402.

D Eligible Debtors

[7 CFR 761.404(a)] A borrower is eligible for debt settlement if the borrower:

(1) Meets the requirements for the particular type of debt settlement under this part

(paragraph 403); and

(2) Submits a complete application for debt settlement as specified in § 761.405

(subparagraph 405A).

[7 CFR 761.404(c)] A borrower is not eligible for debt settlement if:

(1) The borrower is indebted on another active FLP loan that the borrower cannot

or will not debt settle; or

*--Note: SED is authorized to approve the partial cancellation of debt only as

authorized under subparagraph 408 A.--*

(2) The debt has been referred to the OIG, OGC, or Justice because of suspected

civil or criminal violation, unless investigation was declined or advice was provided that

the debt can be canceled, compromised, or adjusted.

E CFR

For CFR procedure/authority references to use on FSA-2733, item 4B, see paragraph 403.

*--F LexisNexis

LexisNexis provides computer-assisted legal, business, and risk management research

services. Its Accurint system provides efficient search technology to locate real estate

transactions and ownership data; lien, judgment, and bankruptcy records; as well as

professional license information and historical addresses. Additionally, its Courtlink system

provides for online searches of more than 1,250 Federal and State court dockets.

Upon FLC recommendation, SED may request LSPMD obtain a LexisNexis Accurint report

for the following types of delinquent borrowers:

• complex cases involving FSA adverse action proceedings, where it is likely that a

borrower may have significant assets outside of the servicing official’s normal servicing

area

Note: Requests within the normal servicing area may be considered if the area covers

multiple counties and it is not cost-effective for agency officials to complete the

asset search based upon travel and inability to complete online searches for local

records.--*

8-4-22 7-FLP Amend. 11 Page 12-20

Par. 405

405 Debt Settlement Requested by Borrower/Debtor (FSA-2732) (Continued)

*--F LexisNexis (Continued)

• large monetary or complex debt settlement applications

• restructures where FSA will not be fully secured

• disappeared borrowers where FSA efforts have not been successful as provided in 5-FLP,

subparagraph 67 C. The FBP running case record must detail the unsuccessful efforts

previously taken by servicing officials.

Note: Requests should not be made for routine servicing actions.

All requests must include a detailed statement of need and background of the borrower’s

FSA servicing actions.

Note: Unless OGC provides a written opinion in support of a search, FSA should not

request asset searches for borrowers who filed bankruptcy, as the bankruptcy records

contain a detailed list of the borrower’s assets.

SED must submit a request by email to DAFLP at SM.FSA.DCWa2.ADmException or

[email protected]. The email subject should read “LexisNexis – (Borrower’s

Name and State)”.--*

406 Review Timeframes and Responsibilities

A FLM

Within 30 calendar days, FLM will review all relevant information and forward to DD, a

debt settlement package containing the following:

• memorandum with FLM’s recommendation

• FSA-2732 and any applicable forms:

• FSA-2735

• FSA-2737

• FSA-2731 for co-debtors who are not required to sign FSA-2732 and FSA-2735

• FSA-2490 for deceased borrowers

• FSA-2080 for release of liability.

Note: Any related release of liability, such as a withdrawing joint obligor, must be

approved using FSA-2080, and the transaction must be correctly processed before

processing any approved debt settlement. This will ensure that the withdrawing

joint obligor does not receive IRS Form 1099-C. For additional information, see

4-FLP, Part 8; 4-FLP, paragraphs 231 and 251; and 5-FLP, paragraph 84.

8-4-22 7-FLP Amend. 11 Page 12-21

Par. 406

406 Review Timeframes and Responsibilities (Continued)

A FLM (Continued)

FSA-2733 and supporting documentation, including asset investigation

Note: Exhibit 35 may be used as an optional guide to document asset investigation

and/or search (item 14A on FSA-2733).

• relevant and applicable servicing office files.

B DD

Within 30 calendar days of receiving the debt settlement package, or within 60 calendar days

of the borrower submitting all needed information (whichever is less), the DD will:

• review the case file

• sign FSA-2733

• forward the debt settlement package to the State Office.

C State Office

Within 30 calendar days of receiving the debt settlement package, or within 90 calendar days

of the borrower submitting all needed information (whichever is less):

• FLP State Office Review Official and Farm Loan Chief will review the debt

settlement package and sign FSA-2733, before it is presented to SED

• SED will sign all applicable forms and letters to:

• approve the borrower’s request for debt settlement, or

• deny/reject the borrower’s request and provide appeal rights, or

• recommend the debt settlement be approved by the Administrator or DOJ.

