United States

Department of

Agriculture

INELIGIBLE

TRACKING

SYSTEM

HANDBOOK

2021 and Succeeding Crop Years

Federal Crop

Insurance

Corporation

FCIC-24050

(06-2020)

FCIC-24050-1h

(06-2021)

THIS PAGE IS INTENTIONALLY LEFT BLANK

UNITED STATES DEPARTMENT OF AGRICULTURE

RISK MANAGEMENT AGENCY

KANSAS CITY, MISSOURI 64133

June 2021 FCIC 24050-1 TP-1

TITLE: 2021 INELIGIBLE TRACKING

SYSTEM HANDBOOK

NUMBER: FCIC 24050-1

EFFECTIVE DATE:

2021 and Succeeding Crop Years

ISSUE DATE: June 28, 2021

SUBJECT:

2021 Ineligible Tracking System Handbook

OPI: Product Administration and Standards

Division

APPROVED:

/s/ Richard Flournoy

Deputy Administrator for Product Management

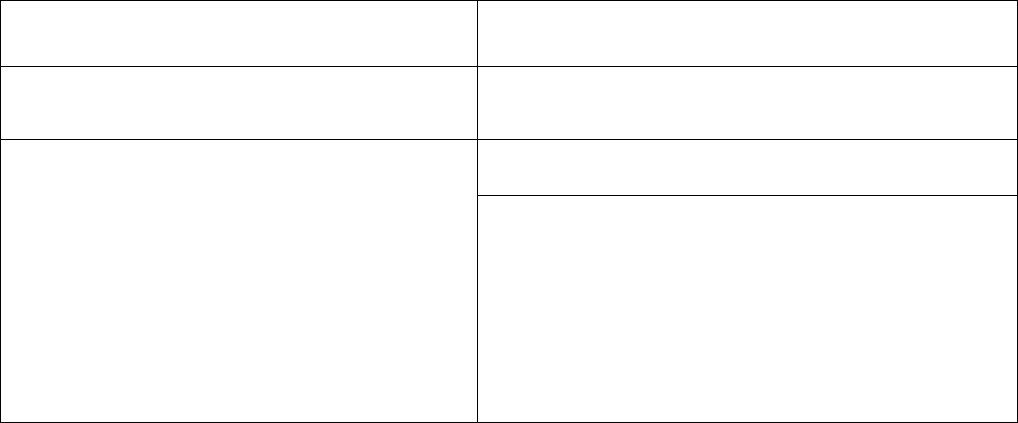

REASON FOR ISSUANCE

This handbook provides the official FCIC standards and instructions for use in administering the

Ineligible Tracking System, provides procedures, instructions, and examples of notification letters

consistent with the amended regulations at 7 CFR Part 400, subpart U and in accordance with the

Standard Reinsurance Agreement for the 2021 and succeeding crop years.

June 2021 FCIC 24050-1 TP-2

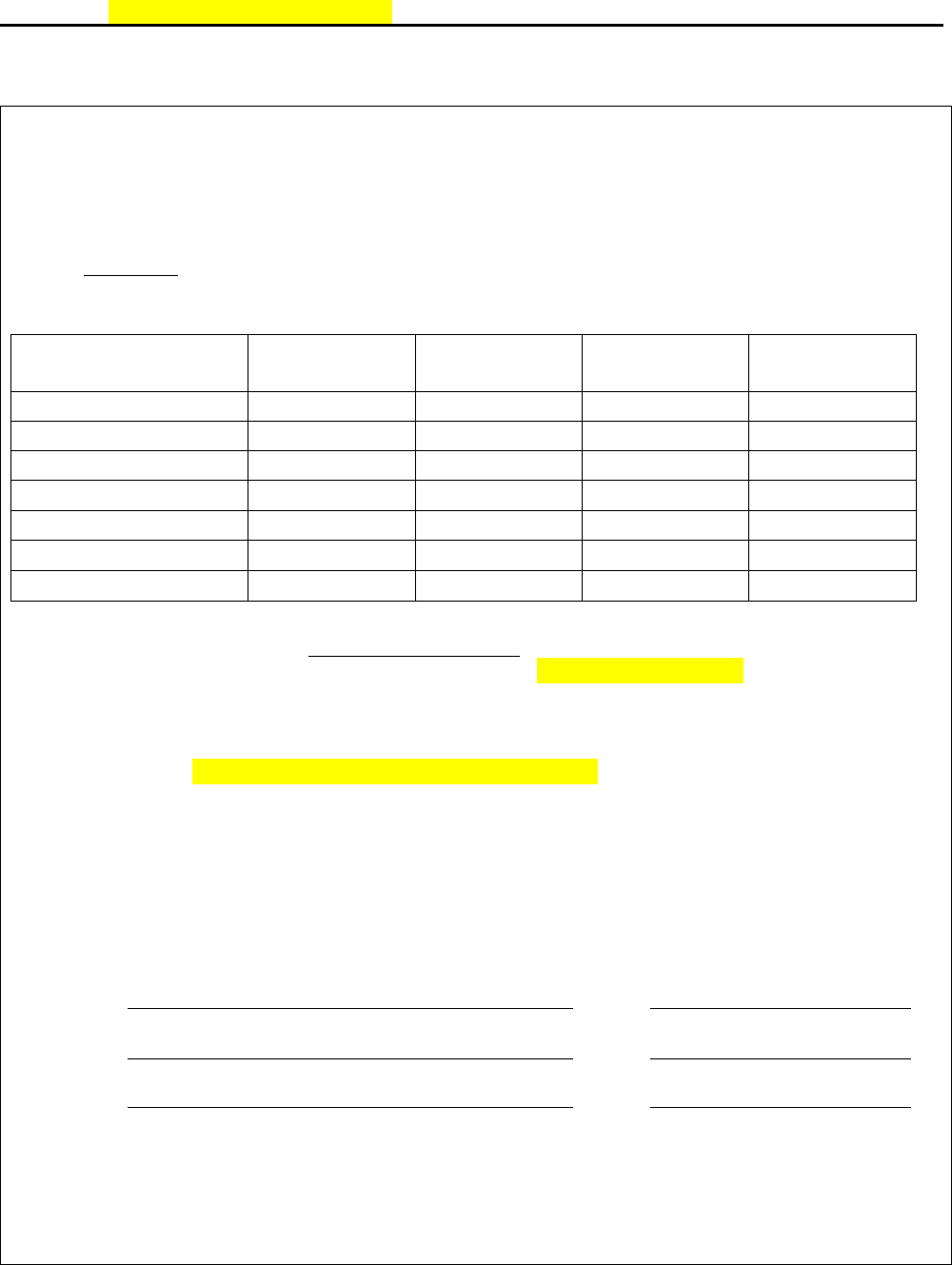

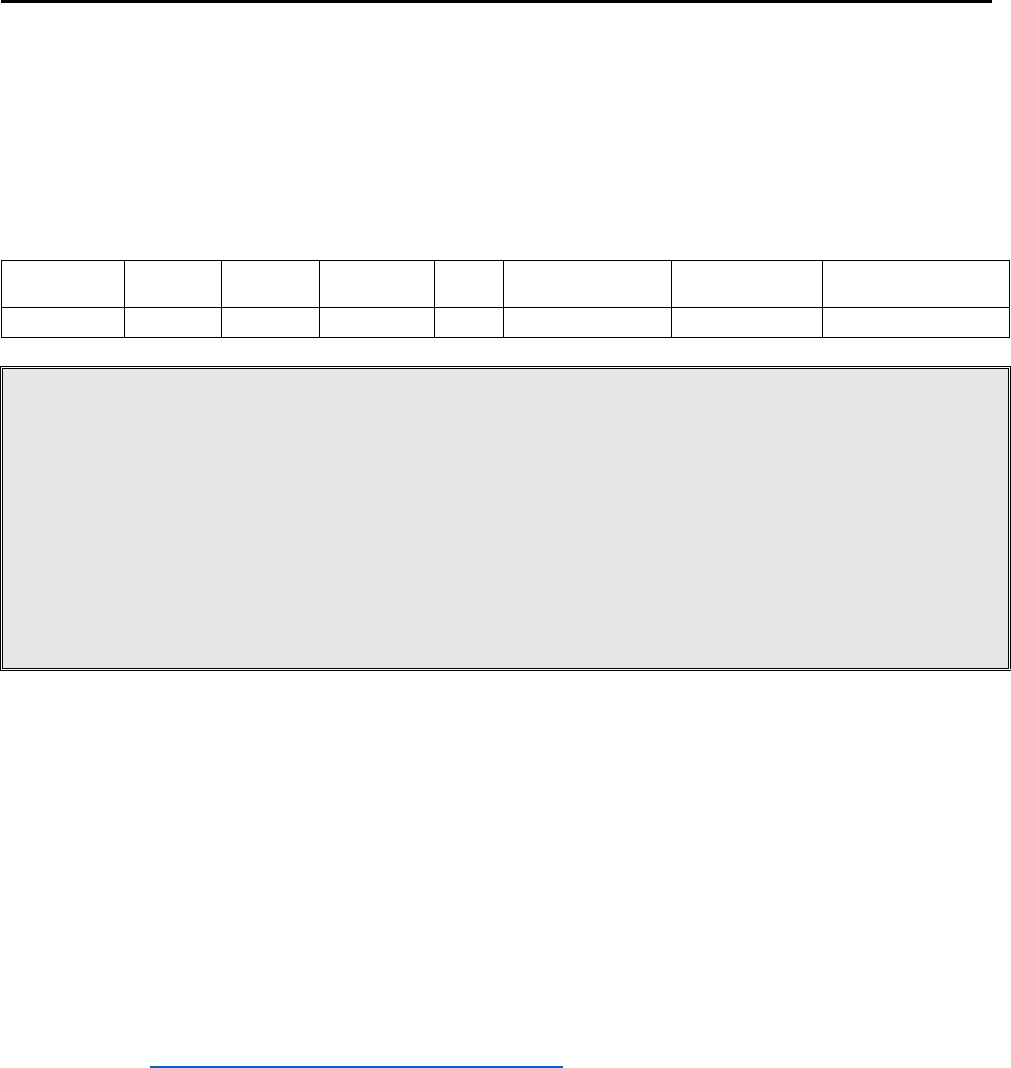

SUMMARY OF CHANGES

The chart below identifies significant changes or modifications from prior issuances of the ITS

Handbook. Minor changes and corrections are not included in this listing.