D Referrals to DOJ and FLP National Office

Referrals to:

• DOJ will be processed according to Exhibit 34

• DAFLP to use the Administrator’s approval authority will include:

• the memorandum from SED recommending approval

• the debt settlement package

• a legal opinion from the Regional Attorney addressing the statute of limitations, if

applicable

• any additional information requested by DAFLP and/or the Administrator.

8-4-22 7-FLP Amend. 11 Page 12-22

Par. 407

407 Borrower Repayment Ability (Continued)

D Negotiating Settlement

Debtors have the right to make voluntary settlement offers in any amount should they elect to

do so.

When negotiating a settlement, the following will be discussed to assist the debtor:

• repayment ability and a debt settlement amount (subparagraph B) that is based on the

financial documentation (subparagraph 405 A)

• types of settlement (paragraph 403)

• if collection is likely through cross-servicing, the 20 to 30 percent collection fee charged

by Treasury and it’s PCA’s

• any other relevant information such as unaccounted for security

• in cases where the account has been accelerated and all security has been liquidated, for

adjustment offers the payments will be applied to principle before interest.

Note: See subparagraph 409 E for additional information about adjustment payments.

408 Approval and Rejection

A Approval/Rejection Authority

SED’s may delegate to FLC, FLS, DD, FLM, and/or SFLO the authority to reject debt

settlement requests only in cases where debtors do not provide all necessary

documentation/information. Appeal rights must be provided with the rejection letter.

SED may approve or reject:

• cancellations of accounts where all obligors are properly included on FSA-2731 or were

previously released using FSA-2080, without regard to the size of the debt, unless there

was a previous debt forgiveness

Note: For previous debt forgiveness, see Exhibit 34.

8-4-22 7-FLP Amend. 11 Page 12-25

Par. 408

408 Approval and Rejection (Continued)

A Approval/Rejection Authority (Continued)

*--partial cancellation of debt

Note: FSA-2731 provides SED with exception authority to approve partial cancellation

as set forth with either of the following:

• when at least 1 obligor has been discharged in a reorganization bankruptcy and

any obligor not included in the discharge otherwise meet the requirements of

FSA-2731

• for a DOJ settlement or when OGC determines that the debt is legally without

merit when the settlement or opinion covers at least 1 obligor and obligors not

included in the settlement or opinion otherwise meet the requirements of

FSA-2731.

Note: FLC will ensure that the most recent FSA-2731 is being used.--*

• proposed debt settlements that require using FSA-2732 (with or without FSA-2731) when

the outstanding balance of the indebtedness involved in the settlement, less the amount of

any compromise or adjustment offer, is less than $1 million, including principal, interest,

and other charges.

*--Note: SED may not approve partial cancellation of debt using FSA-2732 without an

Administrator’s exception.--*

The Administrator or designee must approve or reject debt settlements that require using

FSA-2732 (with or without FSA-2731) when the outstanding balance of the indebtedness

involved in the settlement, less the amount of any compromise or adjustment offer, is

$1 million or more, including principal, interest, and other charges.

When FSA-2731 is used with FSA-2732, the settlement code for the account (3K transaction)

will be for the settlement approved on FSA-2732. Settlement of the debt will be approved on

FSA-2732.

CONACT and DCIA notification letters generally allow borrowers to apply for debt

settlement within 30 or 60 calendar days as follows:

• FSA-2510 and FSA-2514 provide 60 calendar days

• FSA-2716 provides 30 calendar days

• Exhibit 7 due process letter to refer debt to Treasury provides 60 calendar days.

If an incomplete debt settlement application is submitted in response to the above forms, the

authorized agency official will notify the borrower how many days remain for the borrower

to submit the missing information according to the applicable timeframes. And based on the

information that was submitted, may authorize up to an additional 30 calendar days to submit

the needed information or a new/revised offer depending on the circumstances of the case.

8-4-22 7-FLP Amend. 11 Page 12-26

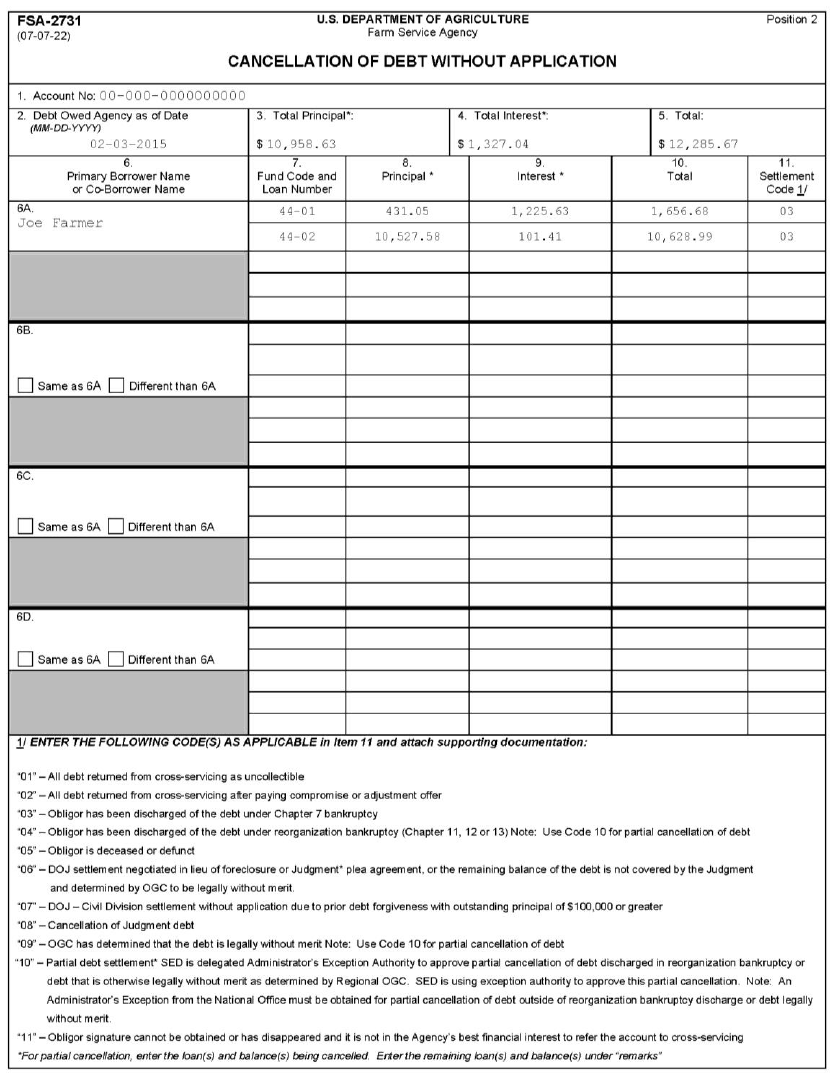

Exhibit 39

(Par. 404)

Completed Examples of FSA-2731, Cancellation of Debt Without Application, and FSA-2731A,

Cancellation of Debt Without Application (Continuation)

A Example 1

In the following completed example of FSA-2731, the borrowers have been returned from

cross-servicing and the co-borrower is liable for all debt.

*--

--*

8-4-22 7-FLP Amend. 11 Page 1

Exhibit 39

(Par. 404)

Completed Examples of FSA-2731, Cancellation of Debt Without Application, and FSA-2731A,

Cancellation of Debt Without Application (Continuation) (Continued)

A Example 1 (Continued)

*--

--*

8-4-22 7-FLP Amend. 11 Page 2

Exhibit 39

(Par. 404)

Completed Examples of FSA-2731, Cancellation of Debt Without Application, and FSA-2731A,

Cancellation of Debt Without Application (Continuation) (Continued)

B Example 2

In the following completed examples of FSA-2731 and FSA-2731A, the borrower is an entity.

The entity and all of the members of the entity, except 2, were discharged from Chapter 7

Bankruptcy. Of the 2 not discharged from bankruptcy, 1 member is deceased and 1 member

resides in a nursing home and is incapacitated. In addition, 1 member was liable for only 1 loan.