REFERENCE

VERSION

DESCRIPTION OF ADDITIONS, DELETIONS, CHANGES OR

CLARIFICATIONS

Para. 1E

24050

Updated the debt.management@usda.gov e-mail address

Para. 351

24050

Added requirement to CC: the insured’s agent on AIP ineligibility

notification

Para. 414

24050

Added notification of payments during written payment agreement

Para. 414-417

24050

Renumbered paragraphs

Para. 416D

24050

Added language for 15-day grace period for previously executed

payment agreements

Part 5

24050

Section 1 header added LRP-Fed, Feeder and Swine (2021 and

subsequent). Section 3 header added Lamb behind LRP and LRP-Fed,

Feeder and Swine (2020 or prior)

Part 5-

Section 1

24050-1

Section 1 header added (2021 or prior) after DRP and added Section

1.1 for 2022 DRP which uses cancellation date instead of sales closing

date as the effective date for termination.

Para. 601

24050

Added criteria for when a policy would be voided for dismissal of a

bankruptcy petition before discharge occurs for LRP-Lamb and LRP-

Fed, Feeder and Swine (2020 or prior). Additionally, added the

following policy to when a dismissal of a bankruptcy petition before

discharge occurs results in termination, not voidance, LRP-Fed,

Feeder and Swine (2021 and subsequent)

Para. 603

24050

Changed subparagraph C(3) to LRP-Lamb and LRP-Fed, Feeder and

Swine (2020 or prior) and subparagraph C(4) to DRP and LRP-Fed,

Feeder and Swine (2021 and subsequent)

Exhibits 3-4

24050

Added Written Request Waiver Letter Examples

Exhibits 5-6

24050

Added CC: for insured’s agent

Exhibit 7

24050

Moved Written Payment Agreement example here. Modified to

remove statement “These payments are to be made by me(us) without

regular billings from the AIP.”

Exhibit 8

24050

Added Written Payment Agreement Notification example

June 2021 FCIC 24050-1 TP-3

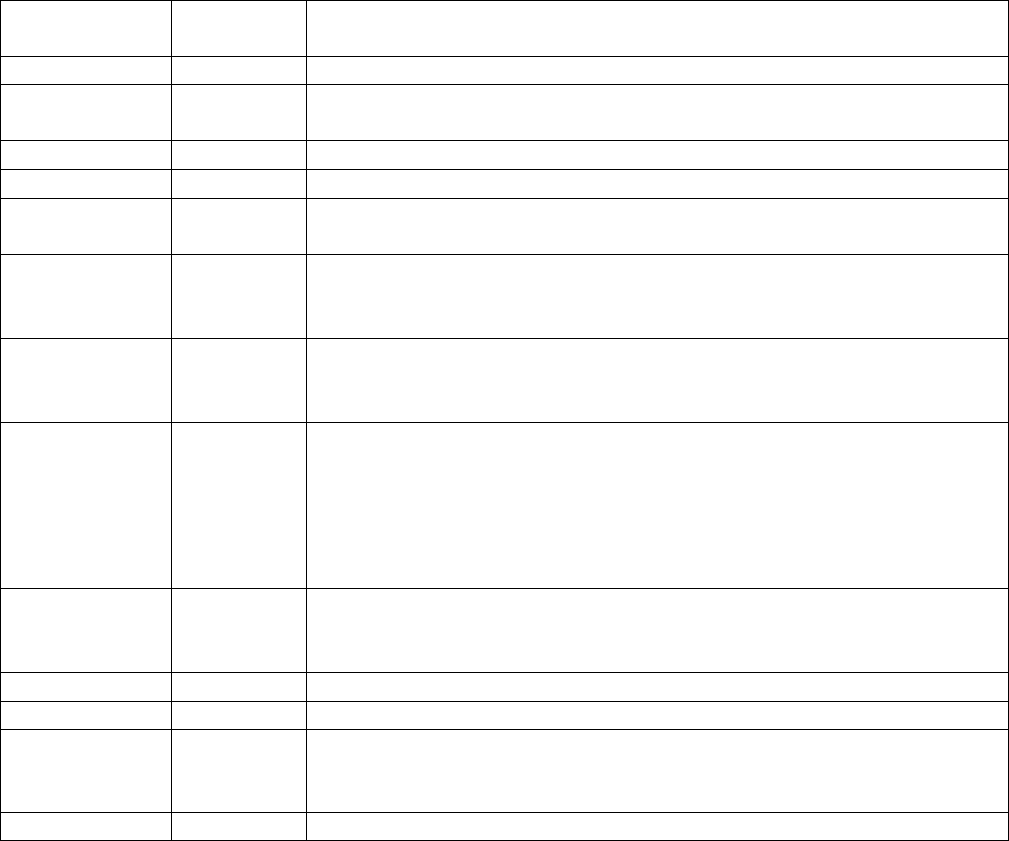

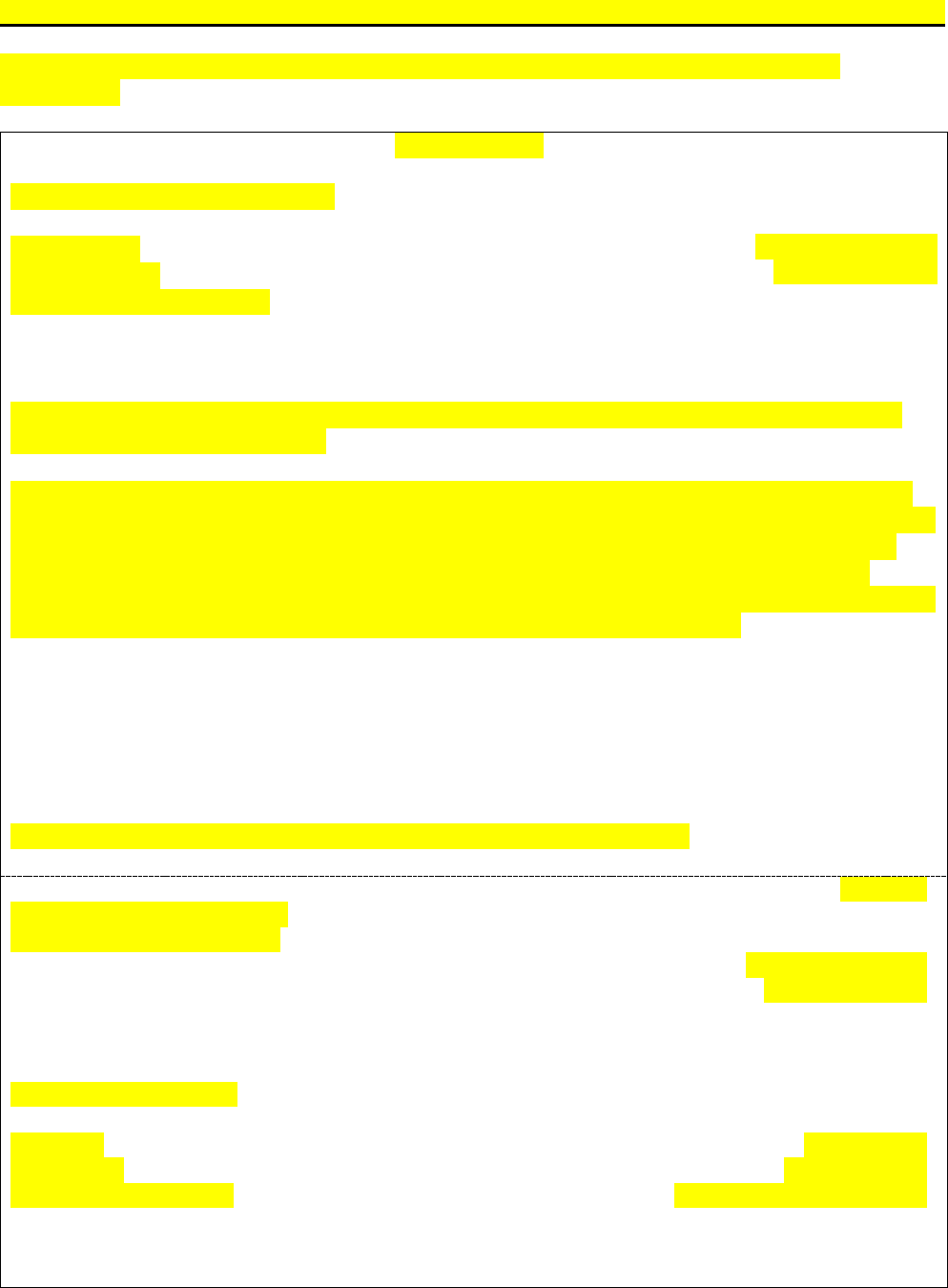

CONTROL CHART

TP Page(s)

TC Page(s)

Text Pages

Exhibits

Date

Directive Number

Remove

1-2

1-4

49-50

June 2020

FCIC 24050

Insert

1-4

1-4

49-50.2

June 2021

FCIC 24050-1

Current

1-4

1-4

June 2021

FCIC 24050-1

1-48

June 2020

FCIC 24050

49-50.2

June 2021

FCIC 24050-1

51-62

63-80

June 2020

FCIC 24050

FILING INSTRUCTIONS

This directive is effective on the date issued and will remain in effect until superseded or slip-sheeted.