*--

--*

8-4-22 7-FLP Amend. 11 Page 3

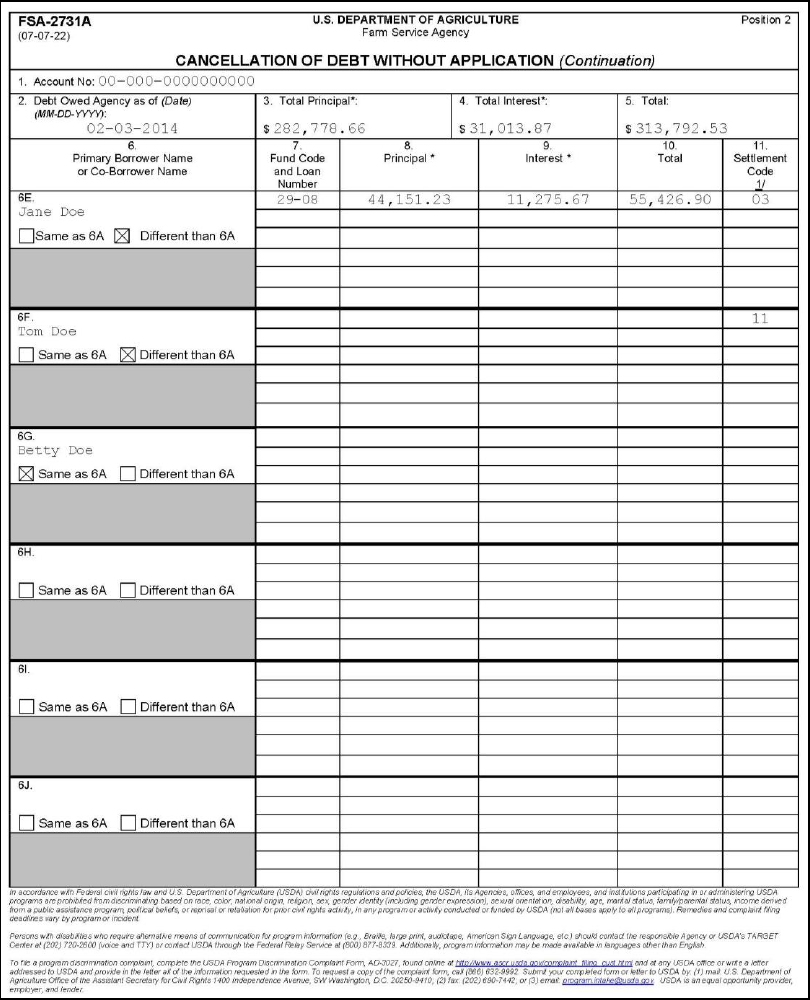

Exhibit 39

(Par. 404)

Completed Examples of FSA-2731, Cancellation of Debt Without Application, and FSA-2731A,

Cancellation of Debt Without Application (Continuation) (Continued)

B Example 2 (Continued)

*--

--*

8-4-22 7-FLP Amend. 11 Page 4

Exhibit 39

(Par. 404)

Completed Examples of FSA-2731, Cancellation of Debt Without Application, and FSA-2731A,

Cancellation of Debt Without Application (Continuation) (Continued)

B Example 2 (Continued)