RMA will amend this directive to administer programs reinsured by FCIC under authority of the

Federal Crop Insurance Act, 7 U.S.C. 1502 et. seq. FCIC-24050 Ineligible Tracking System

Handbook issued June 29, 2019, is superseded by this directive.

June 2021 FCIC 24050-1 TP-4

THIS PAGE IS INTENTIONALLY LEFT BLANK

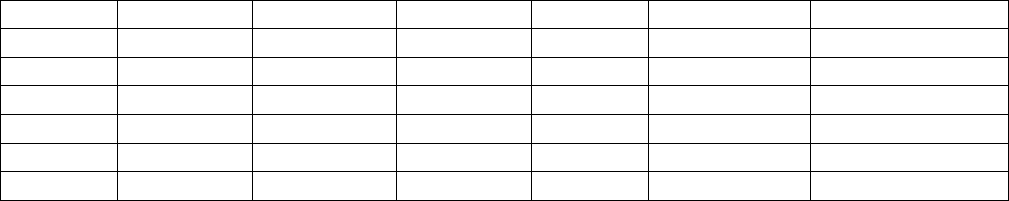

TABLE OF CONTENTS

June 2021 FCIC 24050-1 TC-1

PART 1 GENERAL INFORMATION AND RESPONSIBILITIES ................................................. 1

1 General Information ...................................................................................................................... 1

2 Acronyms and Definitions ............................................................................................................ 3

3 Title VI of the Civil Rights Act of 1964 ....................................................................................... 3

4 The Privacy Act of 1974 ............................................................................................................... 3

5 Responsibilities ............................................................................................................................. 4

6 Maintaining Supporting Documentation ...................................................................................... 6

7-200 (Reserved) .................................................................................................................................. 6

PART 2 ITS, REPORTING, ADMINISTRATION AND MAINTENANCE ................................... 7

201 Ineligible Tracking System ....................................................................................................... 7

202 Transmitting Records to ITS .................................................................................................... 7

203 Deleting Incorrect Records ....................................................................................................... 8

204-300 (Reserved) .............................................................................................................................. 8

PART 3 INELIGIBILITY ..................................................................................................................... 9

Section 1: Criteria ................................................................................................................................... 9

301 Ineligible Persons ...................................................................................................................... 9

302 Verification of Eligibility Status ............................................................................................. 12

303-310 (Reserved) ............................................................................................................................ 12

Section 2: Ineligibility Determination ................................................................................................. 13

311 Effect of Ineligibility .............................................................................................................. 13

312 Basis for Ineligibility Determination ...................................................................................... 13

313 Ineligibility Effective Dates .................................................................................................... 15

314 Time Period of Ineligibility .................................................................................................... 19

315-320 (Reserved) ............................................................................................................................ 20

Section 3: Ineligible Person Types ....................................................................................................... 21

321 Overview ................................................................................................................................. 21

322 Individuals .............................................................................................................................. 21

323 Spouses and Minors ................................................................................................................ 21

324 Landlords/Tenants .................................................................................................................. 22

325 Transferors/Transferees .......................................................................................................... 23

326 General Partnerships, Joint Ventures, Limited Partnerships, Limited Liability Partnerships,

and Limited Liability Companies ....................................................................................................... 23

327 Association, Estate, Trust, Corporation, or Other Similar Entity ........................................... 25

328 Estates and Trusts Administration .......................................................................................... 27

329 Entities Created to Conceal or Evade Ineligibility ................................................................. 28

330-350 (Reserved) ............................................................................................................................ 28

Section 4: Notification and Certification ............................................................................................ 29

351 AIP Ineligibility Notification for a Debt ................................................................................ 29

352 AIP Notification for Disqualification, Suspension, Debarment, or Conviction ..................... 31

353 AIP Certifying Records to RMA ............................................................................................ 31

354 RMA Actions Upon Receipt of Information of Ineligibility .................................................. 32

355-400 (Reserved) ............................................................................................................................ 32

TABLE OF CONTENTS

June 2021 FCIC 24050-1 TC-2

PART 4 MAINTAINING, REGAINING, AND REINSTATING ELIGIBILITY ......................... 33

Section 1: Reviews and NAD Appeals ................................................................................................. 33

401 Reviews Before Certification as Ineligible ............................................................................. 33

402 Reviews After Certification as Ineligible ............................................................................... 33

403 NAD Appeal Requirements .................................................................................................... 33

404 Impacts of NAD Appeal ......................................................................................................... 34

405-410 (Reserved) ............................................................................................................................ 34

Section 2: Written Payment Agreements ........................................................................................... 35

411 Purpose ................................................................................................................................... 35

412 Requirements and Modifications ............................................................................................ 35

413 Timing and Signature ............................................................................................................. 36

414 Notifications of Payments Due during a Written Payment Agreement .................................. 36

415 Failure to Make Payments Timely .......................................................................................... 37

416 Written Payment Agreement and AIP Authorized Reinstatement ......................................... 37

417 ITS Transmissions and Written Payment Agreements ........................................................... 39

418-425 (Reserved) ............................................................................................................................ 40

Section 3: RMA Administrator and AIP Authorized Reinstatement .............................................. 41

426 Late Payment of Debt Authority............................................................................................. 41

427 AIP Authorized Reinstatement ............................................................................................... 41

428-450 Reserved ............................................................................................................................... 41

Section 4: Bankruptcy .......................................................................................................................... 42

451 General .................................................................................................................................... 42

452 Filing of Bankruptcy Petition and Ineligibility Determinations ............................................. 42

453 Bankruptcy Discharge ............................................................................................................ 43

454 Bankruptcy Dismissal ............................................................................................................. 43

455 ITS Transmissions for Bankruptcy Filings, Dismissals, and Discharges ............................... 43

456-460 (Reserved) ............................................................................................................................ 45

Section 5: Regaining, Reestablishing, and Reinstating Eligibility ................................................... 46

461 Regaining Eligibility After a Period of Ineligibility ............................................................... 46

462 Criteria for Retaining, Regaining, Reestablishing, and Reinstating Eligibility ...................... 46

463 Debt Write-Off Authority to Retain or Reinstate Eligibility .................................................. 46

464 Reestablishing Eligibility After NAD Appeal ........................................................................ 46

465 Regaining Eligibility Under a Written Payment Agreement .................................................. 47

466 Reestablishing Eligibility for Bankruptcy .............................................................................. 47

467 Reinstatement of Eligibility .................................................................................................... 48

468 Obtaining Crop Insurance After Regaining Eligibility ........................................................... 48

469 Coverage for a Reinstated Policy ........................................................................................... 48

470-500 (Reserved) ............................................................................................................................ 48

TABLE OF CONTENTS

June 2021 FCIC 24050-1 TC-3

PART 5 TERMINATION .................................................................................................................... 49

Section 1: CCIP (2011 and subsequent, with a CCD on or after April 30, 2010), ARPI, RIVI

Plans, DRP (2021 or prior), LGM –Dairy (2011 and Subsequent) and Swine (2012 and

subsequent), and LRP-Fed, Feeder, and Swine (2021 and subsequent) .......................................... 49

501 Unpaid Administrative Fees or Premiums .............................................................................. 49

502 Other Amounts Due ................................................................................................................ 49

503 Failure to Make Scheduled Payment Under Written Payment Agreement ............................ 49

504 All Other Policies Affected .................................................................................................... 50

505 Dismissal of Bankruptcy Petition Before Discharge .............................................................. 50

Section 1.1: DRP (2022 and subsequent) ............................................................................................ 50

506 Unpaid Administrative Fees or Premiums .............................................................................. 50

507 Other Amounts Due ................................................................................................................ 50

508 Failure to Make Scheduled Payment Under Written Payment Agreement ............................ 50

509 All Other Policies Affected .................................................................................................... 50

510 Dismissal of Bankruptcy Petition Before Discharge .............................................................. 50

Section 2: WFRP ................................................................................................................................... 51

511 Unpaid Administrative Fees or Premiums .............................................................................. 51

512 Other Amounts Due ................................................................................................................ 51

513 Failure to Make Scheduled Payment Under Written Payment Agreement ............................ 51

514 All Other Policies Affected .................................................................................................... 51

515 Dismissal of Bankruptcy Petition Before Discharge .............................................................. 51

516-520 (Reserved) ............................................................................................................................ 51

Section 3: LRP-Lamb, LGM-Cattle, LGM –Swine (2011 or prior) and Dairy (2010 or prior), and

LRP-Fed, Feeder and Swine (2020 or prior) ...................................................................................... 52

521 Unpaid Premiums or Administrative Fees .............................................................................. 52

522 Other Amounts Due ................................................................................................................ 52

523 Failure to Make a Scheduled Payment Under a Written Payment Agreement....................... 52

524 All Other Policies Affected .................................................................................................... 52

525 Dismissal of Bankruptcy Petition Before Discharge .............................................................. 52

526-530 (Reserved) ............................................................................................................................ 53

Section 4: CCIP (2010 or prior CYs and 2011 CY with CCD before April 30, 2010) .................... 54

531 Unpaid Administrative Fees or Premiums .............................................................................. 54

532 Other Amounts Due ................................................................................................................ 54

533 Failure to Make Scheduled Payment Under Written Payment Agreement ............................ 54

534 All Other Policies Affected .................................................................................................... 54

535 Dismissal of Bankruptcy Petition Before Discharge .............................................................. 55

536-580 (Reserved) ............................................................................................................................ 55

Section 5: Disqualification, Debarment, Suspension, and Knowingly Defrauding the United