*--

--*

8-4-22 7-FLP Amend. 11 Page 5

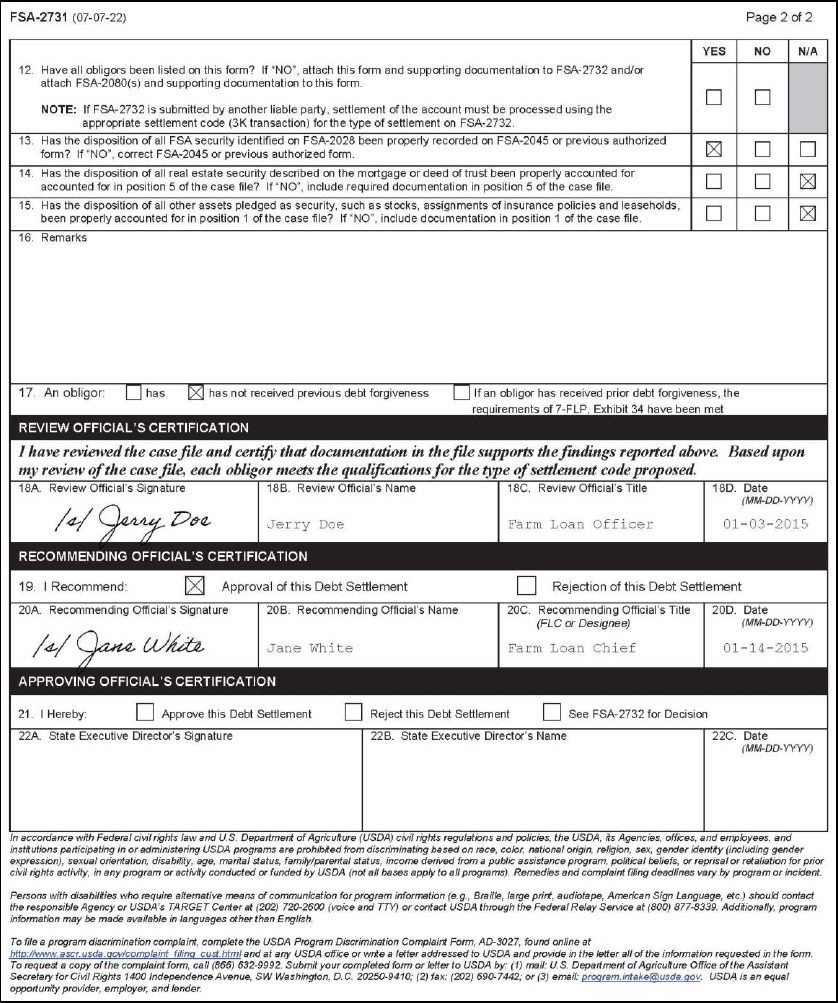

Exhibit 39

(Par. 404)

Completed Examples of FSA-2731, Cancellation of Debt Without Application, and FSA-2731A,

Cancellation of Debt Without Application (Continuation) (Continued)