States ...................................................................................................................................................... 56

581 Disqualification, Debarment, or Suspension Termination Effective Date ............................. 56

582 Knowingly Defrauding the United States Termination Effective Date .................................. 56

583-590 (Reserved) ............................................................................................................................ 56

TABLE OF CONTENTS

June 2021 FCIC 24050-1 TC-4

Section 6: Pending Claims .................................................................................................................... 57

591 Claim Pending ........................................................................................................................ 57

592-600 (Reserved) ............................................................................................................................ 57

PART 6 VOIDANCE ............................................................................................................................ 58

601 Criteria for Voiding Policies ................................................................................................... 58

602 Concealment, Misrepresentation, or Fraud ............................................................................. 58

603 Voidance Effective Date ......................................................................................................... 59

604-700 (Reserved) ............................................................................................................................ 61

PART 7 RESERVED ............................................................................................................................ 62

701-800 (Reserved) ............................................................................................................................ 62

EXHIBITS ............................................................................................................................................. 63

Disclaimer ........................................................................................................................................... 63

Exhibits 1-2 Reserved ......................................................................................................................... 64

Exhibit 3 - Written Request Waiver Letter Example for 15-day Grace Period .................................. 65

Exhibit 4 - Written Request Waiver Letter Example for 7-day Transit ............................................. 66

Exhibit 5 - Notice of Debt and Pre-Termination for Debts, Except Debts of Other Amounts Due ... 67

Exhibit 6 - Notice of Debt and Pre-Termination for Debts of Other Amounts Due .......................... 68

Exhibit 7 - Written Payment Agreement ............................................................................................ 69

Exhibit 8 - Written Payment Agreement Notification Examples ....................................................... 70

Exhibit 9 - AIP Debtors Notice of Ineligibility .................................................................................. 71

Exhibit 10 - AIP Debtors Notice of Ineligibility for Partners of Indebted Partnerships .................... 72

Exhibit 11 - AIP Debtors Notice of Ineligibility for Spouse of Indebted Individual ......................... 73

Exhibit 12 - Notice of Ineligibility for Controlled Substance Violation ............................................ 74

Exhibit 13 - Notice of Ineligibility for Disqualification, Suspension, or Debarment......................... 75

Exhibit 14 - FCIC Debtors Notice of Ineligibility .............................................................................. 76

Exhibit 15 - FCIC Debtors Notice of Ineligibility for Partners of Indebted Partnerships .................. 79

Exhibit 16 - FCIC Debtors Notice of Ineligibility for Spouse of Indebted Individual ....................... 80

June 2020 FCIC 24050 1

PART 1 GENERAL INFORMATION AND RESPONSIBILITIES

1 General Information

A. Purpose and Objective

This handbook provides procedures and instructions for:

(1) administering the ITS;

(2) identifying and notifying ineligible persons; and

(3) implementing RMA and AIP reinstatement.

The ITS is a tool to aid in identifying ineligible persons. The system contains identifying

information of ineligible persons, including but not limited to the:

(1) reason for ineligibility; and

(2) time period of ineligibility.

RMA maintains the ITS to aid AIPs, partners, cooperators, and contractors in identifying

ineligible persons. The ITS may not include all ineligible persons, such as but not limited to,

persons debarred, disqualified or suspended from receiving government benefits by an agency

other than RMA.

Whether or not a person is identified in ITS does not change the eligibility status of the

person. AIPs, partners, cooperators, and contractors must ensure the persons with whom they

are doing business are eligible to participate in the programs authorized by the Act.

B. Source of Authority

Federal programs enacted by Congress and the regulations and policies developed by RMA,

USDA, and other Federal agencies provide the authority for program and administrative

operations; and basis for RMA directives. Administration of the Federal crop insurance

program is authorized by the following.

(1) The Federal Crop Insurance Act, 7 U.S.C. 1501

(2) The Food Security Act of 1985, 16 U.S.C. 3801 et seq.

(3) Controlled Substance Act of 1970, 21 U.S.C. 801 et seq.

(4) Personal Responsibility and Work Opportunity Reconciliation Act of 1996,

42 U.S.C. 653a

(5) Privacy Act of 1974, 7 U.S.C. 552a

(6) Drug Abuse Prevention and Control, Title 21 U.S.C., Chapter 13

(7) Agriculture General Administrative Regulation, 7 CFR Part 400

June 2020 FCIC 24050 2

1 General Information (continued)

B. Source of Authority (continued)

(8) Highly Erodible Land Conservation and Wetland Conservation, 7 CFR Part 12

(9) Standard Reinsurance Agreement and Livestock Price Reinsurance Agreement

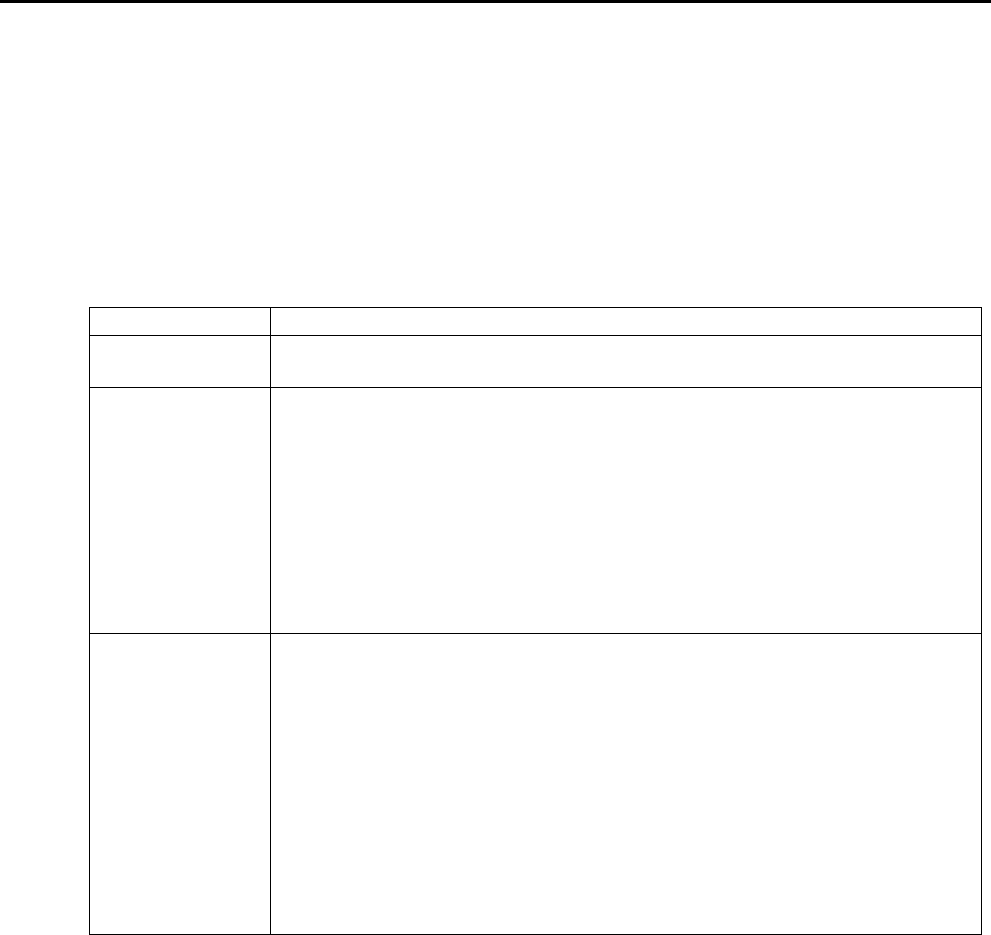

C. Related Handbooks

The following table provides handbooks related to this handbook.

HANDBOOK

RELATION/PURPOSE

Appendix III

Provides the ITS requirements for PASS processing.

DSSH

Provides form standards and procedures for use in the sales and service

of crop insurance contracts. Provides submission and review

procedures for non-reinsured supplemental policies.

AIP forms must meet the form standards as provided in the DSSH.

The DSSH provides the substantive elements for AIP form

development including conflict of interest, nondisclosure, and Privacy

Act statements.

GSH

Provides the official FCIC approved standards for policies

administered by AIPs under the General Administrative Regulations, 7

CFR Part 400; Common Crop Insurance Policy (CCIP) Regulations,

Basic Provisions, 7 CFR §457.8 including the Catastrophic Risk

Protection Endorsement, 7 CFR Part 402 and the Actual Production

History Regulation 7 CFR Part 400 subpart G; the Area Risk Protection

Insurance (ARPI) Regulations, 7 CFR Part 407; Stacked Income

Protection Plan; the Rainfall and Vegetative Indices (RIVI); and the

Whole Farm Revenue Protection Pilot Policy (WFRP) for the 2016 and

succeeding crop years.

D. Procedural Issuance Authority

This handbook is written and maintained by:

Office of Deputy Administrator for Product Management

Product Administration and Standards Division

USDA—Risk Management Agency

Beacon Facility—Mail Stop 0812

P.O. Box 419205

Kansas City, MO 64141-6205

June 2020 FCIC 24050 3

1 General Information (continued)

E. Procedural Questions

Questions regarding insured eligibility, this handbook, and associated procedures must be

directed to the RMA Product Administration and Standards Division, Underwriting Standards

Branch using the address in D. above. Procedural questions regarding the ITS may also be

emailed to [email protected].

AIPs are to refer persons with questions or inquiries regarding their individual ITS status to

the RMA debt line at (816) 926-7299. No specific information regarding a person’s ITS

status will be answered by RMA via email to the individual.

F. Applicability

The procedures in this handbook apply for the 2021 and succeeding crop years for all

policies.

2 Acronyms and Definitions

Refer to the GSH for applicable acronyms and definitions.