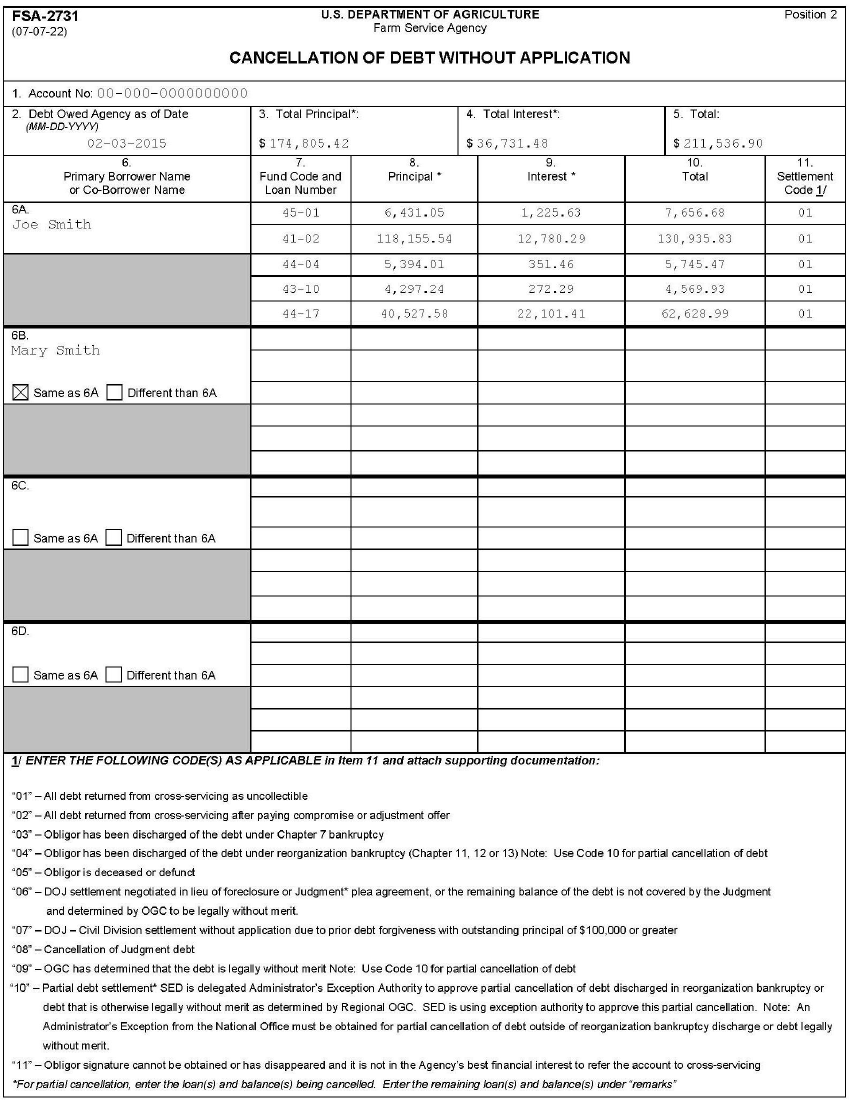

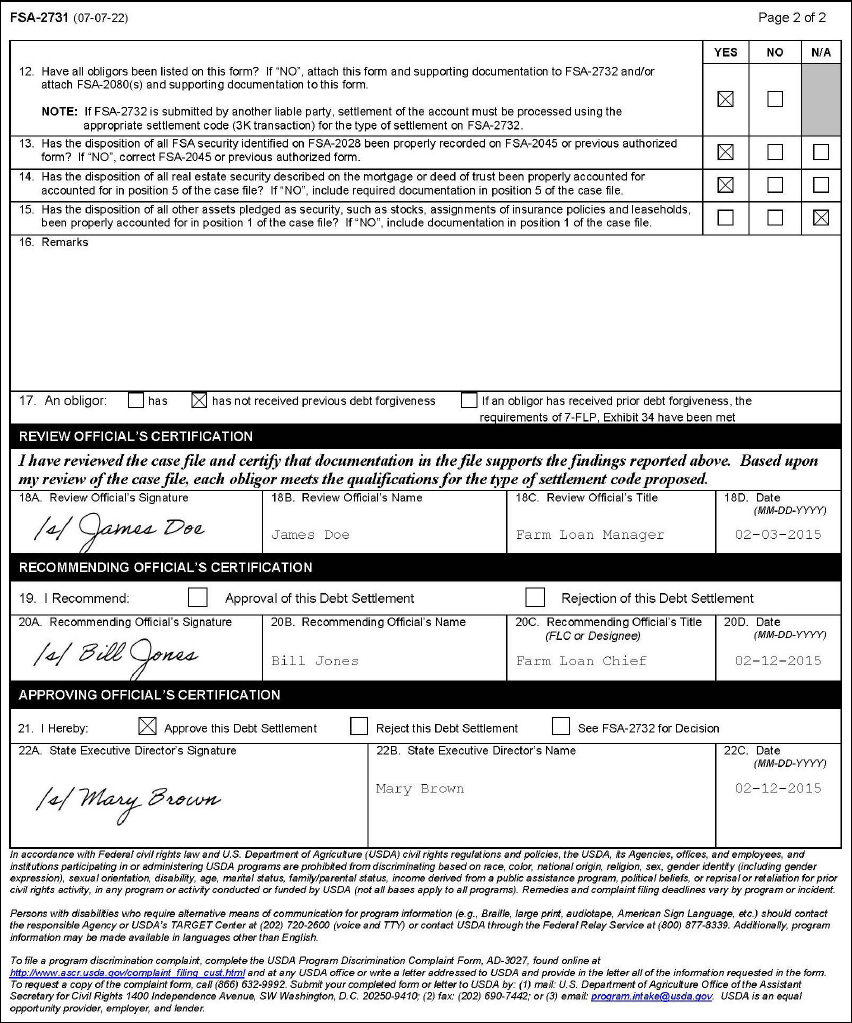

C Example 3

In the following completed example of FSA-2731, the primary borrower was discharged from

Chapter 7 Bankruptcy. The co-borrower, who did not file bankruptcy, subsequently requested

debt settlement and has submitted FSA-2732.

*--

--*

8-4-22 7-FLP Amend. 11 Page 6

Exhibit 39

(Par. 404)

Completed Examples of FSA-2731, Cancellation of Debt Without Application, and FSA-2731A,

Cancellation of Debt Without Application (Continuation) (Continued)

C Example 3 (Continued)

*--

--*

8-4-22 7-FLP Amend. 11 Page 7

Exhibit 39

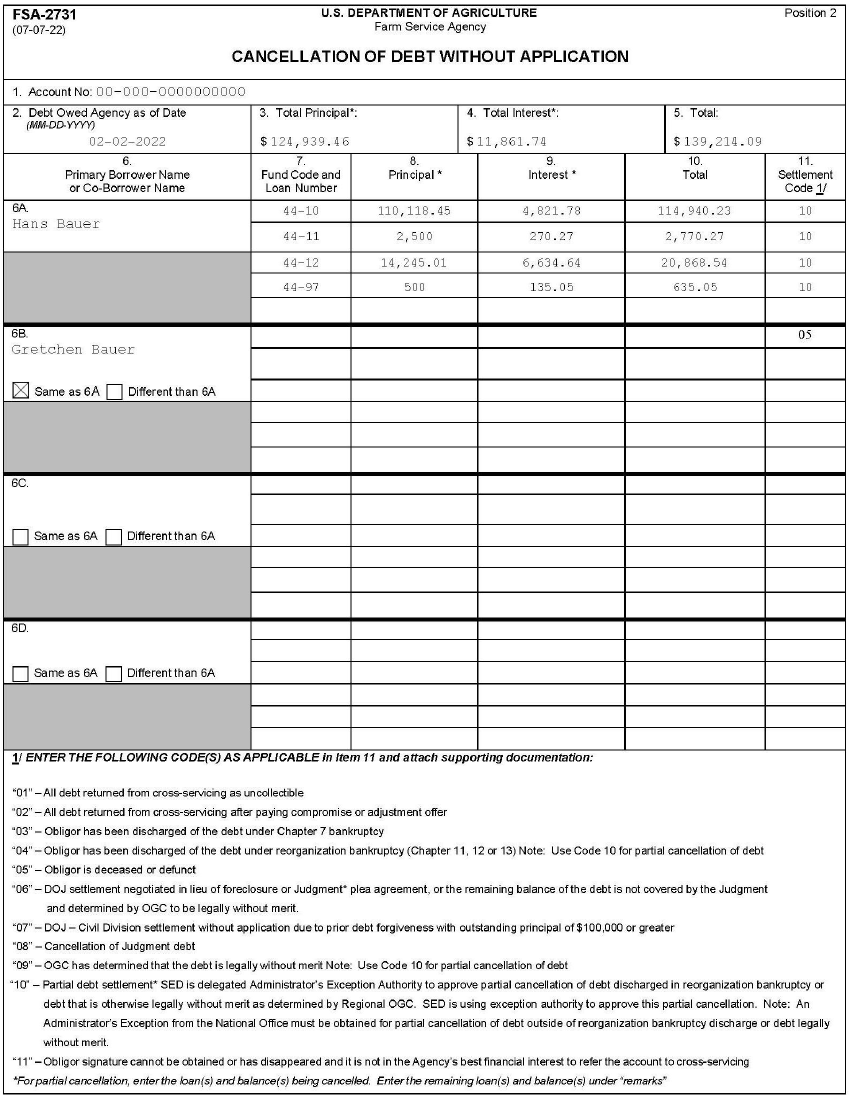

(Par. 404)

Completed Examples of FSA-2731, Cancellation of Debt Without Application, and FSA-2731A,

Cancellation of Debt Without Application (Continuation) (Continued)