3 Title VI of the Civil Rights Act of 1964

The USDA prohibits discrimination against its customers. Title VI of the Civil Rights Act of

1964 provides that “No person in the United States shall, on the ground of race, color, or national

origin, be excluded from participation in, be denied the benefits of, or be subjected to

discrimination under any program or activity receiving Federal financial assistance.” Therefore,

programs and activities that receive Federal financial assistance must operate in a non-

discriminatory manner. Also, a recipient of RMA funding may not retaliate against any person

because he or she opposed an unlawful practice or policy, or made charges, testified or

participated in a complaint under Title VI.

It is the AIPs’ responsibility to ensure that standards, procedures, methods and instructions, as

authorized by FCIC in the sale and service of crop insurance contracts, are implemented in a

manner compliant with Title VI. Information regarding Title VI of the Civil Rights Act of 1964

and the program discrimination complaint process is available on the RMA public website at

www.ascr.usda.gov/.

4 The Privacy Act of 1974

The Privacy Act of 1974, 5 U.S.C. §552a (Privacy Act), establishes a code of fair information

practices that governs the collection, maintenance, use, and dissemination of information about

individuals that is maintained in systems of records by federal agencies. A system of records is a

group of records under the control of an agency from which information is retrieved by the name

of the individual or by some identifier assigned to the individual.

June 2020 FCIC 24050 4

4 The Privacy Act of 1974 (continued)

In accordance with the Privacy Act, the Risk Management Agency is authorized by the Federal

Crop Insurance Act or other Acts, and the regulations promulgated thereunder, to solicit the

information requested on documents established by RMA, or by AIPs, that have been approved by

the FCIC, to deliver Federal crop insurance. The information is necessary for AIPs and RMA to

operate the Federal crop insurance program, determine program eligibility, conduct statistical

analysis, and ensure program integrity.

5 Responsibilities

A. AIP Responsibilities

AIPs must:

(1) verify the eligibility status of applicants and insureds;

(2) maintain security of data files, records, and reports according to the Privacy Act and

7 CFR Part 400, subpart Q;

(3) notify applicable RMA Regional Compliance Office of known or suspected cases of:

(a) violations of the controlled substance provisions of the Food Security Act of 1985 or

Title 21 U.S.C., Chapter 13; or

(b) fraud, misrepresentation, or use of a material scheme or device relating to a Federal

crop insurance program or policy;

(4) provide written notice of debt to the person according to Para. 351;

(5) ensure all requirements according to Para. 351A are met before certifying a debtor to

ITS;

(6) maintain supporting documentation regarding a determination of delinquent debt and its

resolution according to Para. 351B and C;

(7) upon request, send RMA documentation and evidence of the person’s delinquent debt

and notification of such debt, including but not limited to:

(a) Applications;

(b) acreage reports;

(c) claims;

(d) correspondence;

(e) billing statements;

(f) pre-termination letters and responses to such;

(g) demand letters and responses to such;

(h) requests for AIP reinstatement; and

(i) notice of debt;

June 2020 FCIC 24050 5

5 Responsibilities (continued)

A. AIP Responsibilities (continued)

(8) transmit an I60 and I60A, and I60B or I65, if applicable, to RMA certifying a debtor for

affected persons, including all SBI holders for general partnerships and joint ventures;

(9) delete incorrect I60 Record within seven days of initial transmission; and

(10) transmit a P49 Record deleting any insured data submitted prior to a determination of

ineligibility effective for the current crop year.

B. PAAD Responsibilities

PAAD will:

(1) develop, test, and maintain the record descriptors, database, and data processing

requirements and programming for ITS;

(2) assure proper security is maintained for access to ITS;

(3) generate, review, and distribute Notices of Ineligibility;

(4) update ITS with appropriate data indicating eligible or ineligible status at the completion

of an appeal;

(5) provide a Notice of Debt to FCIC debtors and certify ITS records for FCIC debtors;

(6) provide a Notice of Ineligibility to persons disqualified, debarred, suspended or

convicted of controlled substance violations;

(7) process eligibility reinstatements and, when applicable, delete AIP ITS records per

written request submitted to PAAD for additional coverage policies after the seven-day

period, and for all CAT I60/I65 Record delete requests;

(8) maintain ITS records for FCIC debtors, persons disqualified, debarred, suspended or

convicted of controlled substance violations;

(9) maintain AIP records which are requested by RMA and submitted as documentation and

evidence of delinquent debt as related to Notice of Ineligibility;

(10) prepare reports as requested;

(11) modify or define ITS requirements for PASS processing that will be specified in

Appendix III;

(12) provide assistance to AIPs, RMA offices, and others, as needed;

(13) transmit ineligible producer file I61 output file to AIPs;

June 2020 FCIC 24050 6

5 Responsibilities (continued)

B. PAAD Responsibilities (continued)

(14) respond to inquiries regarding ITS errors;

(15) reject PASS records that are identified as ineligible;

(16) amend Appendix III, as appropriate; and

(17) review AIP’s operations to determine compliance with the provisions of subpart U and

this handbook as part of the financial review process.

C. PASD Responsibilities

(1) assure ITS is properly defined in the System of Records;

(2) revise 7 CFR Part 400, subpart U, as appropriate;

(3) update this handbook, as appropriate;

(4) represent RMA in NAD hearings;

(5) provide assistance regarding 7 CFR Part 400, subpart U and this handbook; and

(6) contact AIP for supporting documentation whenever a person files a request for an

appeal relating to being placed on ITS.

D. RMA Regional Compliance Office’s Responsibilities

RMA Regional Compliance Offices will notify appropriate authorities, including FSA, of

known or suspected cases of:

(1) violations of the controlled substance provisions of the Food Security Act of 1985 or

Title 21 U.S.C., Chapter 13; or

(2) fraud, misrepresentation, or use of a material scheme or devise relating to a Federal crop

insurance program or policy.

For applicable RMA Regional Compliance office contacts referenced throughout this

handbook, refer to www.rma.usda.gov/en/RMALocal/Field-Offices/Regional-Offices or

www.rma.usda.gov/en/RMALocal/Field-Offices/Regional-Compliance-Offices.

6 Maintaining Supporting Documentation

AIPs must maintain supporting documentation regarding a determination of delinquent debt and

its resolution for a period of three years after the resolution of the debt. Supporting documentation

must be maintained indefinitely if a delinquent debt is not resolved, such as the debt never being

satisfied or not being discharged through bankruptcy.

7-200 (Reserved)

June 2020 FCIC 24050 7

PART 2 ITS, REPORTING, ADMINISTRATION AND MAINTENANCE

201 Ineligible Tracking System

The Ineligible Tracking System (ITS) is a system designed to track persons who are ineligible to

participate in any program administered by RMA under the Act, including CAT and additional

coverage programs, and private insurance products authorized under the Act and reinsured by

FCIC.

A person will be placed on ITS for any delinquent debt as of termination date, or any other

applicable due date, and may be removed pending the outcome of any dispute resolution.

Affected persons will be provided an opportunity to contest and resolve a delinquent debt, or to

contest the findings of an administrative proceeding, before a determination of ineligibility will be

made by the AIP. Options to contest and resolve a delinquent debt may include, depending on the

policy, mediation, arbitration, judicial review, or appeal to NAD. See Part 4 for procedure

regarding dispute resolutions before certifying a person ineligible.

Persons debarred or suspended by FCIC and persons convicted of controlled substance violations

will also be placed on ITS.

All persons applying for or renewing existing policies for programs administered by FCIC will be

subject to validation of their eligibility status using ITS. Applications, transfers, or benefits

approved and accepted are considered approved or accepted subject to review of eligibility status.

202 Transmitting Records to ITS

AIP must transmit an I60 and I60A Record, and an I60B and I65 Record, if applicable, to ITS for

all affected persons, including all SBI holders. SBI holders include, but are not limited to,

spouses, minors, and members and partners of general partnerships, joint ventures, limited

partnerships, limited liability partnerships, and limited liability companies. A revocable trust and

the grantor of such trust are considered to be the same person for crop insurance purposes. AIPs

transmitting any of these records are certifying that a person is ineligible.

Ineligible transferees and transferors under transfer of coverage and right to indemnity are both

certified and transmitted in the same manner as other policy debtors.

The records must be transmitted not later than 21 days after the applicable ineligibility date or not

later than 30 days after failure to make payments under a written payment agreement.

See Para. 313 for the applicable ineligibility date. Failure to timely certify debtors according to

these procedures may result in a delay in denying program benefits to the person.

If the date of ineligibility falls on a Saturday, Sunday, or Federal holiday, the next business day

will apply for determining the record submission deadline. If the resulting 21

st

or 30

th

calendar

day also falls on a Saturday, Sunday, or Federal holiday, the next business day will be the

deadline.

June 2020 FCIC 24050 8

202 Transmitting Records to ITS (continued)

The I60 Record in conjunction with an I60A Record, I60B Record and I65 Record, if applicable,

will be used to:

(1) initially establish ineligibility;

(2) reestablish eligibility;

(3) reestablish ineligibility related to defaulted written payment agreements or dismissals of

bankruptcies;

(4) reinstate eligibility when reinstatement is granted by the AIP or RMA; and

(5) establish the receivable for CAT policies using the I65 record.

I60 Records must be submitted to ITS not later than 21 days after the date of a resolution of the

delinquent debt, notification of dismissal of a bankruptcy for cause, or not later than 30 days after

failure to make payments under a written payment agreement.

When a specific time limit is set for ineligibility, such as for a controlled substance violation, ITS

will automatically restore eligibility at the end of the time limit.

203 Deleting Incorrect Records

AIP must delete any incorrect I60 Record within seven days of initial transmission. Any deletions

required after seven days must be submitted with documentation to PAAD. All requests to delete

CAT I60 or I65 records must be submitted to PAAD with the appropriate documentation.