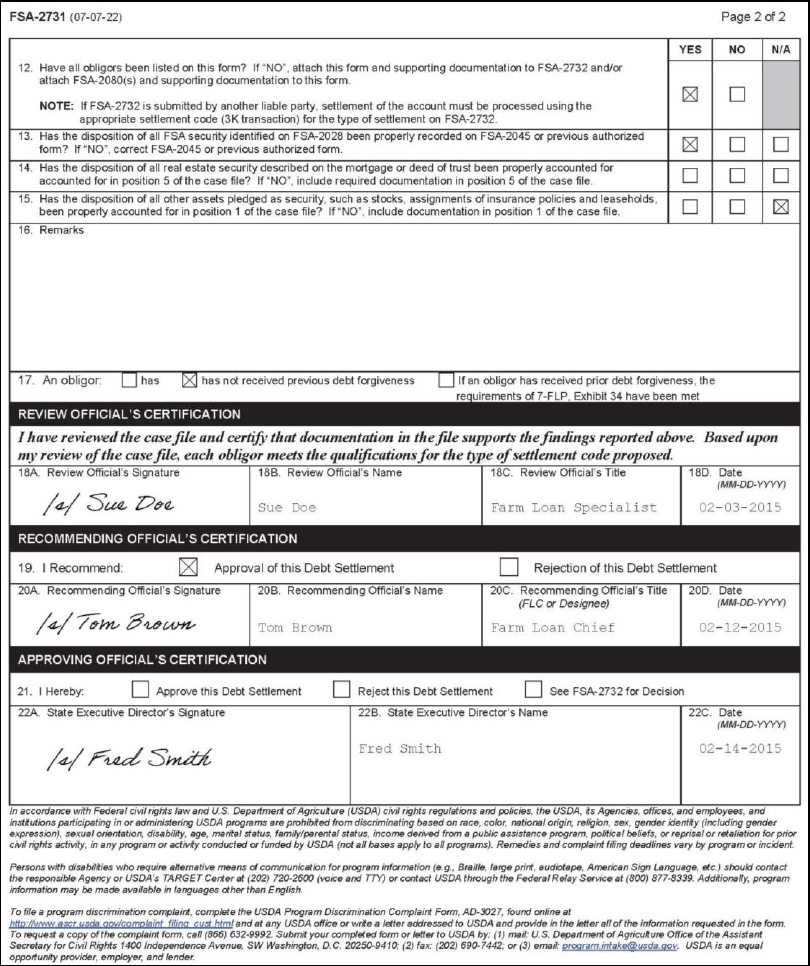

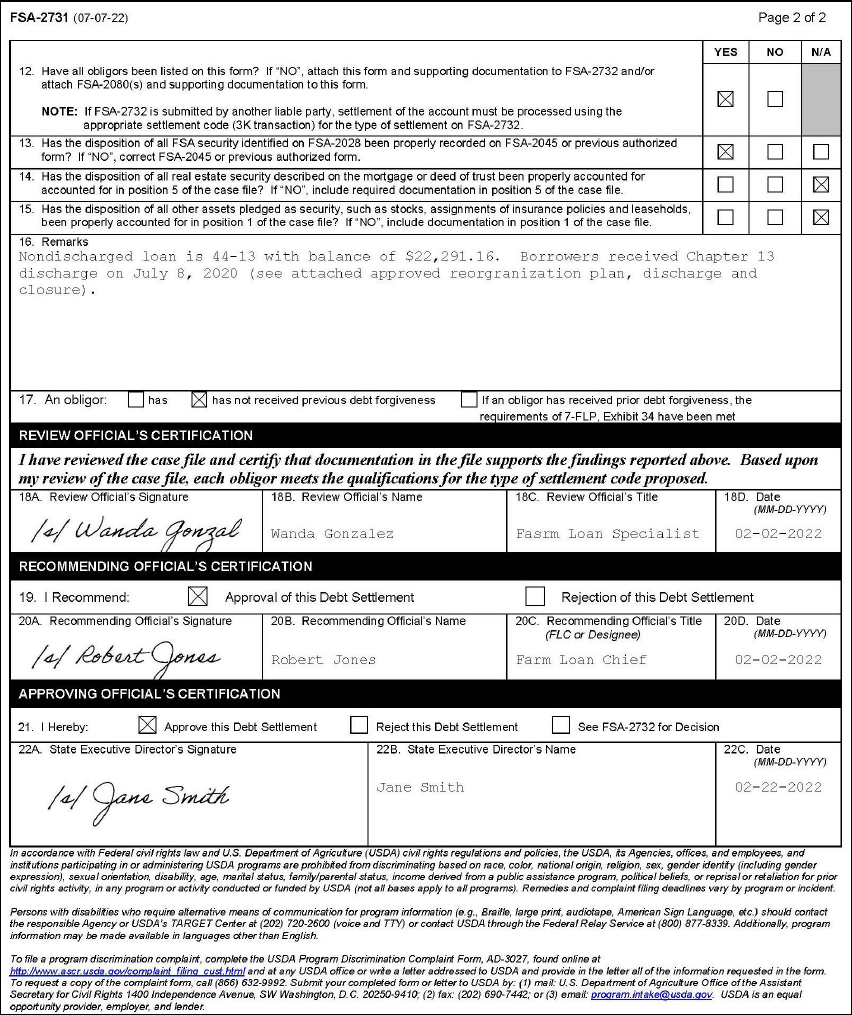

*--D Example 4

In the following completed example of FSA-2731, 1 borrower was discharged of a portion of the

debt in reorganization bankruptcy (Chapter 13 in this case) and the other is deceased.

--*

8-4-22 7-FLP Amend. 11 Page 8

Exhibit 39

(Par. 404)

Completed Examples of FSA-2731, Cancellation of Debt Without Application, and FSA-2731A,

Cancellation of Debt Without Application (Continuation) (Continued)

*--D Example 4 (Continued)

--*

8-4-22 7-FLP Amend. 11 Page 9

.