204-300 (Reserved)

June 2020 FCIC 24050 9

PART 3 INELIGIBILITY

Section 1: Criteria

301 Ineligible Persons

To participate in the crop insurance program a person must be eligible. To be eligible the person

must be:

(1) competent;

(2) of legal majority;

(3) possess an insurable share of the crop;

(4) possess the applicable identification number and person type; and

(5) must not be ineligible.

A. Criteria for Ineligibility

A person is ineligible to participate in any program administered by FCIC under the Act if the

person:

(1) has a delinquent debt according to subparagraph B;

(2) is an individual that has been convicted of a controlled substance violation according to

subparagraph C;

(3) has been disqualified, debarred, or suspended according to subparagraph D;

(4) is an individual and is not a United States citizen, United States non-citizen national, or a

qualified alien, see subparagraph E;

(5) has been convicted of a felony for knowingly defrauding the United States in connection

with any program administered by USDA; or

(6) has been debarred for knowingly doing business with a person debarred or suspended

under 2 CFR Part 180 or 2 CFR Part 417, or successor regulations.

B. Delinquent Debt

A delinquent debt is a debt that is not satisfied on or before the date of delinquency, such as

the termination date, due date contained in a written payment agreement, or due date

specified in the notice to the person of the amount due.

(1) Date of delinquency includes:

(a) The termination date specified in the applicable policy for administrative fees and

premiums owed for insurance issued under the authority of the Act, and any interest

and penalties on those amounts, if applicable; and

(b) The due date specified in the notice to the person of the amount due for any other

amounts due the AIP or FCIC for insurance issued under the authority of the Act.

June 2020 FCIC 24050 10

301 Ineligible Persons (continued)

B. Delinquent Debt (continued)

(2) Other amounts due, includes, but are not limited to,

(a) indemnities, prevented planting payments, or replant payments found not to have

been earned or that were overpaid, premium billed with a due date after the

termination date for the crop year in which premium is earned; and

(b) any interest, administrative fees, and penalties on such amounts, if applicable.

The existence and delinquency of the debt must be verifiable. A delinquent debt does

not include debts discharged in bankruptcy or any debt to an AIP’s agent.

CAT administrative fees prior to crop year 1998 are not established as a delinquent debt.

C. Conviction – Controlled Substance

The Food Security Act of 1985, as amended, provides that any person who is convicted under

Federal or state law of planting, cultivating, growing, producing, harvesting, or storing a

controlled substance in any crop year will be ineligible for USDA benefits from the beginning

of the crop year of conviction and the four subsequent consecutive crop years.

For crop insurance purposes, an individual or entity is considered to have been “convicted”

when:

(1) A judgment of conviction has been entered against the individual or entity by a Federal,

State, or local court, regardless of whether there is an appeal pending or whether the

judgment of conviction or other record relating to criminal conduct has been expunged;

(2) There has been a finding of guilt against the individual or entity by a Federal, State, or

local court;

(3) A plea of guilty or nolo contendere by the individual or entity has been accepted by a

Federal, State, or local court; or

(4) The individual or entity has entered into participation in a first offender, deferred

adjudication, or other arrangement or program where judgment of conviction has been

withheld.

Conviction, for crop insurance purposes, is limited to controlled substance violations.

However, a person may be suspended, disbarred, or disqualified from USDA programs based

upon a conviction not related to crop insurance. If applicable, the ineligibility is based on the

disqualification, suspension or debarment from federal programs, and not the specific

conviction.

June 2020 FCIC 24050 11

301 Ineligible Persons (continued)

D. Disqualification, Suspension, or Debarment

Any person who has been disqualified under section 515(h) of the Act or has been debarred

or suspended under 7 CFR Part 400, subpart R, 2 CFR Part 180 or 2 CFR Part 417, or

successor regulations, is ineligible to participate in any program administered under the Act.

(1) FCIC may disqualify insureds, agents, loss adjusters, AIPs, or other persons who

willfully and intentionally provide false information to FCIC or an approved insurance

provider with respect to an insurance policy or plan of insurance for a period of up to

five years.

Disqualifications prohibits the person or entity from receiving any benefit under the Act

as well as certain statutory entitlement programs, such as programs administered by the

FSA.

(2) Suspensions are a temporary action that takes place immediately for a period of up to one

year, or may continue until the completion of an investigation, a judicial or an

administrative proceeding. Suspension is commonly imposed upon an indictment for

certain criminal offenses. Such action is taken when it is determined that immediate

action is necessary to protect the public interest.

(3) A debarment is an extended action for a period of three years or longer if circumstances

warrant. Debarment is a judgment in certain civil matters or commission of any offense

indicating a lack of business integrity or business honesty that directly affects the present

responsibility of a person and is commonly imposed upon the conviction of certain

criminal offenses.

Suspensions and debarments prohibit the person or entity from selling, servicing, adjusting,

or acting in any capacity relating to crop insurance policies, or participating in any

procurement or non-procurement activity with any U.S. Government agency. Suspensions

and debarments affect eligibility for some of the same programs covered by disqualification,

plus additional programs, including non-USDA programs. Imposition of suspension and

debarments are made by the RMA Administrator as the suspending/debarring official for

FCIC.

Names of persons disqualified, suspended or debarred are listed on the EPLS, or successor

website. If a person is placed on the ITS due to disqualification, suspension, or debarment,

the person will be ineligible from the date the order is signed until the period specified in the

order has expired.

E. Personal Responsibility and Work Opportunity Reconciliation Act of 1996 (PRWROA)

An individual that is not a United States citizen, United States non-citizen national, or a

qualified alien is ineligible to participate in any program administered under the Act

according to the PRWORA. Such individuals may not be recorded in ITS.

Refer to Part 2 of the GSH for PRWORA determinations and eligibility.

June 2020 FCIC 24050 12

302 Verification of Eligibility Status

The AIP must utilize the I61-Ineligible Entity Output file to verify a person’s eligibility. No

records should be sent to PASS if the person is ineligible on the output file.

303-310 (Reserved)

June 2020 FCIC 24050 13

Section 2: Ineligibility Determination

311 Effect of Ineligibility

The effect of ineligibility is to deny reinsurance, premium subsidies, and other benefits under the

Act for persons meeting any of the ineligibility criteria. All persons submitting an Application for

insurance, as well as persons with an existing policy, under the Act are subject to verification of

their eligibility status.

PASS will reject the policy when an:

(1) applicant or insured is the sole insured and is an ineligible person included on ITS; or

(2) ineligible person included on ITS has a SBI in the applicant or insured and the insured share

is not reduced commensurately.

312 Basis for Ineligibility Determination

The program and benefits affected by ineligibility depend on the basis for the ineligibility. All

persons submitting an Application or who are currently insured under the Act are subject to

verification of their eligibility status.

A. Delinquent Debt

A delinquent debt for any policy may result in termination of all the insured’s policies issued

under the authority of the Act. A person who is determined to be ineligible based upon

failure to timely pay a delinquent debt is ineligible for crop insurance authorized by the Act.

See Para. 313 for more information regarding ineligibility effective dates for delinquent debt,

by basic provision, for the policy on which the delinquent debt occurred and other policies.

B. Suspension or Debarment

A person who is determined to be ineligible based upon a suspension or debarment is

ineligible to:

(1) participate in any program authorized under the Act, including but not limited to:

(a) obtaining crop insurance;

(b) acting as a(n) agent, loss adjuster, AIP, or affiliate, as defined in the SRA or LPRA;

(c) entering into any contracts with FCIC under sections 506(l) and section 522(c) of

the Act; or

(d) entering into any cooperative agreement or partnerships under sections 506(l),

522(d) and 524(a) of the Act; or

(2) participate in any other transaction as specified in 2 CFR Part 180 and 2 CFR Part 417,

or successor regulation.

June 2020 FCIC 24050 14

312 Basis for Ineligibility Determination (continued)

C. Disqualification Under Section 515(h) of the Act

A person who is determined to be ineligible based upon a disqualification under section

515(h) of the Act is ineligible to:

(1) participate in any program authorized under the Act, including but not limited to:

(a) obtaining crop insurance;

(b) acting as a(n) agent, loss adjuster, AIP, or affiliate, as defined in the SRA or LPRA;

(c) entering into any contracts with FCIC under sections 506(l) and section 522(c) of

the Act; or

(d) entering into any cooperative agreement or partnerships under sections 506(l),

522(d) and 524(a) of the Act; or

(2) participate in any programs listed in section 515(h)(3)(B) and (C) of the Act.

D. Felony Conviction for Knowingly Defrauding the U.S. in Connection with Any Program

Administered by the USDA

A person who is determined to be ineligible based upon a felony conviction for knowingly

defrauding the U.S. in connection with any program administered by the USDA is ineligible

to participate in any program offered by the USDA.

E. Conviction of a Controlled Substance Violation

A person who is determined to be ineligible based upon a conviction of a controlled

substance violation is ineligible to:

(1) participate in any program authorized under the Act, including but not limited to:

(a) obtaining crop insurance;

(b) acting as a(n) agent, loss adjuster, AIP, or affiliate, as defined in the SRA or LPRA;

(c) entering into any contracts with FCIC under sections 506(l) and section 522(c) of

the Act; or

(d) entering into any cooperative agreement or partnerships under sections 506(l),

522(d) and 524(a) of the Act; or

(2) participate in any programs listed in section 515(h)(3)(B) and (C) of the Act.

June 2020 FCIC 24050 15

312 Basis for Ineligibility Determination (continued)

F. Not a U.S. Citizen, U.S. Non-Citizen National, or a Qualified Alien

A person who is determined to be ineligible based upon not being a U.S. citizen, U.S. non-

citizen national, or a qualified alien as determined by PRWORA is ineligible to:

(1) participate in any program authorized under the Act, including but not limited to:

(a) obtaining crop insurance;

(b) acting as a(n) agent, loss adjuster, AIP, or affiliate, as defined in the SRA or LPRA;

(c) entering into any contracts with FCIC under sections 506(l) and section 522(c) of

the Act; or

(d) entering into any cooperative agreement or partnerships under sections 506(l),

522(d) and 524(a) of the Act; or

(2) participate in any programs listed in section 515(h)(3)(B) and (C) of the Act.

313 Ineligibility Effective Dates

A. Effective Date of Ineligibility

The effective date of the ineligibility for the person is the:

(1) date that a policy was terminated for an unpaid premium, administrative fee, or any

related interest owed;

(2) payment due date contained in any notification of indebtedness for any overpaid

indemnity, prevented planting payment, replanting payment, or other amounts due if the

amount owed, including any related interest owed, as applicable, is not paid on or before

the due date;

(3) termination date determined under the applicable policy provisions in effect at the time

the written payment agreement is executed;

Example: An insured enters into a written payment agreement on March 14, 2021,

for a policy with a termination date of March 15, 2021. The written

payment agreement is entered into while the 2011 (or subsequent) CCIP

Basic Provisions are in effect. The insured did not make the scheduled

payment due on or before July 1, 2022. The applicable termination date is

March 15, 2022, according to the CCIP Basic Provisions.

(4) termination date the policy was or would have been terminated if the bankruptcy petition

is dismissed before discharge;

(5) date specified in a notification of disqualification, debarment, or suspension; or

June 2020 FCIC 24050 16

313 Ineligibility Effective Dates (continued)

A. Effective Date of Ineligibility (continued)

(6) beginning of the crop year in which the person is convicted of a controlled substance

violation, which is effectively the earliest termination date applicable under any policy,

unless determined otherwise by the court.

Example: An insured individual is convicted of a controlled substance violation in

2021. The effective date of ineligibility for the convicted individual is the

earliest termination date for the 2021 crop year.

Note: The date of delinquency refers to the date the debt becomes delinquent

and may be the same as the ineligibility effective date, unless some other

condition or exception applies. See also Paras. 301B and 313C.

B. Ineligibility Effective Date and Weekend or Federal Holidays

If the termination date, or other due date, falls on a Saturday, Sunday, or Federal holiday, the

next business day will apply for purposes of determining if the debt is delinquent.

This applies to the date of postmark as well as the date payment is received. The published

termination date or due date will not be changed and will be the date of ineligibility if the

person is determined a debtor and ineligible for crop insurance programs administered by

FCIC.

Example: The termination date of November 15, 2020, is a Sunday. The AIP may

accept payments on the next business day of November 16, 2020. If the

insured does not pay on or before November 16, 2020, the ineligible record

sent to RMA must have a debt delinquency date of November 15, 2020.

When determining eligibility on policies with a November 15, 2020,

termination date, the postmark date for payments mailed will also be extended

to the next business day of November 16, 2020.

Note: The 7-day transit rule for receipt of late payments due to postal errors began

March 16, 2015. See also Part 7 of the GSH for more information regarding

the 7-day transit rule.

C. Ineligibility Effective Date and Benefits Termination

The applicable date for ineligibility applies to the person, not to a specific crop. However,

program benefits may not cease immediately for all insured crops. See Part 5 for more

information regarding policy termination.

June 2020 FCIC 24050 17

313 Ineligibility Effective Dates (continued)

C. Ineligibility Effective Date and Benefits Termination (continued)

(1) Termination Date Prior to the Date of Ineligibility

Program benefits will continue for any insured crop where the termination date is prior to

the date of ineligibility and will continue to the end of the insurance period for that

insured crop. If eligibility has not been reinstated or regained, benefits will be denied on

the next termination date of that insured crop.

Exception: Program benefits are denied immediately for an insured convicted of a

controlled substance violation or whose bankruptcy petition is dismissed.

Persons are ineligible for benefits effective the crop year of conviction or

bankruptcy dismissal, irrespective of any applicable crop termination date

or whether insurance has already attached to the crop.

(2) Date of Ineligibility Prior to the Termination Date

Program benefits are denied immediately for any insured crop on the termination date

when the date of ineligibility is on or before the termination date. This includes denial of

program benefits for any PP coverage applicable for a person insured the previous crop

year.

Example 1: Insured A insures his 2021 wheat and corn. When the AIP transmits data

to RMA for fall wheat on October 15, 2020, the insured is eligible for

2021 wheat coverage. Insured A fails to pay the premium for 2020 corn

and is terminated March 15, 2021. On March 21, 2021, the AIP transmits

an I60 record to ITS certifying insured A as a debtor for corn. A Notice

of Ineligibility is mailed to insured A and his name is added to ITS.

The effective date of ineligibility is the March 15, 2021, termination date.

Insurance data for any crop with a SCD of March 15, 2021, or later, will

be rejected by PASS. All insurance data for the 2021 wheat will be

accepted. Insured A will be ineligible for wheat coverage beginning with

the 2022 crop year and corn coverage beginning with the 2021 crop year.

Example 2: Insured B owes premium to AIP A for 2020 corn and is terminated

March 15, 2021, for failure to pay. Insured B submits an Application for

insurance for 2021 corn to AIP B on March 15, 2021. AIP B transmits

Appendix III entity and policy records on March 21, 2021, which are

accepted by PASS. On March 22, 2021, AIP A transmits an I60 record

certifying insured B as a debtor to ITS, and insured B is added to ITS. On

June 15, 2021, AIP B submits insured B’s corn acreage record data, which

is rejected because of insured B’s ineligible status.

June 2020 FCIC 24050 18

313 Ineligibility Effective Dates (continued)

C. Ineligibility Effective Date and Benefits Termination (continued)

AIP B must transmit a P49 Record deleting all previously submitted data

accepted by PASS for affected crops. Insured B’s Application for corn

insurance is rejected by AIP B according to the provisions of the policy,

and any payments of indemnities made prior to rejecting the Application

must be repaid. Additionally, any PP or replanting payments made prior

to rejecting the Application must be repaid.

(3) Policies with a SCD Prior to Termination Date

For polices with a SCD prior to the termination date, such policies will terminate for the

current crop year even if insurance attached prior to the termination date. Termination

will be considered effective as of the SCD and no insurance will be considered to have

attached for the crop year and no indemnity, PP or replanting payment will be owed.

Example 1: Insured A insures wheat for 2021 with a SCD of September 30, 2020, and

a termination date of November 30, 2021. Insured A fails to pay premium

for 2020 wheat by November 30, 2020. The AIP reports the insured to

ITS with a debt delinquency date and effective date of ineligibility of

September 30, 2020.

Example 2: Insured A had 2020 annual forage and wheat policies. Insured A insures

annual forage for 2021 with a SCD of September 30, 2020, and a

termination date of September 30, 2021. Insured A also has a 2021 wheat

policy with a SCD of September 30, 2020, and a termination date of

November 30, 2021. The 2020 forage policy premium was paid timely on

or before the September 30, 2020, termination date.

However, insured A fails to pay the 2020 wheat policy premium by the

November 30, 2020, termination date for wheat. The AIP reports insured

A to ITS with a debt delinquency date and effective date of ineligibility of

September 30, 2020, which means insured A is ineligible for both the

2021 forage and wheat policies.

Example 3: Insured A had 2020 crop annual forage and winter wheat policies.

Insured A insures annual forage for 2021 with a SCD of

September 30, 2020, and a termination date of September 30, 2021.

Insured A also has a 2021 winter wheat policy with a SCD of

September 30, 2020, and a termination date of November 30, 2021. The

2020 forage policy premium was not paid on or before the

September 30, 2020, termination date. Insured A does pay the 2020

winter wheat premium by November 30, 2020 but does not pay the 2020

forage policy premium. The AIP reports insured A to ITS with a debt

delinquency date and effective date of ineligibility of September 30, 2020,

and insured A is ineligible for both the forage and winter wheat 2021 crop

policies even though the premium was paid for the 2020 crop winter

wheat policy.

June 2020 FCIC 24050 19

314 Time Period of Ineligibility

The time period of ineligibility depends upon the type of ineligibility determination.

A. Delinquent Debt

If the basis for ineligibility is based upon a delinquent debt, then the time period for

ineligibility is from the date of ineligibility until:

(1) the debt is paid in full;

(2) debt is discharged in bankruptcy or a motion to incur debt is received by the AIP; or

(3) a written payment agreement is executed.

B. Disqualification, Suspension, or Debarment

If the basis for ineligibility is based upon a disqualification, suspension, or debarment then

the time period for ineligibility is from the date of disqualification, suspension, or debarment

is signed/approved by person authorized to take such action until the time period specified in

the order expires.

C. Felony Conviction for Knowingly Defrauding the U.S. in Connection with Any Program

Administered by the USDA

If the basis for ineligibility is based upon a felony conviction for knowingly defrauding the

U.S. in connection with any program administered by the USDA, then the time period for

ineligibility is permanent beginning with the crop year in which the person is convicted.

Exception: The Secretary of Agriculture may reduce the time period of ineligibility to a

period of no less than 10 years.

D. Conviction of Planting, Cultivating, Growing, Producing, Harvesting, or Storing a

Controlled Substance

If the basis for ineligibility is based upon a conviction for planting, cultivating, growing,

producing, harvesting, or storing a controlled substance, then the time period for ineligibility

is from the beginning of the crop year in which the person is convicted and the four

subsequent consecutive crop years.

E. Conviction of Possession of or Trafficking in a Controlled Substance

If the basis for ineligibility is based upon a conviction of possession of or trafficking in a

controlled substance, then the time period of ineligibility is in addition to the time period for a

conviction of planting, cultivating, growing, producing, harvesting, or storing a controlled

substance, from the beginning of the crop year in which the person is convicted, unless

determined otherwise by the court, until the time imposed by the court expires.

June 2020 FCIC 24050 20

314 Time Period of Ineligibility (continued)

F. Not a U.S. Citizen, U.S. Non-Citizen National, or a Qualified Alien

If the basis for ineligibility is based upon a person not being a U.S. citizen, U.S. non-citizen

national, or a qualified alien, then the period of ineligibility is until such time the individual

becomes a U.S. citizen, U.S. non-citizen national, or a qualified alien.

315-320 (Reserved)

June 2020 FCIC 24050 21

Section 3: Ineligible Person Types

321 Overview

Ineligibility, as well as the basis for ineligibility, affects person types differently. This section

provides the effects of ineligibility for different person types.

322 Individuals

When the ineligible person is an individual, all crop insurance policies in which the ineligible

person is the sole insured will:

(1) terminate, if the person is ineligible for any reason other than a controlled substance violation;

or

(2) be void, if the person is ineligible due to being convicted of a controlled substance violation.

The ineligible person must be reported on all policies in which they have a SBI in the applicant or

insured. The insured share under such policies will be reduced commensurate with the ineligible

person’s SBI in the applicant or insured for as long as the ineligible person remains ineligible.

323 Spouses and Minors

A. Spouses and Minors Separate from the Individual

The spouse and minor child of an individual insured is considered the same as the individual

and subject to the same ineligibility, except when the:

(1) individual is ineligible due to being convicted of a controlled substance violation;

(2) individual is ineligible as a result of a felony conviction for knowingly defrauding the

United States in connection with any program administered by USDA;

(3) individual is ineligible because they are not a United States citizen, United States non-

citizen national, or a qualified alien;

(4) individual is ineligible as a result of a disqualification, debarment, or suspension;

(5) spouse can prove they are legally separated or otherwise legally separate under the

applicable State dissolution of marriage laws; or

(6) minor child has a separate legal interest in such person or is engaged in a separate

farming operation from the individual.

June 2020 FCIC 24050 22

323 Spouses and Minors (Continued)

B. Minor Child with a Separate Farming Operation from the Parent

A minor child with a separate farming operation is considered a separate person with respect

to the separate farming operation if the:

(1) minor’s parent or other entity in which the parent has a SBI does not have any interest in

the minor’s farming operation or in any production from such operation;

(2) minor establishes and maintains a separate household from the parent;

(3) minor personally carries out the farming activities with respect to the minor’s farming

operation; and

(4) minor has separate accounting and recordkeeping for the minor’s farming operation.

324 Landlords/Tenants

Any person(s) may insure their landlord’s and/or tenant’s share. The ineligibility of the

landlord/tenant insured under another person’s policy does not affect the eligibility of the insured

or other SBIs. In such instances, the following apply:

(1) the insurable share of the policy must be reduced commensurate to the amount of interest the

ineligible landlord/tenant has in the policy;

(2) all crop insurance policies in which the ineligible person is insured as a landlord/tenant will

terminate on the next termination date; and

(3) the other persons on such policy, including the insured, may submit a new Application for

crop insurance coverage on or before the applicable SCD of the following year to obtain

insurance if they are otherwise eligible for crop insurance.

Example: Landlord A is insured under Tenant B’s corn policy and is listed on the policy as

having a 10 percent interest in corn. Landlord A is ineligible beginning with the

2020 crop year due to non-payment of premium. Tenant B’s 2020 corn policy

must be reduced by 10 percent due to the landlord’s ineligibility.

Tenant B’s corn policy will terminate on the termination date of March 15, 2021,

due to the ineligibility of Landlord A, if Landlord A remains ineligible. Tenant B

must obtain a new corn policy not insuring ineligible Landlord A’s share by

March 15, 2021 (2021 corn SCD), if Tenant B wants to have a corn policy in 2021.

June 2020 FCIC 24050 23

325 Transferors/Transferees

Both the transferor and transferee under the transfer of right to indemnity are jointly and severally

responsible for payment of the premium, administrative fees, overpaid indemnities, other amounts

due and applicable interest. Both will be ineligible if any amount is not paid by the applicable

termination date or other due date.

If only part of the share of the policy is transferred, transferee is only responsible for the premium,

overpaid indemnities or other amounts due for that portion of the share of the policy. Failure of

the transferor to pay the premium for any portion of the policy not transferred to the transferee

does not impact the eligibility of the transferee.

326 General Partnerships, Joint Ventures, Limited Partnerships, Limited Liability Partnerships,

and Limited Liability Companies

Subparagraphs A – D provide the effects of ineligibility on a(n) General Partnerships, Joint

Ventures, Limited Partnerships, Limited Liability Partnerships, and Limited Liability Companies.

A. Delinquent Debt

If the General Partnerships, Joint Ventures, Limited Partnerships, Limited Liability

Partnerships, and Limited Liability Companies are ineligible because of a delinquent debt,

then:

(1) all partners or members of the general partnership, joint venture, limited partnership,

limited liability partnership or limited liability company will be ineligible;

(2) all policies in which the ineligible general partnership, joint venture, limited partnership,

limited liability partnership or limited liability company is the sole insured will terminate

on the respective termination dates;

(3) all policies in which the ineligible partner or member is the sole insured will terminate on

the respective termination dates; and

(4) the ineligible general partnership, joint venture, limited partnership, limited liability

partnership or limited liability company and all ineligible partners or members must be

reported on any other policy in which they have a SBI in the applicant or insured, and the

insured share under such policies will be reduced commensurate with the ineligible

general partnership, joint venture, limited partnership, limited liability partnership or

limited liability company or the ineligible partner’s or member’s SBI in the applicant or

insured for as long as they remain ineligible.

June 2020 FCIC 24050 24

326 General Partnerships, Joint Ventures, Limited Partnerships…(continued)

B. Disqualification, Suspension, or Debarment

If the General Partnerships, Joint Ventures, Limited Partnerships, Limited Liability

Partnerships, and Limited Liability Companies are ineligible due to a disqualification,

suspension, or debarment, then:

(1) all policies in which the ineligible general partnership, joint venture, limited partnership,

limited liability partnership or limited liability company is the sole insured will terminate

on the termination dates; and

(2) the ineligible general partnership, joint venture, limited partnership, limited liability

partnership or limited liability company must be reported on any other policy in which it

has a SBI in the applicant or insured, and the insured share under such policies will be

reduced commensurate with the ineligible general partnership, joint venture, limited

partnership, limited liability partnership or limited liability company SBI in the applicant

or insured for as long as the it remains ineligible.

C. Felony Conviction for Knowingly Defrauding the U.S. in Connection with Any Program

Administered by the USDA

If the General Partnerships, Joint Ventures, Limited Partnerships, Limited Liability

Partnerships, and Limited Liability Companies are ineligible due to felony conviction for

knowingly defrauding the U.S. in connection with any program administered by the USDA,

then:

(1) all policies in which the ineligible general partnership, joint venture, limited partnership,

limited liability partnership or limited liability company is the sole insured will terminate

on the termination dates; and

(2) the ineligible general partnership, joint venture, limited partnership, limited liability

partnership or limited liability company must be reported on any other policy in which it

has a SBI in the applicant or insured, and the insured share under such policies will be

reduced commensurate with the ineligible general partnership, joint venture, limited

partnership, limited liability partnership or limited liability company SBI in the applicant

or insured for as long as the it remains ineligible.

D. Debarment for Knowingly Doing Business with a Person Debarred or Suspended under

2 CFR Part 180 or 2 CFR Part 417, or Successor Regulations

If the General Partnerships, Joint Ventures, Limited Partnerships, Limited Liability

Partnerships, and Limited Liability Companies are ineligible due to a debarment for

knowingly doing business with a person debarred or suspended under 2 CFR Part 180 or

2 CFR Part 417, or successor regulations, then:

(1) all policies in which the ineligible general partnership, joint venture, limited partnership,

limited liability partnership or limited liability company is the sole insured will terminate

on the respective termination dates; and

June 2020 FCIC 24050 25

326 General Partnerships, Joint Ventures, Limited Partnerships…(continued)

D. Debarment for Knowingly Doing Business with a Person Debarred…(continued)

(2) the ineligible general partnership, joint venture, limited partnership, limited liability

partnership or limited liability company must be reported on any other policy in which it

has a SBI in the applicant or insured, and the insured share under such policies will be

reduced commensurate with the ineligible general partnership, joint venture, limited

partnership, limited liability partnership or limited liability company SBI in the applicant

or insured for as long as the it remains ineligible.

327 Association, Estate, Trust, Corporation, or Other Similar Entity

Subparagraphs A – D provide the effects of ineligibility on an association, estate, trust,

corporation, or other similar entity.

Note: A revocable trust and the grantor(s) of a revocable trust and an estate and the

deceased person are considered to be the same person for crop insurance purposes.

Note: The grantor(s) and/or trustee(s) of an irrevocable trust and the executor or personal

representative of an estate are not considered to be the same person for crop

insurance purposes. However, Paras. 327A(3) and 328B may apply.

A. Delinquent Debt

If the association, estate, trust, corporation or similar entity is ineligible due to a delinquent

debt, then:

(1) all policies in which the ineligible association, estate, trust, corporation or other similar

entity is the sole insured will terminate on the respective termination dates;

(2) the ineligible association, estate, trust, corporation or other similar entity must be

reported on any other policy in which it has a SBI in the applicant or insured, and the

insured share under such policies will be reduced commensurate with the ineligible

person’s SBI in the applicant or insured for as long as the person remains ineligible;